Tax time can bring mixed feelings for farmers.

Some are worried about pulling that shoebox full of receipts out that they shoved under the desk. Others know exactly what their tax preparer will say since they strategically bought or sold in the fourth calendar quarter to take full advantage of credits and deductions. Most farmers, however, fall somewhere in between.

There are a few tips you can begin implementing now to handle tax management with ease this new year.

The IRS publishes a Farmer's Tax Guide, publication 225, that provides some great tax information for farmers.

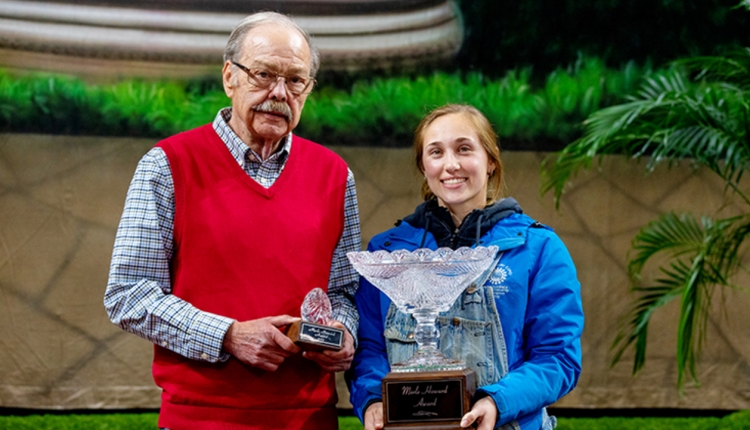

The author , Ali Enerson, was the special publications editor, responsible for books, plans, distribution of the e-newsletter and various internal communication pieces. She grew up on a 60-cow dairy in northwest Wisconsin, and is a graduate of University of Wisconsin–Madison with a degree in life sciences communications

Some are worried about pulling that shoebox full of receipts out that they shoved under the desk. Others know exactly what their tax preparer will say since they strategically bought or sold in the fourth calendar quarter to take full advantage of credits and deductions. Most farmers, however, fall somewhere in between.

There are a few tips you can begin implementing now to handle tax management with ease this new year.

- Ensure all expenses are taken by keeping good records. If you don't have a smooth-running expense tracking system in place, now is the time to try something better.

- Evaluate what portion of business-personal expenses you can deduct based on your situation. Electricity, phone costs and auto deductions are easy to overlook. Mileage for charitable and even medical purposes may be itemized.

- Know what credits are available to you. Taking advantage of tax credits will help you maximize your dollars.

- A Health Savings Account (HSA) may be a good alternative to standard health insurance. HSAs allow income tax-free contributions to the account and may be used tax free for qualified expenses.

- Look into a retirement plan, and learn the benefits of maximizing your contributions each year. There are many types: SEP IRAs, Roth IRAs, IRAs and even SIMPLE plans for small employers to encourage employee retirement savings.

- Plan for your retirement. Don't let retirement sneak up on you. Devise a plan for more income from rent, dividends and interest rather than earned income.

The IRS publishes a Farmer's Tax Guide, publication 225, that provides some great tax information for farmers.

The author , Ali Enerson, was the special publications editor, responsible for books, plans, distribution of the e-newsletter and various internal communication pieces. She grew up on a 60-cow dairy in northwest Wisconsin, and is a graduate of University of Wisconsin–Madison with a degree in life sciences communications