The author is the Coordinator, Economic Policy and Global Analysis, National Milk Producers Federation

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.

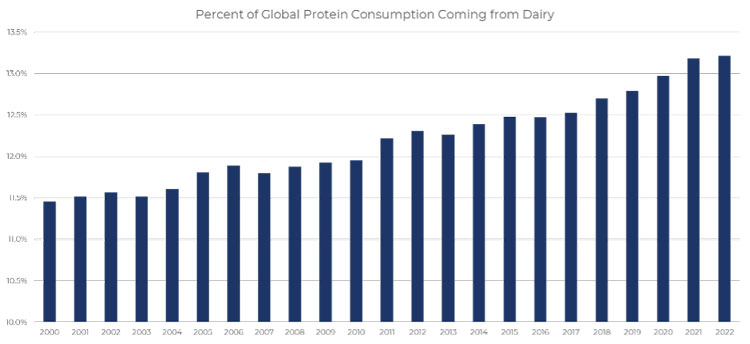

Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.

Still, despite that resiliency, inflation and economic uncertainty have affected consumers and the dairy industry.

Inflation had mixed effects

In 2022, consumers started to really take notice of rising grocery and food costs. Prices for goods across all categories, not just dairy, were starting to climb more than usual due to several factors, including the ongoing COVID-19 pandemic and international supply chain disruptions. Inflation reached a peak in summer of 2022, and though it has eased slightly since, prices are still significantly higher compared to three years ago.

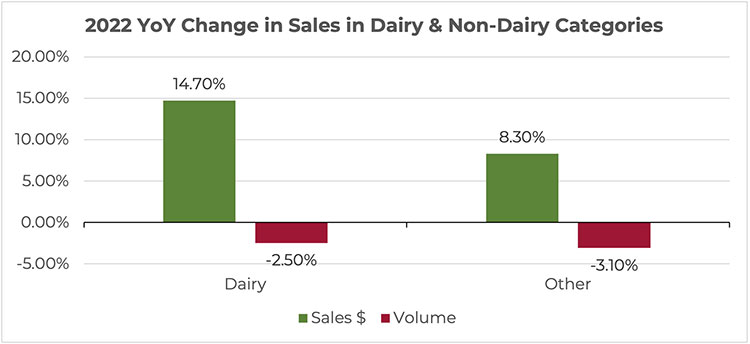

Source: NMPF-USDEC, IRI, NPD

Grocery and food items were some of the most prevalent and hardest hit areas by inflation, and dairy products were not immune. The price of dairy in food and beverage stores rose by more than 15% in 2022 compared to 2021, the highest jump in prices of all categories. The value of dairy sales grew significantly in 2022. Even so, and although this can partially be attributed to the higher prices, the growth in dairy sales (up 14.7%) outpaced that of non-dairy categories (8.3% greater).

Additionally, though all categories’ volume fell, the volume of dairy products sold fell less than that of non-dairy products. In other words: even though dairy had higher inflation rates, the slide in volume sold was less than the dip of other food and beverage categories. Shoppers were continuing to put dairy products in their cart despite the higher prices. That’s a testament to the dairy’s place as a dietary staple for many around the country and the world.

Dairy demand persists

Consumers prefer dairy products over plant-based alternatives: sales of cheese, frozen products, and other dairy goods dwarf plant-based imitations in stores. As even more alternatives fill shelves, dairy doesn’t lose shelf space. Rather, per capita consumption in several areas have grown, including cheese (up 17% from 2020), yogurt (up 5%), and butter (up 21%). The dairy aisle remains of top value when compared to other aisles within major food and beverage stores and is one of the fastest growing aisles in terms of sales dollars, topping $75 billion in 2022.

Cheese is expected to grow only more popular as time goes on, as is butter and yogurt. The U.S. dairy industry is poised to meet this demand as the industry advances in the coming years. As inflation wanes, consumers may return to trying higher value dairy products, of which there is no shortage. U.S. dairy will continue to be a major part of consumers’ diets and shopping carts.