In the coming years, China intends to make significant capital investments that will enable the country to produce milk to meet the needs of its 1.4 billion citizens. To put these future investments into perspective, we need to review recent changes in China’s dairy industry. That was the premise of the presentation “Dairy Chain Development in China” delivered at the International Dairy Federation’s World Dairy Summit in Rotterdam, Netherlands.

Over the past nine years, large freestall operations have been built in China as a way to modernize and improve the efficiency of its dairy industry. Due to shortages of land, raising homegrown forages is an expensive proposition. To supplement shortages in roughage supplies, hay was (and is) imported from the U.S.; this is also an expensive endeavor.

More recently, the Chinese government made the decision that it cannot afford to take land out of crop production involving grain and oilseeds and devote the land to forage production to offset these costs. Thus, it plans to cease building new, high technology-based dairy facilities. Instead, the Chinese government’s goal is to control the production sources of fresh milk for its population by vertical integration of its supply chain.

Milk takes flight

The Chinese government plans to buy and/or build large dairy farms in other regions of the world and airfreight fresh milk back to China for final processing into fluid milk and other dairy products. During the presentation, the speaker stated that Chinese interests own farms in New Zealand and Kenya. The Chinese firm Shanghai Pengxin Group Co. Limited controls Milk New Zealand Limited that owns 29 farms with 29,650 acres and 30,000 cows. These enterprises supply milk to a processing plant that produces UHT or ultra-high temperature processed milk and other dairy products.

In addition, Shanghai Pengxin Group Co. Limited is the ultimate investor in Synlait Farms Limited. It owns 13 dairy farms, comprising approximately 11,265 acres. In March 2013, Yashili New Zealand Dairy and Oceania Dairy received permission from the Overseas Investment Office of the New Zealand government to purchase land to build milk powder processing plants, which will purchase milk from local farmers. The milk powders are shipped to markets in China.

There’s more

The Oceania Dairy website has announced details of a further five-year NZ$400 million development project of milk powder at its Glenavy plant. It is expected that the completed project will add 150 new jobs to the Oceania Dairy facility. The first phase of the expansion project began in early 2015, and the remaining phases have been scheduled to be completed by 2019.

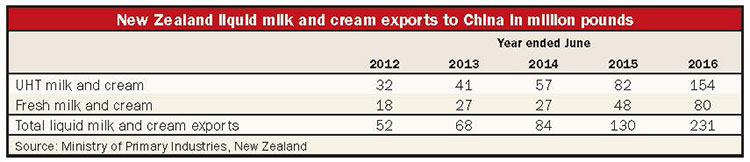

A review of New Zealand’s 2012 to 2016 exports to China validates these insights. According to the New Zealand Ministry of Primary Industries, around 51 percent of New Zealand’s liquid milk exports went to China from July 2015 to June 2016. That included 102 million liters or 231 million pounds of liquid milk and cream sent to China, of which over 99 percent was sent by sea freight. Of these 102 million liters, 68 million liters or 154 million pounds were exported as UHT milk. Liquid milk exports to China were valued at NZ$215 million for the year ended June 2016, making up 7.2 percent of New Zealand’s total dairy exports to China.

Same story in other countries

The Kenya Dairy Board was unable to confirm that Chinese investors have purchased farmland in Kenya. However, the representative for the Kenya Dairy Board stated that county governments might have arrangements, which they have not identified due to the complexity (secretive nature) of business dealings. The Kenya Dairy Board has not certified any milk exports to China.

The situation in Australia is similar. In February 2016, the Foreign Investment Review Board in Australia approved the sale of Van Diemen’s Land Company (VDL) in Tasmania, which has 17,890 dairy cows and over 17,450 acres, to the Chinese investment company Moon Lake Investments, according to ABC News reports. In October 2016, the owner of VDL announced that 10 percent of its milk production would be processed by a dairy in Hobart. After processing, the milk will be bottled, packaged, and flown from the Hobart airport to China. It is anticipated that shipments of processed milk will begin during the first quarter of 2017.

What it means

The Chinese government’s decision to control the sources of milk production has long-term implications for American dairy farmers. China clearly has the goal to purchase land, dairy cattle, and milk processing facilities outside its borders and ship milk and other processed dairy products back to its country. This self-sufficiency goal means China may not be a consistent buyer of dairy products on world markets in the future. The record dairy prices of 2014 due to massive Chinese purchases may not be repeated for many years. Given this situation, other questions emerge with collateral impacts:

What are the consequences of overestimating the impact of China’s role in world markets?

What proactive, if any, actions should American dairy farmers be considering?