The author is emeritus professor of agricultural economics at Pennsylvania State University.

Dairy markets have taken a tumble with the restrictions associated with the novel coronavirus. Milk usage has changed due to severe limitations on dining out. My own community in State College, Pa., has some 40,000 students who have gone home with the termination of in-person classes for the spring semester. Without the students, the many businesses that cater to the activities of these young people are struggling.

Milk production in the United States has been growing about twice as fast as population growth in recent months, with the latest estimate being a 2.2% gain above the same month last year. Dairy exports absorbed almost 16% of milk production in the last report, which helps farm prices. At this point, if we don’t export about 15% of production, milk prices struggle.

Too much everything

World inventories are high, especially in the European Union. EU milk production in 2020 is above 2019 by more than 2%, which helps depress milk prices across the globe.

Cheese and powder inventories are high, which will limit the upward price potential until the inventories are reduced. The EU has announced that it will not accumulate any more stocks until the industry reduces stocks through food aid or other measures.

Lower feed prices are helping U.S. producer margins, especially for those producers who buy a substantial amount of feed. The feed markets will remain depressed for the foreseeable future, given the large U.S. feed crops in 2019, and large surpluses in Argentina, and, to a lesser extent, Brazil.

Export demand

For many years, dairy profitability has been tied to export demand. So far in 2020, dairy exports are 15% above 2019 levels through March. Powdered milk is the major product with higher exports, with dry whey also up.

Southeast Asia is the major destination for these dry products. The dollar has gained strength against the germane competing currencies, which is bad for dairy exports. The Mexican peso in particular has collapsed. Our exports suffer when the Canadian dollar and Mexican pesos are weak, as they have been, and we don’t compete well if the other exporters have weaker currencies.

Recently, the European Union is having a variety of problems, especially with Britain’s withdrawal from the EU. Furthermore, the collective EU has problems with immigration. The cost of agricultural supports for the newer EU members is substantial, and the transition is a challenge for countries like Poland and other new members from eastern Europe that have numerous very small dairy farmers.

U.S. milk production was up 2.9% through March, and some of that total included the effect for the additional day for Leap Year. Production per cow usually grows with genetic improvements over time, and the mild weather in the Northeast certainly helped matters. While inventories of powdered milk are high, cheese and butter stocks are not excessive.

