The author is a dairy economist and publisher of the Daily Dairy Report, Libertyville, Ill.

It may not seem like it, but times are a changing on the milk price front. After a stellar run in farm-level margins from mid-2013 through 2014, signs are pointing to dramatically reduced margins next year. U.S. dairy producers are fortunate to have private and public sector financial tools to protect their 2015 margins, and they should consider taking advantage of them.

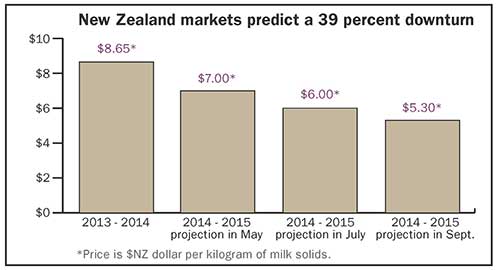

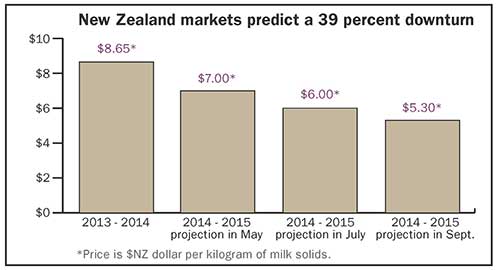

The first signal of a changing marketplace took place in May. That's when Fonterra cut its payout projection for the 2014-15 milk season (July 1 to June 30) to $7 per kilogram of milk solids based on the New Zealand dollar, a drop of 17 percent compared to 2013-14's record payout of $8.65.

At the end of July, the Kiwis primary cooperative further reduced its estimated payout to $6 per kilogram of milk solids due to strong production globally, a build-up of inventory in China, and falling demand in some emerging markets in response to high dairy commodity prices. And on September 24 Fonterra cut another 70 cents from its projected price payout and pegged $5.30 per kilogram of milk solids.

The U.S. correlation?

What is the outlook for the U.S. All-Milk price if it follows the expected path of New Zealand milk prices?

Fonterra's current forecast for the 2014-15 milk price is a daunting 39 percent less than the prior season (see graph). The most conservative bank estimates are closer to 40 percent lower.

From July 2013 through June 2014, the U.S. All-Milk price averaged nearly $22.50 per hundredweight, also a record high. If U.S. milk prices face a similar downturn as predicted in New Zealand, the July 2014 to June 2015 All-Milk price average would be near $13.80 on the low side and $15.75 on the high side of the predictions.

Granted, New Zealand prices are weighted heavily by milk powder markets, while U.S. cheese markets tend to buoy domestic milk prices in years with low milk powder prices. This was the case in 2012. Nevertheless, the Class III milk price was less than $16 per cwt. from March through June 2012.

An All-Milk price of $15.75 is below average production costs of most U.S. dairy farms. But there is no guarantee that milk prices will cover cost of production. USDA's September 2014 estimate for the 2015 All-Milk price is between $19.40 and $20.40, almost 19 percent less than the most recent 2014 All-Milk estimate. An additional 12 percent decline (as indicated in Fonterra's last forecast) puts the 2015 All-Milk price range between $17 and $18. The low-side estimate based on the bankers' forecast lands the All-Milk price between $15.30 and $16.10.

U.S. dairy producers appear to be wrapped in a cocoon of record high mailbox prices. It is difficult for many to imagine that milk prices could be 30 to 40 percent lower next spring. However, when the bankers in the largest dairy export country - where currency fluctuates with changes in Global Dairy Trade auction prices - forecast a 40 percent decline in milk prices, it's prudent to take cover.

U.S. producers are fortunate to have private sector milk and feed futures markets and forward contracting programs, which allow them to manage their margins. For 2015, producers will have the additional option of purchasing margin insurance through the government-supported Margin Protection Program (MPP-Dairy) as set forth in the 2014 farm bill.

The MPP-Dairy provides producers the opportunity to protect the margin between the national average All-Milk price and average feed costs derived from USDA's National Agricultural Statistics Service (NASS) monthly national average corn and alfalfa prices and the soybean meal price as reported by USDA's Agricultural Marketing Service. The program distributes payments to producers when the margin between the U.S. All-Milk price and national average feed costs is below the level of coverage selected for any one of six consecutive two-month periods during the year. Basic margin coverage of $4 per hundredweight is free after producers pay a $100 registration fee. Additional coverage levels are available in 50-cent increments per hundredweight at varying premiums.

Run your own numbers

USDA and the National Milk Producers Federation (NMPF) have developed tools to help producers decide what level of coverage to acquire. The MPP-Dairy Decision Tool, developed by USDA's Farm Service Agency, the University of Illinois' farmdoc, and the National Program on Dairy Markets and Policy can be found online at: www.fsa.usda.gov/mpptool. This tool allows producers to input their milk production information along with model-generated daily futures prices for milk and feed to determine coverage-level choices under MPP-Dairy. The tool also allows producers to look back in time to see predicted versus actual margins.

For example, on Sept. 30, 2008, the model predicted margins in excess of $7 per cwt. for most periods in 2009, with the probability of margins being less than $4 per cwt. in the single digits. However, as most producers painfully remember, markets plunged quickly, and margins were less than $4 from January through August 2009.

