by Lucas Sjostrom, Hoard's Dairyman Associate Editor

While the U.S. is a world superpower in being a consumer, we don't rule the oil market. The Wall Street Journal said this morning that government numbers show a 12 percent surge in U.S. crude oil production in 2012 and another 8 percent jump in 2013. Next year's projected levels will be the highest level since 1993.

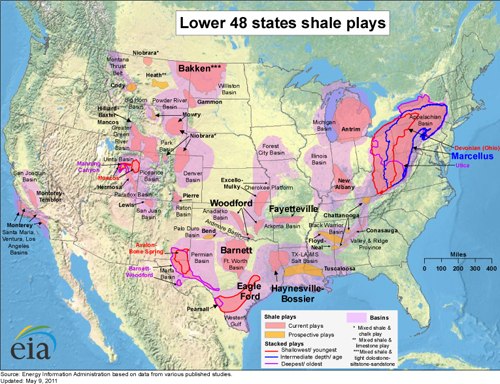

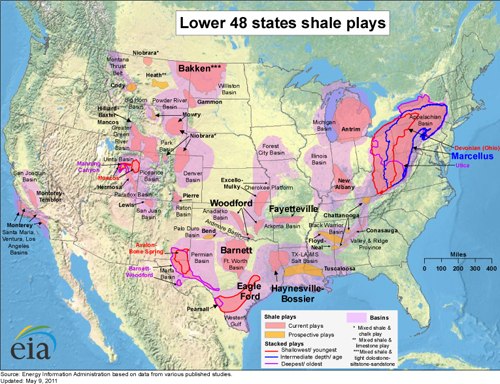

But we're still not seeing any relief at the pump. That's because the U.S. is small beans in regard to the world crude oil market. It also doesn't help that much of the new oil is landlocked in places like North Dakota, where there is little pipeline structure to get that oil to the coasts. That glut is causing low crude oil prices in the U.S., allowing refiners to make a handy profit on each barrel they convert to fuel.

Brent's to blame

If you're looking for someone to blame for high gas prices despite the U.S. glut of oil, the person, or benchmark rather, is Brent. "Brent" is the European benchmark that trades against the West Texas Intermediate (WTI) based in Cushing, Okla.

Our friend Brent is typically within a few dollars of the WTI price. This year, Brent skies $23 above the WTI price, more than doubling from $8.55 last December. The Brent is concerned about tight supplies outside the U.S. and continued tension in the Middle East. While this spread in Brent and WTI pricing surprised investors and analysts, according to the article, neither analysts nor investors expect the spread to shrink anytime soon.

In other words, I've got no tips on whether gas prices will rise or fall before spring planting, especially since the crude market, courtesy of our new friend Brent, is an animal all its own.

Glimmer of hope

The article did note that Midwest gas prices would be most likely to benefit from a drop in oil prices. Today, Midwestern refinery supplies still don't meet demand, so some gasoline is shipped in from elsewhere.

While the U.S. is a world superpower in being a consumer, we don't rule the oil market. The Wall Street Journal said this morning that government numbers show a 12 percent surge in U.S. crude oil production in 2012 and another 8 percent jump in 2013. Next year's projected levels will be the highest level since 1993.

But we're still not seeing any relief at the pump. That's because the U.S. is small beans in regard to the world crude oil market. It also doesn't help that much of the new oil is landlocked in places like North Dakota, where there is little pipeline structure to get that oil to the coasts. That glut is causing low crude oil prices in the U.S., allowing refiners to make a handy profit on each barrel they convert to fuel.

Brent's to blame

If you're looking for someone to blame for high gas prices despite the U.S. glut of oil, the person, or benchmark rather, is Brent. "Brent" is the European benchmark that trades against the West Texas Intermediate (WTI) based in Cushing, Okla.

Our friend Brent is typically within a few dollars of the WTI price. This year, Brent skies $23 above the WTI price, more than doubling from $8.55 last December. The Brent is concerned about tight supplies outside the U.S. and continued tension in the Middle East. While this spread in Brent and WTI pricing surprised investors and analysts, according to the article, neither analysts nor investors expect the spread to shrink anytime soon.

In other words, I've got no tips on whether gas prices will rise or fall before spring planting, especially since the crude market, courtesy of our new friend Brent, is an animal all its own.

Glimmer of hope

The article did note that Midwest gas prices would be most likely to benefit from a drop in oil prices. Today, Midwestern refinery supplies still don't meet demand, so some gasoline is shipped in from elsewhere.