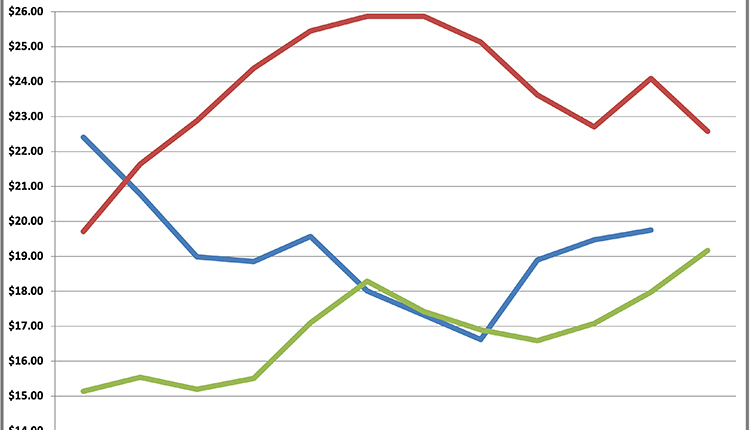

Last year's strong milk prices were a welcomed addition to the income side of dairy farm ledgers. Even though mailbox prices - the actual milk check received by producers - remained robust by historical standards as shown in Table 2, in some cases milk checks still didn't cover all expenses, especially when factoring in historically high feed costs.

High commercial disappearance, lower imports, and improved export markets all contributed to improved milk prices last year. Dairy product purchases, measured as commercial disappearance, were up 2.5 percent after being down 1.2 percent the previous year. Imports followed the opposite pattern but had the same impact on mailbox prices as fewer dairy products came into the country. Dairy product imports were down 23.6 percent in 2010 after being up 3.2 percent the previous year. The export markets also rebounded last year as dairy product sales to other country's accounted for 12.8 percent (on a total solids basis) of U.S. production. This is an all-time high, on both a volume and monetary basis, and is up from the previous year's 9.3 percent.

So what was your take-home pay? We recapped monthly mailbox prices for 20 regions (Table 3). That table also provides Class I (fluid) utilization, and monthly Class I, II, III, and IV prices. This past year Class III averaged $14.41. Note, Class I beverage prices are higher than those listed because differentials are added to the price. To compare your mailbox price to those in the tables, simply add back any voluntary deductions from your check. Those check-offs can include dairy products or supplies, associations fees, and other assessments.

To read the complete article with charts comparing the various regions, see the April 10, 2011 issue of Hoard's Dairyman on page 241.

High commercial disappearance, lower imports, and improved export markets all contributed to improved milk prices last year. Dairy product purchases, measured as commercial disappearance, were up 2.5 percent after being down 1.2 percent the previous year. Imports followed the opposite pattern but had the same impact on mailbox prices as fewer dairy products came into the country. Dairy product imports were down 23.6 percent in 2010 after being up 3.2 percent the previous year. The export markets also rebounded last year as dairy product sales to other country's accounted for 12.8 percent (on a total solids basis) of U.S. production. This is an all-time high, on both a volume and monetary basis, and is up from the previous year's 9.3 percent.

So what was your take-home pay? We recapped monthly mailbox prices for 20 regions (Table 3). That table also provides Class I (fluid) utilization, and monthly Class I, II, III, and IV prices. This past year Class III averaged $14.41. Note, Class I beverage prices are higher than those listed because differentials are added to the price. To compare your mailbox price to those in the tables, simply add back any voluntary deductions from your check. Those check-offs can include dairy products or supplies, associations fees, and other assessments.

To read the complete article with charts comparing the various regions, see the April 10, 2011 issue of Hoard's Dairyman on page 241.