When it comes to the new Dairy Margin Coverage (DMC) program, I want to make sure dairy farmers and their lenders know what the point of the program is. It isn’t to get a bunch of money out of the federal government every year; it’s to make sure that dairy farmers have an adequate safety net when they need it.

DMC works so that when the milk price is up, operations get more from the marketplace; but in bad years, the program kicks in, which makes overall gross revenue less subject to extreme market swings.

A major impact

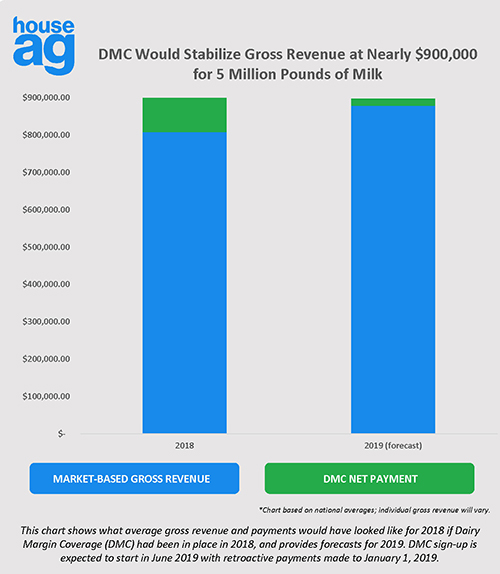

If DMC had been in place for both 2018 and 2019, a farmer marketing 5 million pounds of milk would have yielded just under $900,000 in gross revenue each year based on national average All-Milk prices.

The difference between the two years is that in 2018, about $810,000 of the total would have come from market receipts and $90,000 would have come from using DMC at the $9.50 per hundredweight (cwt.) coverage level. Prices are expected to improve in 2019 so about $880,000 is forecasted to come from market receipts, and only about $20,000 is likely to come from using DMC at the $9.50 per cwt. level. In either case, the farm is grossing about $900,000 for those 5 million pounds.

Prefer marketplace demand

One of my biggest priorities as chairman is to grow demand for U.S. dairy products so that dairy farmers can get all their income directly from the marketplace, but until that is the case, DMC will be there so dairy farmers have a chance to keep going when times are tough.