The author is a dairy economist with Keough Ledman and Associates and publisher of the Daily Dairy Report, Libertyville, Ill.

When your milk price falls by more than 30 percent, there is little solace in hearing that it could be worse. But, really, it could be worse. U.S. dairy producers are faring better than their New Zealand and European counterparts largely due to a strong domestic market, lower feed costs and the regulatory framework of classified pricing.

When your milk price falls by more than 30 percent, there is little solace in hearing that it could be worse. But, really, it could be worse. U.S. dairy producers are faring better than their New Zealand and European counterparts largely due to a strong domestic market, lower feed costs and the regulatory framework of classified pricing.

Photo: It may take a double-digit reduction in New Zealand's milk production this upcoming season or a year-over-year reduction in Europe or U.S. milk flow to rebalance milk powder markets.

Down, down, down

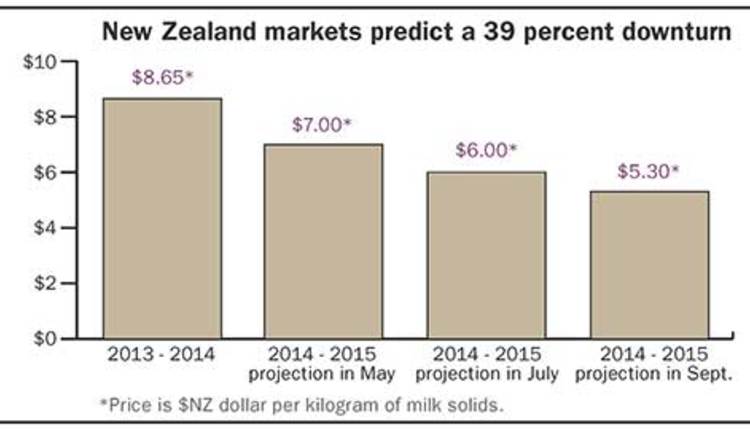

The foreshadowing of a major - and perhaps ultimately unprecedented - correction in milk prices came in May 2014. Fonterra, New Zealand's largest dairy cooperative and the world's leader in dairy exports, cut its pay price forecast to $7 per kilogram of milk solids (NZ$) for the 2014-15 season. That was a 19 percent drop compared to the record payout of $8.65 for the 2013-14 season. But that wasn't the end of it.

In late July 2014, Fonterra revised its estimated payout to $6 per kilogram of milk solids due to strong production globally, a build-up of inventory in China, and dwindling demand in some emerging markets in response to high dairy commodity prices. After a few more adjustments, the 2014-15 payout was only $4.40 per kilogram of milk solids, down 49 percent from the prior year.

As Fonterra, which markets over 90 percent of New Zealand's milk, geared up for the 2015-16 season, global dairy product markets remained in the doldrums. The co-op first estimated the 2015-16 payout at $5.25 per kilogram of milk solids in June 2015. The latest payout estimate was pegged at $3.85 per kilogram of milk solids. That is 12.5 percent less than the 2014-15 payout and a staggering 55 percent lower than 2013-14's record high payout.

Under New Zealand law, Fonterra is required to update its current season milk production forecast in early September. The cooperative stated that farmers are responding to a lower forecast for farmgate milk prices by returning to more traditional farming practices, which include reducing feed supplements, lowering stocking rates per hectare, and raising culling levels.

In Fonterra's production forecast announcement, the cooperative indicated that it is maintaining its earlier estimate of a 2 to 3 percent decline in output for the entire 2015-16 season. However, Fonterra also noted that current daily milk intake as of early September was lower than the same period last year, and there was further evidence that farmers were curbing production, which could lead to a downward revision in forecasted milk production through the season.

A market collision

The massive erosion in the New Zealand milk price was largely due to higher milk output around the globe that collided with China's exodus from the global market and Russia's ban on dairy product imports from the 28 nations in the European Union (EU-28), United States, Australia, Canada, Norway and Ukraine. While the United States was directly unscathed by the Russian ban because of licensing issues, the EU-28 lost access to its largest cheese market. As a result, EU dairy processors adjusted their product mix and sent more milk to dryers than cheese vats. Still, with year-over-year EU-28 milk production rising more than 2 percent, ample milk supplies have been able to fill cheese vats, too.

