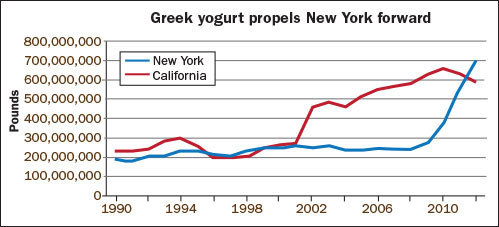

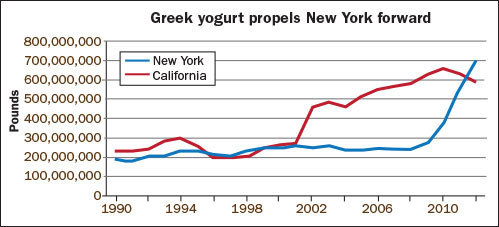

Greek yogurt. It's what gave New York the push it needed to pass California as the top yogurt producing state in the nation. Last year, California represented 13 percent of U.S. yogurt production. Meanwhile, New York accounted for almost 16 percent.

The switching of the ranks in 2012 went hand-in-hand with the growth of Greek yogurt consumption and New York's leading production of this product. This data comes from a dairy markets and policy research paper from Robert Boynton and Andrew Novakovic at Cornell University (http://dairy.wisc.edu/PubPod/Pubs/RP13-01.pdf).

But, who's going Greek, what do they want, and does it come at a cost to other products?

Data from last fall indicate that retail yogurt sales occur primarily in grocery stores (two-thirds of all retail sales). Almost all of the remaining third is accounted for in drug store sales. IRI InfoScan data show that 83 percent of U.S. households bought some kind of yogurt in 2012.

Last year, adult males represented 25 percent of total in-home yogurt consumption. Women represented 52 percent, with children and teenagers the balance. This data also shows that low-fat and nonfat yogurts are the most preferred, representing 90 to 95 percent of all yogurt sales.

Greek products have shown phenomenal growth. In 2012, Greek yogurt sales were 34 percent of total yogurt dollars and 22.5 percent of total yogurt volume sales. As recently as 2009, Greek sales by volume were only 2 percent of total yogurt sales. From 2011 to 2012, non-Greek yogurt fell 10 percent by volume while Greek volume rose 71 percent in the same time period.

Shortly after the boom, market analysis indicated that sales were primarily from two types of consumers: women who were already yogurt eaters and men who saw Greek yogurt as a new sports nutrition product. These men were new consumers who were substituting Greek yogurt for other protein supplements.

In both of these cases, there is a cannibalization of dairy product sales. It is likely that newer Greek products increased the overall usage of milk. But the product is often touted as a substitute for sour cream, buttermilk, cream or other cooking uses.

It is likely, that Greek yogurt will become an enduring part of the U.S. food landscape. Yet, per capita consumption of yogurt in the U.S. falls well behind that of Europe. USDA estimates that per capita consumption of yogurt in the U.S. has risen from 2 pounds in 1975 to about 14 pounds today. This still remains well below the 60 pounds consumed in Germany and France, as well as the 20 pounds consumed in Canada. US per capita spending on all yogurt was $21.10 while in Europe that figure was $41.

The author, Amanda Smith, was an associate editor and is an animal science graduate of Cornell University. Smith covers feeding, milk quality and heads up the World Dairy Expo Supplement. She grew up on a Medina, N.Y., dairy, and interned at a 1,700-cow western New York dairy, a large New York calf and heifer farm, and studied in New Zealand for one semester.

The switching of the ranks in 2012 went hand-in-hand with the growth of Greek yogurt consumption and New York's leading production of this product. This data comes from a dairy markets and policy research paper from Robert Boynton and Andrew Novakovic at Cornell University (http://dairy.wisc.edu/PubPod/Pubs/RP13-01.pdf).

But, who's going Greek, what do they want, and does it come at a cost to other products?

Data from last fall indicate that retail yogurt sales occur primarily in grocery stores (two-thirds of all retail sales). Almost all of the remaining third is accounted for in drug store sales. IRI InfoScan data show that 83 percent of U.S. households bought some kind of yogurt in 2012.

Last year, adult males represented 25 percent of total in-home yogurt consumption. Women represented 52 percent, with children and teenagers the balance. This data also shows that low-fat and nonfat yogurts are the most preferred, representing 90 to 95 percent of all yogurt sales.

Greek products have shown phenomenal growth. In 2012, Greek yogurt sales were 34 percent of total yogurt dollars and 22.5 percent of total yogurt volume sales. As recently as 2009, Greek sales by volume were only 2 percent of total yogurt sales. From 2011 to 2012, non-Greek yogurt fell 10 percent by volume while Greek volume rose 71 percent in the same time period.

Shortly after the boom, market analysis indicated that sales were primarily from two types of consumers: women who were already yogurt eaters and men who saw Greek yogurt as a new sports nutrition product. These men were new consumers who were substituting Greek yogurt for other protein supplements.

In both of these cases, there is a cannibalization of dairy product sales. It is likely that newer Greek products increased the overall usage of milk. But the product is often touted as a substitute for sour cream, buttermilk, cream or other cooking uses.

It is likely, that Greek yogurt will become an enduring part of the U.S. food landscape. Yet, per capita consumption of yogurt in the U.S. falls well behind that of Europe. USDA estimates that per capita consumption of yogurt in the U.S. has risen from 2 pounds in 1975 to about 14 pounds today. This still remains well below the 60 pounds consumed in Germany and France, as well as the 20 pounds consumed in Canada. US per capita spending on all yogurt was $21.10 while in Europe that figure was $41.

The author, Amanda Smith, was an associate editor and is an animal science graduate of Cornell University. Smith covers feeding, milk quality and heads up the World Dairy Expo Supplement. She grew up on a Medina, N.Y., dairy, and interned at a 1,700-cow western New York dairy, a large New York calf and heifer farm, and studied in New Zealand for one semester.