Yep! Those numbers are current. They are based on worldwide data. Initially, your reaction might be like several I shared the data with. "No way, I don't think so."

We are familiar with reports that show that 1 to 2 percent of U.S. citizens live on farms. In America, we are the minority and our numbers are shrinking. However, there are over 7 billion people in the world and 1 billion live on dairy farms. That is over 14 percent of the world population that see and work with dairy cows every day.

The average herd size in the U.S. is just over 200. Canadian dairy herds average 80 cows. But, worldwide, it is just three cows. Farms with more than 100 cows make up just 0.3 percent of the total dairy farm population. Imagine three-cow dairies scattered across North America . . . it is not even within most of our comprehension to view the scale that small.

The colors and patterns of the cows would be as diverse as collected by the IFCN Dairy Network. Global production average of 4,290 pounds of milk per cow. In some of these cases, milk production comes at a formidable cost.

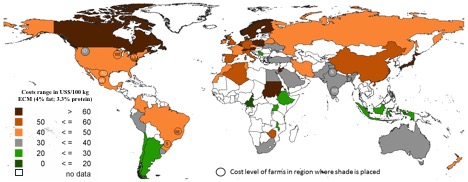

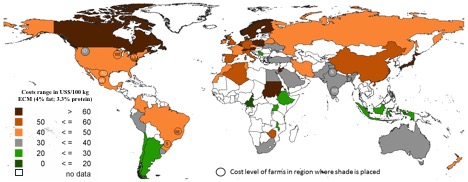

When comparing countries, it seems it is less expensive to produce milk in the Southern Hemisphere and more expensive in the very northern climates. Those low costs of production are often dependant on currency values and inputs fluctuations, and are on the rise. Additionally, weather can wreak havoc on countries dependant on pasture for feed. Purchasing feed can be pricy, which China does a lot of. The above chart demonstrates the cost of milk production on average sized farms around the world.

Low cost regions of the world include Peru, Chile and Uruguay as well as Central and Eastern Africa. While their costs are low, exports are not a consideration.

The dollar value for U.S. funds and the Euro can dictate dairy profitability with higher feed, land, wages and energy prices.

With advanced technology, automation and irrigation can fend off Mother Nature's impact on feed production. Many countries are highly dependent on weather for crop and pasture production.

Based in Germany, IFCN has collected, analyzed and reported on trends in the dairy industry for the past 15 years. Encompassing data from 55 countries they produced a 208-page book on their worldwide dairy findings. While we in the U.S. have a firm grasp on general U.S. dairy statistics, the global outlook is much different.

The author is the online media manager and is responsible for the website, webinars and social media. A graduate of Modesto Junior College and Fresno State, she was raised on a California dairy and frequently blogs on youth programs and consumer issues.

We are familiar with reports that show that 1 to 2 percent of U.S. citizens live on farms. In America, we are the minority and our numbers are shrinking. However, there are over 7 billion people in the world and 1 billion live on dairy farms. That is over 14 percent of the world population that see and work with dairy cows every day.

The average herd size in the U.S. is just over 200. Canadian dairy herds average 80 cows. But, worldwide, it is just three cows. Farms with more than 100 cows make up just 0.3 percent of the total dairy farm population. Imagine three-cow dairies scattered across North America . . . it is not even within most of our comprehension to view the scale that small.

The colors and patterns of the cows would be as diverse as collected by the IFCN Dairy Network. Global production average of 4,290 pounds of milk per cow. In some of these cases, milk production comes at a formidable cost.

When comparing countries, it seems it is less expensive to produce milk in the Southern Hemisphere and more expensive in the very northern climates. Those low costs of production are often dependant on currency values and inputs fluctuations, and are on the rise. Additionally, weather can wreak havoc on countries dependant on pasture for feed. Purchasing feed can be pricy, which China does a lot of. The above chart demonstrates the cost of milk production on average sized farms around the world.

Low cost regions of the world include Peru, Chile and Uruguay as well as Central and Eastern Africa. While their costs are low, exports are not a consideration.

The dollar value for U.S. funds and the Euro can dictate dairy profitability with higher feed, land, wages and energy prices.

With advanced technology, automation and irrigation can fend off Mother Nature's impact on feed production. Many countries are highly dependent on weather for crop and pasture production.

Based in Germany, IFCN has collected, analyzed and reported on trends in the dairy industry for the past 15 years. Encompassing data from 55 countries they produced a 208-page book on their worldwide dairy findings. While we in the U.S. have a firm grasp on general U.S. dairy statistics, the global outlook is much different.

The author is the online media manager and is responsible for the website, webinars and social media. A graduate of Modesto Junior College and Fresno State, she was raised on a California dairy and frequently blogs on youth programs and consumer issues.