The EU's loss of the Russian market heightened competition in other cheese markets. For example, January through June EU-28 cheese exports to South Korea totaled 6,385 metric tons (MT) in 2013 and 8,428 MT in 2014. For 2015, EU-28 cheese exports for the first half of the year soared to 17,566 MT. Meanwhile, U.S. cheese exports through July 2015 to South Korea, the second largest cheese export market for the United States, trailed last year by nearly 3,000 MT. Likewise, EU-28 cheese exports to Japan are up 13,000 MT or 64 percent this year compared to U.S. trade with Japan, which is off 13,300 MT or 37 percent.

A steep decline in European cheese prices and a fortuitous 15 percent drop in the euro this year compared to the U.S. dollar aided European cheese exports. Nevertheless, European dairy product prices, and hence milk prices, have taken a major hit. European skim milk powder prices fell below the government-supported price of 1,698 euros per metric ton (approximately 85.5 cents). From mid-July to the end of August, the EU-28 acquired 14,605 MT of skim milk powder under its intervention program.

Through the first half of 2015, European milk prices averaged nearly 25 percent less than the prior year. The outlook is for more price erosion through year-end or until there is an appreciable slowdown in EU-28 milk production.

Not as bad

Like their New Zealand and European counterparts, U.S. dairy producers are banking much smaller milk checks this year. The U.S. All-Milk price averaged $16.60 per cwt., in July 2015, nearly 30 percent less than July 2014. Strong domestic demand for butter and cheese has buoyed CME spot prices, which are at a significant premium to global markets.

In addition, the regulatory pricing framework across most of the United States results in dairy producers receiving a weighted average milk price based on how all of the milk in their marketing area is utilized. The blending of the classified milk prices assures that the financial burden of balancing the milk supply is shared among all producers in a marketing area and not just those who currently ship milk to a milk powder plant.

Looking forward, the U.S. All-Milk price is expected to average near $16.50 through year-end. The Easter holiday occurs early in 2016, landing on March 27, which should support domestic butter and cheese demand through the first quarter of 2016. However, U.S. dairy product prices and milk prices are expected to retreat in the second quarter of 2016 as U.S. milk production seasonally peaks and exports continue to face strong competition, predominately from Europe.

A significant change in global milk production, such as a double-digit reduction in New Zealand's output or lower year-over-year production in Europe or the U.S., could change this bearish outlook by significantly bolstering milk powder markets.

On the demand side, the markets are waiting for China to resume its old purchasing habits and Russia to open its market, but that could take awhile. The supply correction will most likely come first.

This article appears on page 619 of the October 10, 2015 issue of Hoard's Dairyman.

Return to the Hoard's Dairyman feature page.

When your milk price falls by more than 30 percent, there is little solace in hearing that it could be worse. But, really, it could be worse. U.S. dairy producers are faring better than their New Zealand and European counterparts largely due to a strong domestic market, lower feed costs and the regulatory framework of classified pricing.

When your milk price falls by more than 30 percent, there is little solace in hearing that it could be worse. But, really, it could be worse. U.S. dairy producers are faring better than their New Zealand and European counterparts largely due to a strong domestic market, lower feed costs and the regulatory framework of classified pricing.Photo: It may take a double-digit reduction in New Zealand's milk production this upcoming season or a year-over-year reduction in Europe or U.S. milk flow to rebalance milk powder markets.

Down, down, down

The foreshadowing of a major - and perhaps ultimately unprecedented - correction in milk prices came in May 2014. Fonterra, New Zealand's largest dairy cooperative and the world's leader in dairy exports, cut its pay price forecast to $7 per kilogram of milk solids (NZ$) for the 2014-15 season. That was a 19 percent drop compared to the record payout of $8.65 for the 2013-14 season. But that wasn't the end of it.

In late July 2014, Fonterra revised its estimated payout to $6 per kilogram of milk solids due to strong production globally, a build-up of inventory in China, and dwindling demand in some emerging markets in response to high dairy commodity prices. After a few more adjustments, the 2014-15 payout was only $4.40 per kilogram of milk solids, down 49 percent from the prior year.