Looking long term

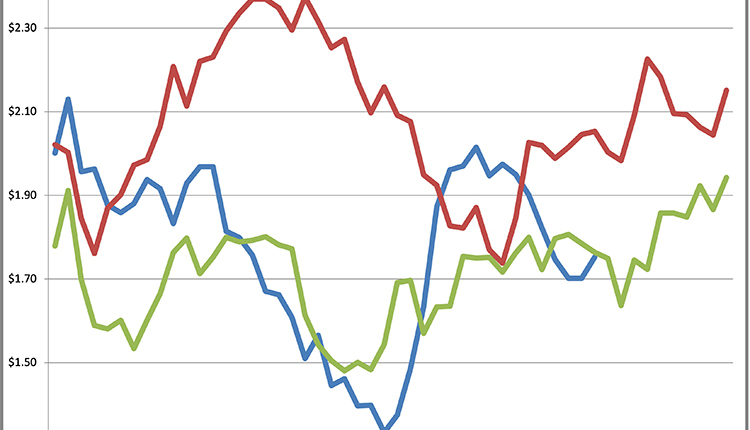

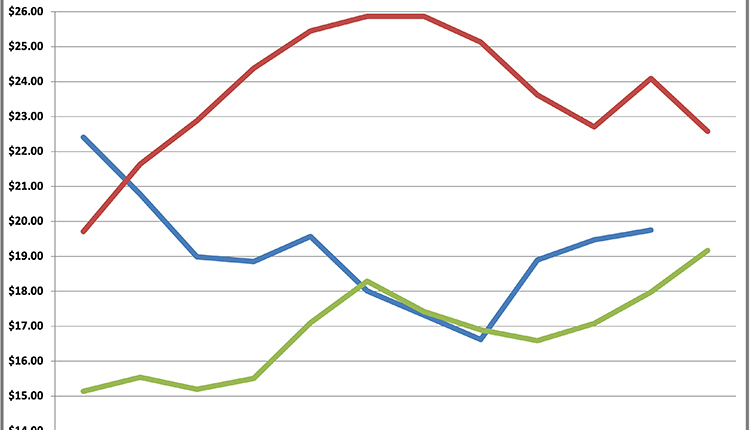

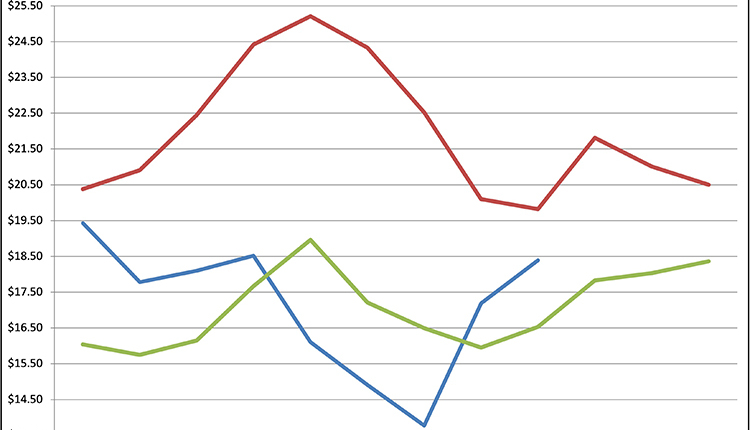

The latest USDA milk production forecast is a 1.5% annual expansion over the next decade. Exports must continue to grow to sell this milk since the percentage growth in production is twice the population growth. As the milk price has plummeted, income over feed cost has also. Feed costs have fallen, but milk prices have dropped more. Nevertheless the 2017 values are above 2016 levels.

The latest USDA Drought Monitor shows moderate drought in California and along the lower Texas-Mexico border. The futures market expects 2020 prices to remain depressed for the remainder of the year.

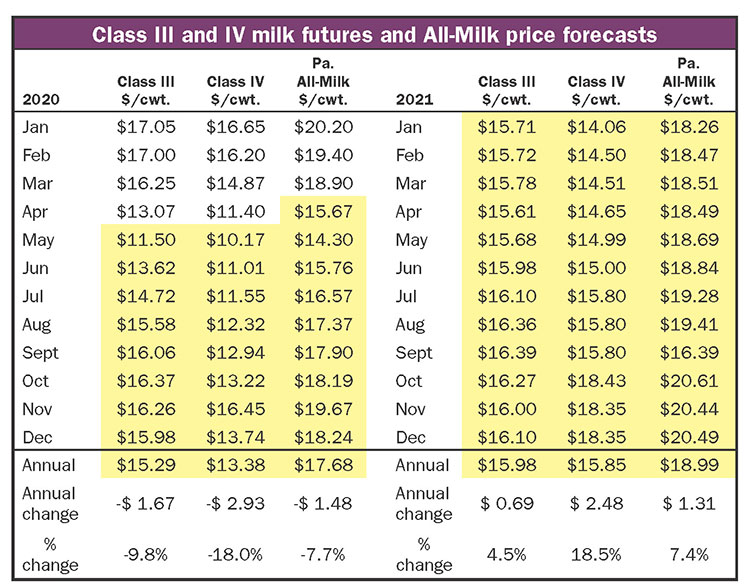

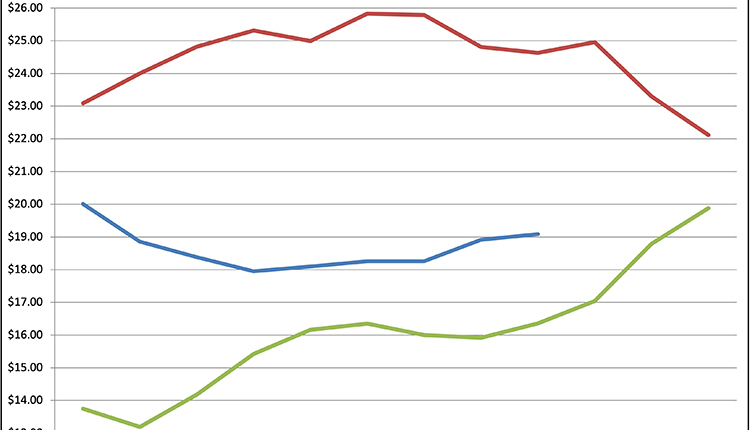

The table shows the latest futures prices and the implied Pennsylvania (Pa.) All-Milk price for 2020 and 2021. The price projections reflect information available as of May 6, 2020, when this article went to press. These prices are of very serious concern for dairy farmers. It is unlikely that any dairy farmers will be profitable for the remainder of 2020. Based on the dairy futures, prices return to more normal levels in 2021.

Feed markets

Fortunately for dairy producers, the corn and soybean meal markets are not especially affected by COVID-19. The 2020 corn and soybean crops are just getting planted. Of course, the expensive dollar hurts exports of feedstuffs also. In most cases, purchased feed will not be unduly expensive. The South American crops of corn and beans are at record levels, so worldwide there is no expected feed shortage.

Overall outlook

The overall dairy outlook for 2021 is somewhat better than for 2020. Dairy exports will be weak for some products and milk prices will reflect the weaker exports. Feed prices will be reasonable, in part because of the strong dollar. The table indicates the latest futures prices for Class III and Class IV milk and the implied Pennsylvania All-Milk price. The remainder of 2020 looks grim, but the 2021 prices return to more normal levels.