NMPF created an online calculator that allows producers to enter annual production volumes and milk and feed price estimates to determine the impact of MPP-Dairy on their own operations.

Current futures markets and the models are not predicting a significant downturn in margins as experienced in 2009. But the September 2008 models didn't predict the 2009 situation either. That is why risk management tools like futures and the MPP-Dairy are important. They provide a level of financial security even when you don't think you need one.

This article appears on page 623 of the October 10, 2014 issue of Hoard's Dairyman.

It may not seem like it, but times are a changing on the milk price front. After a stellar run in farm-level margins from mid-2013 through 2014, signs are pointing to dramatically reduced margins next year. U.S. dairy producers are fortunate to have private and public sector financial tools to protect their 2015 margins, and they should consider taking advantage of them.

The first signal of a changing marketplace took place in May. That's when Fonterra cut its payout projection for the 2014-15 milk season (July 1 to June 30) to $7 per kilogram of milk solids based on the New Zealand dollar, a drop of 17 percent compared to 2013-14's record payout of $8.65.

At the end of July, the Kiwis primary cooperative further reduced its estimated payout to $6 per kilogram of milk solids due to strong production globally, a build-up of inventory in China, and falling demand in some emerging markets in response to high dairy commodity prices. And on September 24 Fonterra cut another 70 cents from its projected price payout and pegged $5.30 per kilogram of milk solids.

The U.S. correlation?

What is the outlook for the U.S. All-Milk price if it follows the expected path of New Zealand milk prices?

Fonterra's current forecast for the 2014-15 milk price is a daunting 39 percent less than the prior season (see graph). The most conservative bank estimates are closer to 40 percent lower.

From July 2013 through June 2014, the U.S. All-Milk price averaged nearly $22.50 per hundredweight, also a record high. If U.S. milk prices face a similar downturn as predicted in New Zealand, the July 2014 to June 2015 All-Milk price average would be near $13.80 on the low side and $15.75 on the high side of the predictions.

Granted, New Zealand prices are weighted heavily by milk powder markets, while U.S. cheese markets tend to buoy domestic milk prices in years with low milk powder prices. This was the case in 2012. Nevertheless, the Class III milk price was less than $16 per cwt. from March through June 2012.

An All-Milk price of $15.75 is below average production costs of most U.S. dairy farms. But there is no guarantee that milk prices will cover cost of production. USDA's September 2014 estimate for the 2015 All-Milk price is between $19.40 and $20.40, almost 19 percent less than the most recent 2014 All-Milk estimate. An additional 12 percent decline (as indicated in Fonterra's last forecast) puts the 2015 All-Milk price range between $17 and $18. The low-side estimate based on the bankers' forecast lands the All-Milk price between $15.30 and $16.10.

U.S. dairy producers appear to be wrapped in a cocoon of record high mailbox prices. It is difficult for many to imagine that milk prices could be 30 to 40 percent lower next spring. However, when the bankers in the largest dairy export country - where currency fluctuates with changes in Global Dairy Trade auction prices - forecast a 40 percent decline in milk prices, it's prudent to take cover.

U.S. producers are fortunate to have private sector milk and feed futures markets and forward contracting programs, which allow them to manage their margins. For 2015, producers will have the additional option of purchasing margin insurance through the government-supported Margin Protection Program (MPP-Dairy) as set forth in the 2014 farm bill.

The MPP-Dairy provides producers the opportunity to protect the margin between the national average All-Milk price and average feed costs derived from USDA's National Agricultural Statistics Service (NASS) monthly national average corn and alfalfa prices and the soybean meal price as reported by USDA's Agricultural Marketing Service. The program distributes payments to producers when the margin between the U.S. All-Milk price and national average feed costs is below the level of coverage selected for any one of six consecutive two-month periods during the year. Basic margin coverage of $4 per hundredweight is free after producers pay a $100 registration fee. Additional coverage levels are available in 50-cent increments per hundredweight at varying premiums.

Run your own numbers

USDA and the National Milk Producers Federation (NMPF) have developed tools to help producers decide what level of coverage to acquire. The MPP-Dairy Decision Tool, developed by USDA's Farm Service Agency, the University of Illinois' farmdoc, and the National Program on Dairy Markets and Policy can be found online at: www.fsa.usda.gov/mpptool. This tool allows producers to input their milk production information along with model-generated daily futures prices for milk and feed to determine coverage-level choices under MPP-Dairy. The tool also allows producers to look back in time to see predicted versus actual margins.

For example, on Sept. 30, 2008, the model predicted margins in excess of $7 per cwt. for most periods in 2009, with the probability of margins being less than $4 per cwt. in the single digits. However, as most producers painfully remember, markets plunged quickly, and margins were less than $4 from January through August 2009.

NMPF created an online calculator that allows producers to enter annual production volumes and milk and feed price estimates to determine the impact of MPP-Dairy on their own operations.

Current futures markets and the models are not predicting a significant downturn in margins as experienced in 2009. But the September 2008 models didn't predict the 2009 situation either. That is why risk management tools like futures and the MPP-Dairy are important. They provide a level of financial security even when you don't think you need one.