As Fonterra, which markets over 90 percent of New Zealand's milk, geared up for the 2015-16 season, global dairy product markets remained in the doldrums. The co-op first estimated the 2015-16 payout at $5.25 per kilogram of milk solids in June 2015. The latest payout estimate was pegged at $3.85 per kilogram of milk solids. That is 12.5 percent less than the 2014-15 payout and a staggering 55 percent lower than 2013-14's record high payout.

Under New Zealand law, Fonterra is required to update its current season milk production forecast in early September. The cooperative stated that farmers are responding to a lower forecast for farmgate milk prices by returning to more traditional farming practices, which include reducing feed supplements, lowering stocking rates per hectare, and raising culling levels.

In Fonterra's production forecast announcement, the cooperative indicated that it is maintaining its earlier estimate of a 2 to 3 percent decline in output for the entire 2015-16 season. However, Fonterra also noted that current daily milk intake as of early September was lower than the same period last year, and there was further evidence that farmers were curbing production, which could lead to a downward revision in forecasted milk production through the season.

A market collision

The massive erosion in the New Zealand milk price was largely due to higher milk output around the globe that collided with China's exodus from the global market and Russia's ban on dairy product imports from the 28 nations in the European Union (EU-28), United States, Australia, Canada, Norway and Ukraine. While the United States was directly unscathed by the Russian ban because of licensing issues, the EU-28 lost access to its largest cheese market. As a result, EU dairy processors adjusted their product mix and sent more milk to dryers than cheese vats. Still, with year-over-year EU-28 milk production rising more than 2 percent, ample milk supplies have been able to fill cheese vats, too.

The EU's loss of the Russian market heightened competition in other cheese markets. For example, January through June EU-28 cheese exports to South Korea totaled 6,385 metric tons (MT) in 2013 and 8,428 MT in 2014. For 2015, EU-28 cheese exports for the first half of the year soared to 17,566 MT. Meanwhile, U.S. cheese exports through July 2015 to South Korea, the second largest cheese export market for the United States, trailed last year by nearly 3,000 MT. Likewise, EU-28 cheese exports to Japan are up 13,000 MT or 64 percent this year compared to U.S. trade with Japan, which is off 13,300 MT or 37 percent.

A steep decline in European cheese prices and a fortuitous 15 percent drop in the euro this year compared to the U.S. dollar aided European cheese exports. Nevertheless, European dairy product prices, and hence milk prices, have taken a major hit. European skim milk powder prices fell below the government-supported price of 1,698 euros per metric ton (approximately 85.5 cents). From mid-July to the end of August, the EU-28 acquired 14,605 MT of skim milk powder under its intervention program.

Through the first half of 2015, European milk prices averaged nearly 25 percent less than the prior year. The outlook is for more price erosion through year-end or until there is an appreciable slowdown in EU-28 milk production.

Not as bad

Like their New Zealand and European counterparts, U.S. dairy producers are banking much smaller milk checks this year. The U.S. All-Milk price averaged $16.60 per cwt., in July 2015, nearly 30 percent less than July 2014. Strong domestic demand for butter and cheese has buoyed CME spot prices, which are at a significant premium to global markets.

In addition, the regulatory pricing framework across most of the United States results in dairy producers receiving a weighted average milk price based on how all of the milk in their marketing area is utilized. The blending of the classified milk prices assures that the financial burden of balancing the milk supply is shared among all producers in a marketing area and not just those who currently ship milk to a milk powder plant.

Looking forward, the U.S. All-Milk price is expected to average near $16.50 through year-end. The Easter holiday occurs early in 2016, landing on March 27, which should support domestic butter and cheese demand through the first quarter of 2016. However, U.S. dairy product prices and milk prices are expected to retreat in the second quarter of 2016 as U.S. milk production seasonally peaks and exports continue to face strong competition, predominately from Europe.

A significant change in global milk production, such as a double-digit reduction in New Zealand's output or lower year-over-year production in Europe or the U.S., could change this bearish outlook by significantly bolstering milk powder markets.

On the demand side, the markets are waiting for China to resume its old purchasing habits and Russia to open its market, but that could take awhile. The supply correction will most likely come first.