The author is a research assistant professor in the department of agricultural and applied economics at the University of Missouri.

With the passage of the Agricultural Act of 2014, known to many as the farm bill, Congress re-authorized California's ability to enter into a Federal Milk Marketing Order (FMMO) and at the same time retain its state quota system for beverage milk. In early February 2015, three dairy cooperatives with membership in California, California Dairies, Dairy Farmers of America and Land O'Lakes, requested that Agriculture Secretary Tom Vilsack hold a public hearing to consider a FMMO for California.

Since then, USDA announced it is seeking additional proposals regarding a California FMMO. Alternative proposals must be received no later than April 10, 2015. After that, USDA currently plans to hold public meetings this May within California to provide information on the hearing process and give petitioners an opportunity to discuss the intent of their proposals.

It could be many months before any clear path becomes apparent. The road will likely see many twists and turns as the process unfolds that could result in the California dairy industry moving to a FMMO.

Minimum pricing is the focus

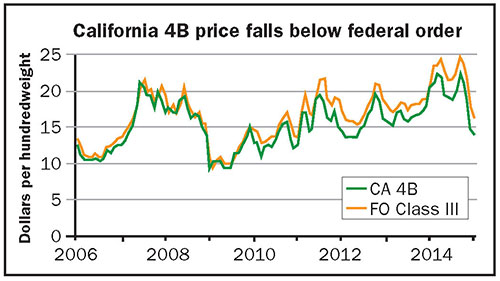

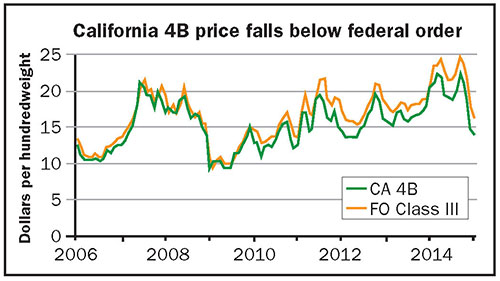

Differences between minimum prices other than fluid milk for California's state order and federal milk orders drove California dairy farmers' interest to join a federal order. The major focus has been the spread between California 4B prices and federal order Class III prices (minimum prices for cheese milk).

California 4B milk prices have typically been lower than federal order Class III prices. Over the 2000 to 2003 period, California 4B milk prices averaged 29 cents per hundredweight below federal order Class III prices. In 2014, the difference between the two widened to $2.41 per hundredweight. The graph shows the monthly prices for California 4B and federal order Class III prices and highlights that the two price series began to move farther apart in 2010. The spread between California 4B and federal order Class III prices is due in large part to the differences in how whey is valued under the two formulas.

California dairy producers have found little success the last few years in formally requesting changes to minimum milk prices to bring 4B prices into closer alignment with federal order Class III prices. This ultimately led to producer interest in a California federal order.

If a California federal order emerges from the co-op led request, the impacts will depend critically on the exact language adopted. Additionally, impacts from a new federal order will be felt by those involved in the Golden State as well as dairy producers throughout the country.

The proposal would establish the same four classification system currently in place in all federal orders. Minimum class milk prices in a new California federal order would follow the current federal system, and Class I differentials would be determined using current federal order regulations. Handlers would be required to pay minimum prices given milk use into the California federal order pool.

The California state quota system would continue under this proposal and be administered by the California Department of Food and Agriculture (CDFA). Payments to quota holders would come out of the market-wide federal order pool and be provided to CDFA to make payments to quota holders.

According to the proposal, transportation credits would be available to move milk to Class I and II processing areas, with these credits coming out of the market-wide pool. All California plants purchasing milk from Grade A producers would be pool plants and would be unable to de-pool. California fluid milk standards are currently different than U.S. fluid milk standards, and that would continue by providing a fortification allowance to Class I handlers.

Important outcomes

California remains the largest dairy state, producing nearly 21 percent of the U.S. milk supply. Many U.S. dairy product exports originate from important West Coast ports, and domestic dairy product use remains high given the state's large population centers.

Implementing a California federal order will have some spillover effects into the rest of the country. The California All-Milk price reported by the National Agricultural Statistics Service of USDA is among the lowest among large dairy states today.

If California becomes a federal milk order region and milk prices received by farmers within the new order go up, more California milk could be produced relative to continuing the current California state system. Although the effect should not be overstated, more California milk production will potentially cause downward price pressure across the country.

The effects of a California FMMO could even affect the new Margin Protection Program (MPP) since its trigger depends on the U.S. All-Milk price. If the California All-Milk price rises as a result of a new federal order, it will marginally change the MPP trigger given that over 20 percent of milk production occurs in California and the U.S. All-Milk price is weighted based on each state's average production.

These examples of potential effects beyond California should convince all dairy participants across the country to follow the debate as a potential California federal milk order unfolds.

The path remains long

Despite being a topic of discussion for years, the implementation of a federal milk order in California remains in the early stages. With the proposal set forth by the three large cooperatives and the request for a public hearing, USDA is now soliciting other input in the next few months that will ultimately determine whether to hold a hearing regarding a California federal order. USDA has emphasized that these proposals should discuss how they resolve current disorderly marketing conditions. If USDA determines that a public hearing should be held on a California federal milk order, there will be numerous ideas of how to develop and implement a new federal order, especially given the unique nature of California's dairy industry.

