by Lucas Sjostrom, Hoard's Dairyman Associate Editor

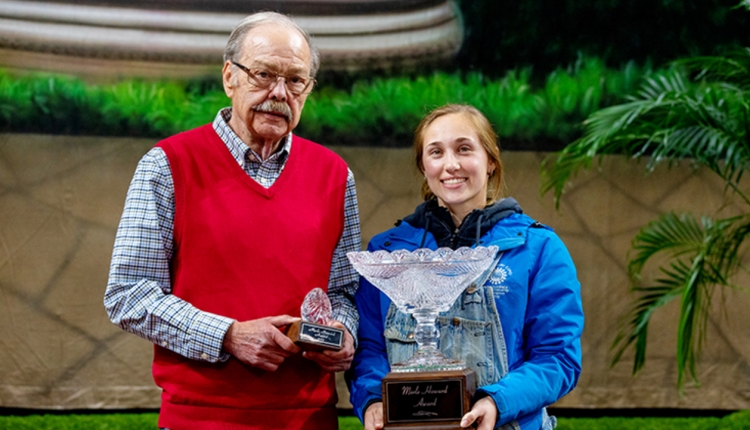

Clayton Yeutter, former U.S. Secretary of Agriculture and Trade Representative (USTR), opened Monday's "Is this farm boom different?" at the Kansas City Federal Reserve by answering the event's main question. Farmers would say yes, said Yeutter, since they're eternal optimists. But, he noted, while much looks the same as the last boom in the 1970s, much is different too.

A 1980s repeat, or not?

Yeutter gave great historical perspective, talking about the booms in U.S. agriculture since the 1900s. Of course, the former Secretary of Agriculture and USTR played a big role in government's positioning from the 1970s through today.

Looking back to the 1970s, Yeutter noted that China is filling the role the Russians took in the late 1970s as big, but previously uninterested, grain buyers. Other similarities include land is being purchased by farmers and nonfarmers alike, high crop prices, high production costs, drought and planting more where possible.

But conversely, farmers are more sophisticated, better at managing risk and more efficient than ever before, said Yeutter. We also have stronger balance sheets, a stronger safety net, better risk management, more land conservation programs and lower interest rates.

Yeutter said too much euphoria existed in the 1970s, and we may have too much today – we're not taking care of our risk. He noted he was attending a board meeting with a large corporation later this week, and even that company did not have its hands wrapped around risk management. His three risks for agriculture are the weather (including potential climate change), energy policy (especially ethanol and the renewable fuels standard) and biotechnology. "The U.S. understands biotech," contended Yeutter, "while others don't if we want to feed 9 billion people."

Economists and industry optimistic

After Yeutter's opening presentation, 12 presentations from economists, bankers and hedge fund managers offered a cautiously optimistic state of today's economy. Brent Gloy, Purdue University, explained that bubbles never really exist, as there's nearly always a rational basis for peoples' economic decisions. But he also noted that the farmland value-to-cash rent multiples for Iowa, Illinois and Indiana are at their highest levels ever – over 30.

Gloy also noted that the only times we saw the return to farm operator income, plus interest and rent, rise above $100 billion (in 2005 dollars) was in the World War II boom and in the 1970s. Today we're not at those levels.

That being said, looking at a survey of Indiana farmers' perceptions of a piece of moderate farmland in the state, farmers did not match their projections for corn prices with their willingness to pay for farmland. There was virtually no correlation, showing that maybe not everything is rational in farmland prices.

The big elephants in the room for other economists were three things; China, corn ethanol and sugar ethanol (in Brazil), outlined first by William Hudson of The ProExporter Network.

Hudson explained, "China is buying our land." It doesn't matter if it is corn or beans because we rotate those crops on the same land base. "What we're really doing," Hudson said, "is giving the world what it needs to feed its meat products, rather than actually feeding the world."

Hudson and others touched on the real possibility of $8.50 corn, rising farmland values being consistent in other parts of the world and the high likelihood that interest rates would remain low through late 2014.

On Tuesday morning, Allen Featherstone of Kansas State University noted that while we're not making more land, a whole bunch more can still be brought into agricultural production. He also stated, and others agreed, that a drop in revenue is more likely to cause the next bust rather than the rising interest rates.

These aren't normal times

To cap the event, Michael Boehlje, Purdue University, noted that farmers shouldn't "drink the Kool-Aid" of agribusiness. It's not a growing population that counts; it's growth in income. Finally, Boehlje noted that the demand for agricultural products appears bullish long-term, but he's pessimistic of the U.S. ability to compete in livestock and dairy worldwide. This is due to other countries' ability to bring new land into production, use cheaper feed (wheat and barley) to feed their animals and catch up to us in efficiency. Near the end of his presentation, Boehlje said, "I think a bust is inevitable."

Update: To see the slides from all the presentations for this conference, visit http://www.kansascityfed.org/publications/research/rscp/rscp-2012.cfm.