Unfortunately, we aren’t done with COVID-19 yet . . . or maybe it’s more correct to say that COVID-19 isn’t done with us yet. Either way, perhaps we should stop and ask what we have learned from the pandemic, which alters the way our markets are working.

director of dairy policy analysis at the Center for Dairy Profitability, Madison, Wis.

Many businesses and their supply chains were the envy of our modern world. Human and, more recently, machine learning has sifted through mountains of data to understand complex underlying demand relationships. This has helped us craft a culture of lean manufacturing. By cutting down on the expense of excess inventory and ordering inputs only when they’re needed, we have shaved costs out of the system. This “just-in-time” management was working like clockwork until COVID-19 gave us considerable grit in the gears.

Cobbled COVID-19 chains

Last year our highly coordinated system almost failed. We experienced serious demand shocks when we were socially isolated and staying safer at home. To be honest, there were some good things that came out of the experience. Many folks returned to their kitchens and dining room tables for meals, and our fluid milk purchases temporarily stopped their downward slide as milk and butter flew off the grocery shelves. But on the whole, isolation was not preferable.

We are trying to get back to more normal living. This year, children are in classrooms, more of us are working from our offices, and we are eating more meals in restaurants. But COVID-19 isn’t in the past yet, and it’s making some things — like price forecasting — harder than ever.

Most dairy processors have developed sophisticated demand models that help them forecast their cheese needs a year in advance. Of course, those are subject to tweaking along the way as new opportunities emerge, but the long-run forecast is a guiding principle for plants to signal just how badly they are going to want milk over the subsequent months.

A new perspective

Last year, during the first wave of COVID-19 cases, we held a few focus groups with processors and others to try to understand what they were doing to manage in the face of the biggest demand shock that we had ever seen. One of the observations was that the definition of “long-term” had declined from yearly to monthly and that short-term had dropped from monthly to daily.

We could no longer depend on demand models that were built with data from more normal times. They simply weren’t providing any insights for what the market wanted and what milk was worth.

In fact, another focus group member said that they had to put away the computer models and just fly by the seat of their pants. In other words, when clockwork wasn’t working, people resorted to the old sun dial, and we had to make do with our mental models.

Known conditions

As I am trying to forecast prices for the year ahead, I’m still using my mental model and putting together the important pieces of information that we know today:

The Delta variant of COVID-19 is surging. The current rise of new cases is not at a peak yet and, like previous waves, it seems to be starting in the Southern states and will probably work its way north through the rest of the country. It is impacting a much higher percentage of children than previous waves, and I have to question whether we can keep our schools continuously open.

Impact: Declining fluid milk sales to schools may be in store.

Access to shipping containers is constrained. The value of electronics and other consumer goods coming from Asia to the U.S. is much greater than the agricultural commodities that we would like to be shipping from the U.S. back to Asia. Containers are making the return trip to Asia empty to be refilled as quickly as possible rather than being sent to the interior of the U.S. to be filled with dairy products.

Impact: Export cheese sales decline.

Extreme weather in the form of heat and drought in the West is extensive. The value of the dairy ration is almost as high as it was back in 2012, and milk production in states like California, Oregon, New Mexico, and Washington is negative or below expectations. Although warmer and dryer than usual, the north central part of the U.S. has received adequate moisture at the right times and forage crops look fairly decent. These regions have the cows, and if we have the feed, we are going to produce milk.

Impacts: There will be less powder for export sales and more cheese produced. This will tend to keep Class III and IV prices more closely aligned with fewer negative PPDs.

Restaurant demand has been surprisingly robust. Many restaurants did not make it through the pandemic, but those that did are seeing large gains in sales. Those who are still in business have altered their ingredient purchases to a much shorter timeline, though. If the new surge of COVID-19 continues, there is concern that we may have to close down in-restaurant eating again.

Impact: Plants are holding inventory to be able to fill out-of-home eating demands on short notice.

Grocery sales are still decent. Although well down from the purchases of a year ago, IRI reports indicate that in April of 2020, we were preparing more than 88% of our meals at home. While that dropped to about 77% in July of 2021, it is still above prepandemic levels. Our shopping pattern has also changed from fewer trips to the store and large cart fills of groceries back to more trips and smaller purchase volumes.

