JULY RECORDED THE FIRST YEAR-OVER-YEAR decline in monthly milk production for 2023, with output for the month down 0.5% from July 2022. Record-breaking temperatures in many key milk-producing states took a toll, along with steady or slightly lower cow numbers.

CALIFORNIA MILK PRODUCTION WAS DOWN a whopping 5.5%. That was the biggest year-over-year decline since 2015. The weather, tight on-farm margins, and high production levels last year all played a role.

THE RELENTLESS HEAT AND LOW MILK PRICES also dropped milk production 4.4% in the Southwest region that includes Arizona, Texas, and New Mexico. On the other hand, production was up 3.8% in the Mideast, 1.8% in the Northeast, and 1.4% in the Midwest.

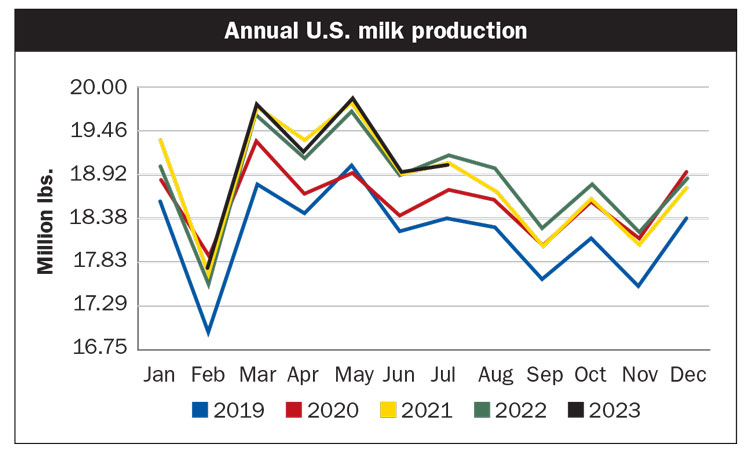

AS OF JUNE, YEAR-TO-DATE U.S. MILK PRODUCTION was up 0.51% over 2022 (see chart). Even though high beef prices have bolstered dairy cow slaughter numbers, the national herd has remained over 9.4 million head, just 13,000 head fewer than this time last year.

STEADY PRODUCTION AND AMPLE DAIRY PRODUCT STOCKS have weighed on milk prices, but according to University of Wisconsin’s Leonard Polzin, there may be light at the end of the tunnel. The Class III futures price is over $18 per hundredweight for the remainder of the year, but Polzin said we are not out of the woods yet. Read more on page 471.

THE FARMGATE MILK PRICE FORECAST was revised downward for the second time in two weeks by New Zealand’s Fonterra Co-operative Group. The forecast was reduced from a midpoint of $7 per kilogram of milk solids (kgMS) for 2023 to 2024 milk to $6.75 per kgMS.

FONTERRA’S CEO MILES HURRELL SAID FALLING Global Dairy Trade prices, down 16% since the opening forecast was released in May, required the co-op to reduce the midpoint another 25 cents. This drop will further challenge the budgets of New Zealand farmers.

WHOLE MILK POWDER PRICES FELL to a seven-year low at the August 15 Global Dairy Trade (GDT) auction. The 10.9% drop stemmed from concerns about Chinese demand.

MEANWHILE, BUTTER SURPASSED $2.70 PER POUND in mid-August CME trading, setting a new 2023 record of $2.77 per pound on August 17 after spending the first six months of the year below $2.50. An impressive 98 loads of butter traded on the CME, the most since November 2004.