Will global demand sustain high milk prices? |

| Jan. 31 2022 |

| By Nate Donnay, StoneX Group Inc. |

|

|

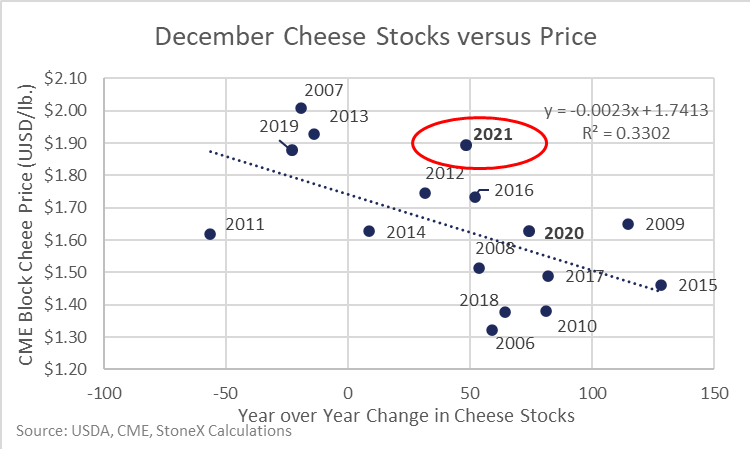

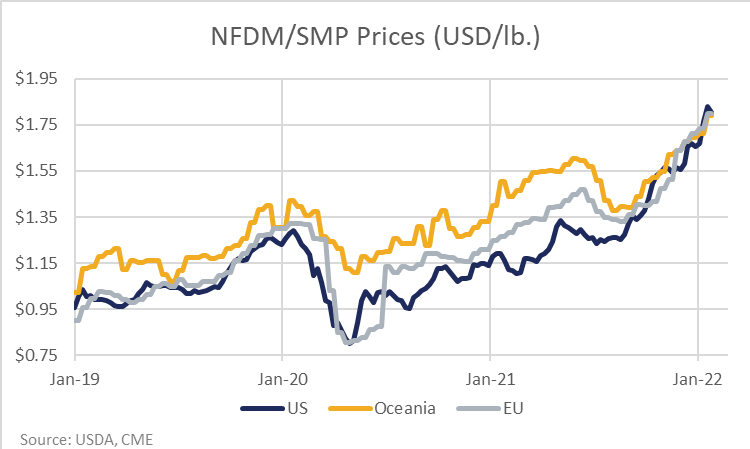

We can’t fully explain current dairy prices without looking at the world market. While U.S. milk production fell below year-ago levels in November and December and stocks of butter and powder have been pulled down, the tighter U.S. fundamentals don’t fully justify the prices that we’ve seen. The best example is probably cheese. Cheese stocks were still up 49 million pounds (+3.5%) from the previous year in December, yet CME block cheese averaged $1.89 as shown by the price circled in red below. With that type of inventory growth, our cheese model would put the “fair” price at $1.60. But a very tight world market with Cheddar prices in the $2.30 to $2.50 range helped to pull U.S. cheese prices higher for the month.  No U.S. dairy product is driven more by the world market than nonfat dry milk (NFDM). A graph of U.S. prices versus our main export competitors shows a very strong long-run correlation. Again, the U.S. NFDM fundamentals have tightened up with stocks held by manufacturers down 21% from the previous year in November. But without the strength that we’ve seen in global powder prices, the upside for U.S. NFDM prices would be capped.  What is driving the world market? The strength is being driven by weak milk production across nearly all of the major dairy exporters combined with supply chain anxiety that has kept buying strong in the face of the higher prices. The slowdown in milk production has been driven by a combination of higher input costs, environmental regulation, and weather. For instance, the December milk production data for New Zealand was just released which showed production down 5.5% from the previous year. Season-to-date, they are down 3.2%. That is partly due to both fewer farms and cows, which is driven by environmental regulation. However, the weather has also been poor since early November, and it has remained dry into late January. I would argue that the poor weather and production in New Zealand probably accounts for 15 cents of the 50-cent rally we’ve seen in NFDM since September. Demand is more of a mixed bag. The tight supply and logistics snarls have made it easier for buyers to stomach the higher prices as they worry more about getting the physical product than about the price, but the higher prices will be slowing demand in coming months. The biggest wild card on the demand side remains China. Their imports were very strong in the first half of 2021, but they flattened out in the second half of the year and they have not been aggressively buying in January either. They seem to have plenty of product on hand. However, one can stir an argument for their imports to swing either higher or lower. The U.S. market has tightened up with farmers cutting dairy cows and milk production dropping below year-ago levels, but global supply and demand has played a big part of the price gains we’ve seen over the past 120 days. The outlook for the world market still looks supportive through the first quarter, but things can change quickly, especially at these price levels. |