Impact: Dairy sales are still significantly above 2019 levels, but there was a bigger hit on fluid milk, butter, yogurt and processed cheese. Natural cheese sales are still holding up.

What it means

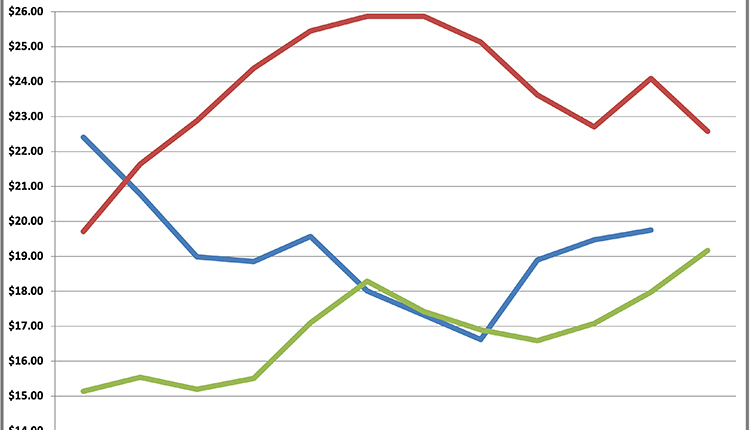

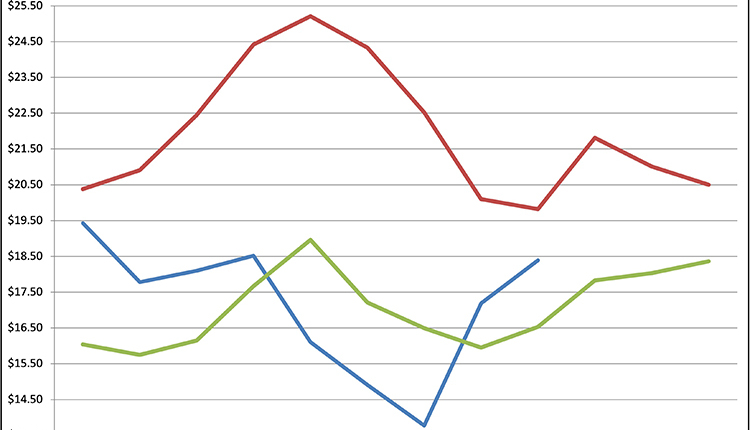

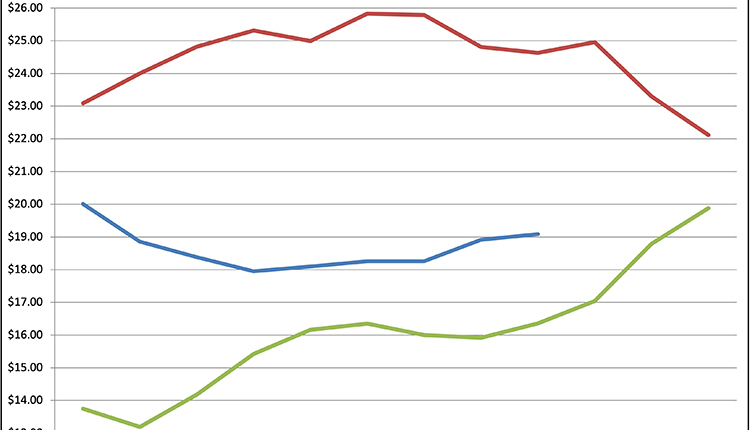

Despite my neutral forecast, it only reflects the fact that I can’t see around the corner. Despite very strong milk production, we have had better than expected domestic and export sales. Our markets seem to be balanced right now, but it is a precarious balance and it probably can’t sustain a very large demand impact. If COVID-19 closes down schools and restaurants again, or we can’t get export products out of our ports, then we can’t maintain the current level of milk production.

I am expecting that heat and high feed prices will have a negative impact on milk production in the U.S., and that may bring enough tightness into the supply side that we could take some smaller setbacks on demand and still not have a large impact on prices.

For planning purposes, look for an average All-Milk price that might average 60 to 80 cents higher than last year. But futures markets seem to be nervous about the long-run, and our milk checks are living in the present.