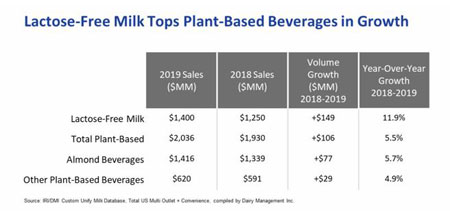

This might be tough to digest if you’re a plant-based fundamentalist, but the numbers don’t lie: In 2019, lactose-free milk sales grew twice as fast as plant-based beverages, with lactose-free poised to surpass almond-beverage sales this year.

How could this be, given the hyperbole about dairy’s decline and the rise of plant-based beverages? Well...

Contrary to some portrayals, the dairy sector is full of innovation, and lactose-free is a prime example of how dairy is addressing per-capita drops in fluid-milk consumption. Dairy categories increasing their sales, including whole milk (now more than two-fifths of consumer sales), lactose-free milk and flavored varieties, are giving plenty of reason for optimism about the future of milk. Meanwhile, plant-foods companies are “innovating” by figuring out which nut or seed to run through the grinder next. Soybeans, then almonds, then oats, and then... if past is prologue, pecans and pistachios are probably getting nervous.

This isn’t to suggest that some plant-based beverage sales aren’t growing. Indeed, some categories are rising quickly, but they’re growing from a tiny base.

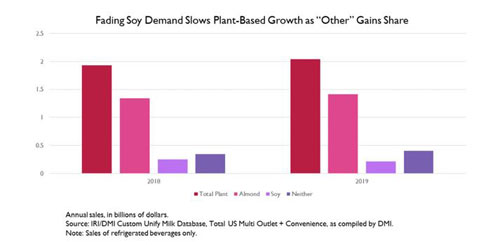

Breaking it down further: Almonds, with about three-quarters of sales, drive the plant-based beverage category. And almond-beverage sales are growing (although not as fast as lactose-free milk). Among plant-based beverages that aren’t almonds, soy is #2. But soy is declining, in 2018 by more than 13 percent from $248 million to $215 million, a percentage drop much greater than any sales decline in dairy. (We’re still waiting for the “Death of Soy” articles to be written, by the way.) Oat-based beverages are growing fast –an eye-popping 872 percent in 2019. But that will be impossible to sustain given its an incredibly small base: $7 million in 2018 to $68 million in 2019.

Meanwhile, Americans bought $13.88 billion of milk in 2019, down from $13.93 billion (we had to use extra digits because both round to 13.9). Size and scope, people. Size and scope.

So again – why does the plant-based-rising-as-dairy-declines narrative even exist? Because upstarts need to cast themselves as innovators -- even as their “innovations” use a lot of water and offer questionable nutrition – to justify the marketing and refrigerated shelf-space budgets spent to convince consumers they’re the Next Big Thing. Many of them pay slotting fees to enter the dairy case and call themselves “milks” – a category in which, nutritionally, they don’t belong. And they do that because the FDA lets them – which, given the FDA’s own labeling rules, they shouldn’t.

New and small vs. old-and-big is an ancient narrative – but miscast narratives, however easy to repeat, impede accuracy, and in this case, public health too. The growth of categories like lactose-free milk, greater innovation within dairy, contrasted with the growth-to-plateau-to-decline of some plant-based products (cashews, rice, hemp and hazelnuts – all saw sales drop last year) are all fresh, under-covered narratives.

The numbers are there. It might be worth a look.

The National Milk Producers Federation, based in Arlington, VA, develops and carries out policies that advance dairy producers and the cooperatives they own. NMPF’s member cooperatives produce more than two-thirds of U.S. milk, making NMPF dairy’s voice on Capitol Hill and with government agencies. For more, visit www.nmpf.org.