Three years have passed since the COVID-19 pandemic began, but there has been a very clear lesson learned regarding the need for risk management. While the tools used from one farm to the next may be different, the data is clear — risk management has become a far more utilized practice as dairy producers have come to learn that volatility can show its face anytime.

From Dairy Margin Coverage (DMC) and Dairy Revenue Protection (DRP), which are subsidized USDA offerings, to your commonly thought of futures, options, and even now some over-the-counter (OTC) products, the greater usage of these products can be seen across the board.

Dairy Margin Coverage is the most obvious of these examples. For those unfamiliar, DMC uses the gross margin levels of dairy farms based on a formula created by USDA. This formula takes the state average milk price reported by the National Agricultural Statistics Service (NASS) and compares it against a weighted average feed cost taking into account corn, alfalfa, and soybean meal. If the gross margin ends up lower than the coverage level that a producer placed, then they will get paid the difference in margin between their coverage level and the calculated margin.

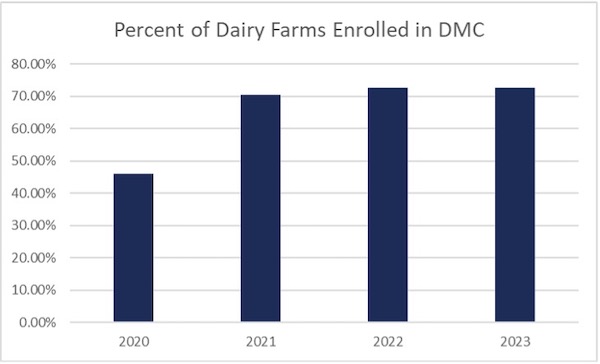

With the opportunity to cover up to 5 million pounds of milk annually (up to $4 per hundredweight (cwt.) gross margin) plus a small administrative cost of $100, it makes sense why there has been a lot of interest in this program. Farmers can secure additional coverage up to $9.50 per cwt. in gross margin protection for an additional fee that can be easily visualized in the DMC decision tool. This particularly holds true when you consider the increasing volatility in milk prices and the substantial step up in feed costs at the farm level. In 2020, which are policies that were committed to in 2019, DMC policies were only in place for 45.85% of dairy operations. Today, policies cover the largest concentration of milk and dairy operations in the history of the program, reaching 78.49% and 72.57%, respectively, for 2023 production and farms.

Dairy Revenue Protection experienced a similar growth in usage following the COVID-19 pandemic. Unlike DMC, DRP provides a farmer the opportunity to protect a specified amount of milk production over the period of a quarter for a specific price depending on the pricing model (class or component) and the coverage factor chosen.

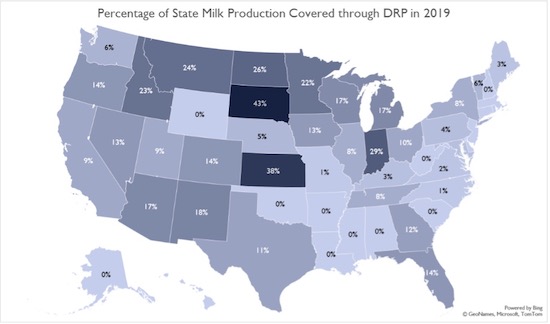

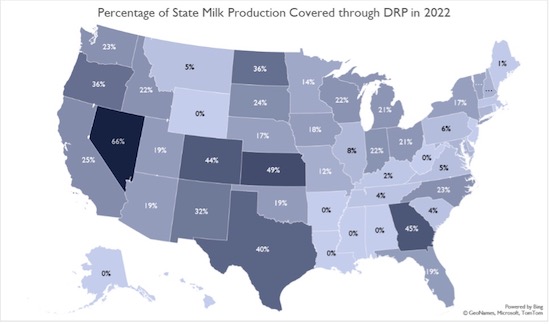

From 2019 to 2020, DRP coverage more than doubled, moving from 30 billion pounds of milk (14% of total U.S. milk production) to 64 billion pounds of milk (nearly 30% of total U.S. milk production). Since 2020, DRP coverage has waned slightly, but volume covered continues to be roughly one quarter of the total milk produced in the U.S. In the maps below, we can see the breakdown of DRP coverage as a percentage of total milk production by state from 2019 compared to 2022. There have been significant gains in DRP usage in states such as California, New York, and Texas.

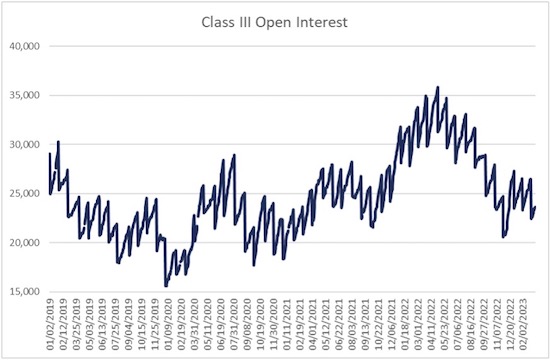

When it comes to the financial market, we can say with certainty that there is a lot more opportunity for dairy than there was even a decade ago. Open interest is a great example of this. We now average nearly 5,000 more contracts in open interest across the Class III forward curve than we did in 2013, and astronomically more contracts than there were in play in the market in the early 2000s. Since 2019, we have seen a bit of an increase in the futures market open interest. However, the real growth has come in options and over-the-counter contracts, which provide added flexibility and opportunity depending on your interest.

With greater use of risk management tools among dairy producers it is becoming clear that the industry has come to agree with what we, at StoneX, believe. Risk management is no longer a tool to simply gain an edge in the market; it is a now a necessary factor of a dairy farmer’s operation in order to stay in business. If you are interested in working with StoneX to manage your dairy operation’s risk at any point in the supply chain, please feel free to reach out to us at any time. https://www.stonex.com/Commodities/Dairy/