LATE DECEMBER FUTURES CONTRACTS predict a dismal start to the year, with January and February Class III milk prices below $16 per hundredweight. Starting in March, futures slowly start to rebound, surpassing $18 per hundredweight in June at the magazine’s closing.

MEANWHILE, CLASS IV FUTURES PRICES retreated some but remain in the $18 and $19 per hundredweight range for the year ahead.

MILK OUTPUT SLID TO 18.08 BILLION POUNDS, down 0.6% from the year before. This marked the fifth straight month of year-over-year deficits. The biggest losses were in the Southwest and West, where milk fell 56 million pounds in New Mexico, 55 million pounds in California, and 30 million pounds in Texas. Output grew in other regions, including increases of 7% in South Dakota, 6.2% in Florida, and 2.5% in Ohio.

FEED PRICES HAVE SOFTENED, but with revenue from milk sales down, financial strain on dairies will likely limit production growth. Still, U.S. milk production for 2024 is expected to be up 0.9% over 2023, wrote NMPF’s Peter Vitaliano. That is a slower annual growth rate compared to the past two decades. Read more on page 42.

THE U.S. DAIRY COW HERD SIZE sank to a three-year low of 9.36 million head in November. That was 10,000 fewer than October and down 44,000 from November 2022. Dairy cow slaughter is also down, but low heifer inventories and milk prices are curbing farm expansion plans.

AFTER FIVE YEARS OF STRONG GROWTH, milk output in China is expected to flatten. Predicted production of 41 million metric tons in 2023 and 2024 would be 33% higher than China’s 2018 milk production.

NOW THAT HOLIDAY DEMAND HAS RECEDED, butter prices sank to below $2.50 a pound on the CME in mid-December. That was down more than $1 per pound compared to the record prices in October.

THE U.S. HOUSE OF REPRESENTATIVES passed the Whole Milk for Healthy Kids Act of 2023 last month. With bipartisan support and a vote of 330 to 99, the bill moved on to the U.S. Senate for consideration.

THE LEGISLATION WOULD ALLOW SCHOOLS to serve whole and reduced fat flavored and nonflavored milk as part of school meals. These varieties of milk were removed from school menus more than a decade ago, negatively impacting milk consumption among students.

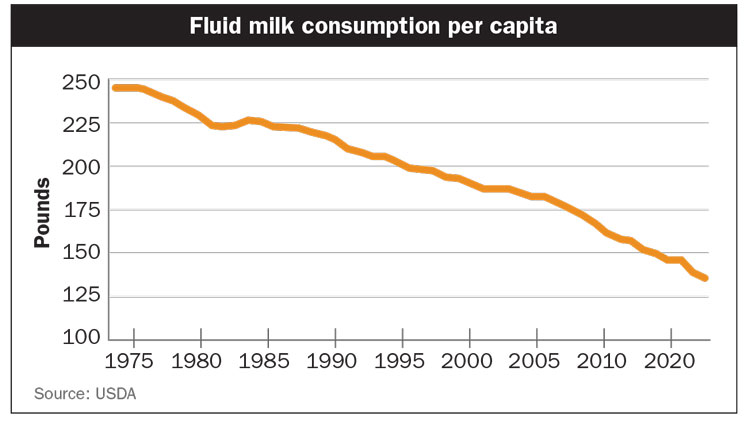

U.S. PER CAPITA CONSUMPTION of fluid milk was just over 15 gallons in 2022. That was down about half a gallon from 2021 and follows a multi-decade trend of falling milk consumption, as shown in the chart.