The information below has been supplied by dairy marketers and other industry organizations. It has not been edited, verified or endorsed by Hoard’s Dairyman.

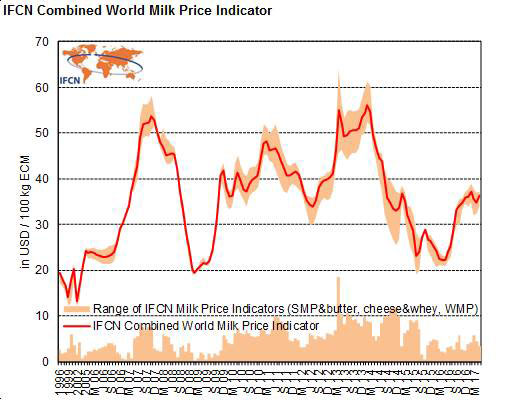

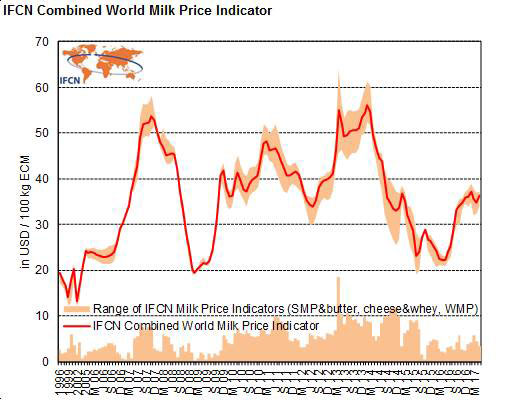

The 18th IFCN Dairy Conference on June 10-14 in Kiel, Germany showed the most recent analysis of the sector developments from 2016 and monthly throughout the 2017. Interestingly, the message from the last IFCN Dairy Conference, at the depth of the milk price crisis, has proved accurate: that milk prices recovered by the end of the year 2016. Indeed, the last price roller-coaster from 2014 with around 50% fluctuations seems to have halted after nine months of recovery and is oscillating due to milk supply responses and high fat prices. Dr. Torsten Hemme, Managing Director of the IFCN, stated: ‘Let’s do not talk just about the milk crisis, better see the bigger picture of price cycles in dairy. The cycle that started in 2013 has now come to an end. And we shall be prepared for the next one.’

The persistent low prices over the last two years have triggered supply response, with 2016 showing the lowest milk production growth since 1998. Leading in growth of milk production last year were India, USA and the Netherlands, offsetting lowest production growth in China, Brazil, Argentina, Oceania. Demand growth has not yet recovered to records from 2006 or average level, yet it has not been devastating. Moreover, milk import demand has picked up in China, Brazil, Philippines, Mexico.

All these factors (prices and production) and many more have influence on the farm structural changes. After a constant growth in farm numbers in the past, a worldwide gradual decrease of farm numbers since 2014 at around 1.5% annually is observed. However, milk production increases ever since.

Anders Fagerberg, Chairman of the IFCN Board concluded at the end of this 3 days conference: We are living in a changing dairy world. This has impact on farm level, but also the entire related dairy chain. Key is to cope with these changes and have confidence and access to data. Retailers and policy makers should have access to this knowledge, to prepare the ground for an economic dairy future.

Looking-forward, however, various elements hint that milk prices are not likely to increase significantly in the near future, but rather to stabilize. In terms of production, since October the milk production growth resumed worldwide and has been raising. Many markets are starting to pick up national production in two first quarters of 2017 reacting to price recovery in the second half of 2016. The issue of stocks remains of major uncertainty and estimated levels are still substantial. Furthermore, oil and feed prices, important drivers of the milk price, appear to remain rather stable and converging.

All these factors (prices and production) and many more have influence on the farm structural changes. After a constant growth in farm numbers in the past, a worldwide gradual decrease of farm numbers since 2014 at around 1.5% annually is observed. However, milk production increases ever since.

Anders Fagerberg, Chairman of the IFCN Board concluded at the end of this 3 days conference: We are living in a changing dairy world. This has impact on farm level, but also the entire related dairy chain. Key is to cope with these changes and have confidence and access to data. Retailers and policy makers should have access to this knowledge, to prepare the ground for an economic dairy future.