A new California FMMO could have many ramifications, both within and outside of the state, and those effects will depend on the exact final order provisions. Ultimately, this issue could be one of the most important decisions that California, and perhaps even the entire U.S. dairy industry, has faced in a long time.

This article appears on page 199 of the Mar 25, 2015 issue of Hoard's Dairyman.

Return to the Hoard's Dairyman feature page.

With the passage of the Agricultural Act of 2014, known to many as the farm bill, Congress re-authorized California's ability to enter into a Federal Milk Marketing Order (FMMO) and at the same time retain its state quota system for beverage milk. In early February 2015, three dairy cooperatives with membership in California, California Dairies, Dairy Farmers of America and Land O'Lakes, requested that Agriculture Secretary Tom Vilsack hold a public hearing to consider a FMMO for California.

Since then, USDA announced it is seeking additional proposals regarding a California FMMO. Alternative proposals must be received no later than April 10, 2015. After that, USDA currently plans to hold public meetings this May within California to provide information on the hearing process and give petitioners an opportunity to discuss the intent of their proposals.

It could be many months before any clear path becomes apparent. The road will likely see many twists and turns as the process unfolds that could result in the California dairy industry moving to a FMMO.

Minimum pricing is the focus

Differences between minimum prices other than fluid milk for California's state order and federal milk orders drove California dairy farmers' interest to join a federal order. The major focus has been the spread between California 4B prices and federal order Class III prices (minimum prices for cheese milk).

California 4B milk prices have typically been lower than federal order Class III prices. Over the 2000 to 2003 period, California 4B milk prices averaged 29 cents per hundredweight below federal order Class III prices. In 2014, the difference between the two widened to $2.41 per hundredweight. The graph shows the monthly prices for California 4B and federal order Class III prices and highlights that the two price series began to move farther apart in 2010. The spread between California 4B and federal order Class III prices is due in large part to the differences in how whey is valued under the two formulas.

California dairy producers have found little success the last few years in formally requesting changes to minimum milk prices to bring 4B prices into closer alignment with federal order Class III prices. This ultimately led to producer interest in a California federal order.

If a California federal order emerges from the co-op led request, the impacts will depend critically on the exact language adopted. Additionally, impacts from a new federal order will be felt by those involved in the Golden State as well as dairy producers throughout the country.

The proposal would establish the same four classification system currently in place in all federal orders. Minimum class milk prices in a new California federal order would follow the current federal system, and Class I differentials would be determined using current federal order regulations. Handlers would be required to pay minimum prices given milk use into the California federal order pool.

The California state quota system would continue under this proposal and be administered by the California Department of Food and Agriculture (CDFA). Payments to quota holders would come out of the market-wide federal order pool and be provided to CDFA to make payments to quota holders.

According to the proposal, transportation credits would be available to move milk to Class I and II processing areas, with these credits coming out of the market-wide pool. All California plants purchasing milk from Grade A producers would be pool plants and would be unable to de-pool. California fluid milk standards are currently different than U.S. fluid milk standards, and that would continue by providing a fortification allowance to Class I handlers.

Important outcomes

California remains the largest dairy state, producing nearly 21 percent of the U.S. milk supply. Many U.S. dairy product exports originate from important West Coast ports, and domestic dairy product use remains high given the state's large population centers.

Implementing a California federal order will have some spillover effects into the rest of the country. The California All-Milk price reported by the National Agricultural Statistics Service of USDA is among the lowest among large dairy states today.

If California becomes a federal milk order region and milk prices received by farmers within the new order go up, more California milk could be produced relative to continuing the current California state system. Although the effect should not be overstated, more California milk production will potentially cause downward price pressure across the country.

The effects of a California FMMO could even affect the new Margin Protection Program (MPP) since its trigger depends on the U.S. All-Milk price. If the California All-Milk price rises as a result of a new federal order, it will marginally change the MPP trigger given that over 20 percent of milk production occurs in California and the U.S. All-Milk price is weighted based on each state's average production.

These examples of potential effects beyond California should convince all dairy participants across the country to follow the debate as a potential California federal milk order unfolds.

The path remains long

Despite being a topic of discussion for years, the implementation of a federal milk order in California remains in the early stages. With the proposal set forth by the three large cooperatives and the request for a public hearing, USDA is now soliciting other input in the next few months that will ultimately determine whether to hold a hearing regarding a California federal order. USDA has emphasized that these proposals should discuss how they resolve current disorderly marketing conditions. If USDA determines that a public hearing should be held on a California federal milk order, there will be numerous ideas of how to develop and implement a new federal order, especially given the unique nature of California's dairy industry.

A new California FMMO could have many ramifications, both within and outside of the state, and those effects will depend on the exact final order provisions. Ultimately, this issue could be one of the most important decisions that California, and perhaps even the entire U.S. dairy industry, has faced in a long time.