The global outlook now is not nearly as dire as it was at the height of the COVID-19 crisis. Dairy markets have seen extreme volatility in recent months and may continue to be a yo-yo as the U.S. reopens.

With the rapid rebound in cheese prices in the U.S., and similar but less extreme gains elsewhere, it may be tempting to assume we have recovered and not look back. But, even if markets have moved back toward, or in some cases above, pre-COVID-19 levels, it does not mean that our expectation for the future should be the same as it was pre-COVID-19.

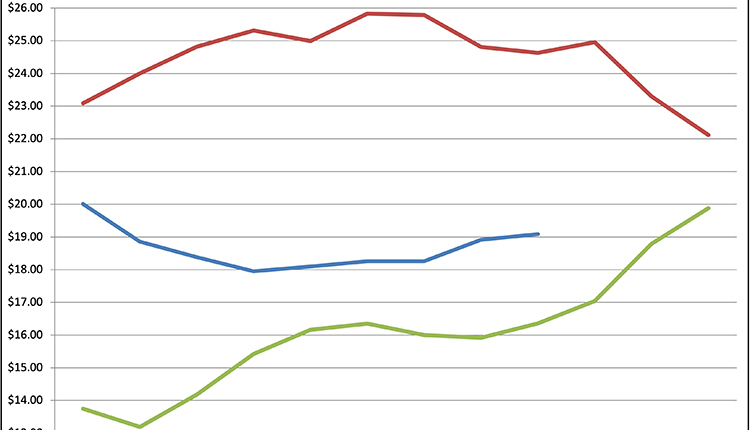

After stay-at-home orders were put in place for much of the country in late March, shuttered restaurants resulted in a shocking drop in cheese prices. CME block cheese spot prices bottomed out at $1 per pound. Some processors sought supply reduction to adjust to the falling demand.

As dairy producers reduced supply, reopening began, and the government swooped in and bought additional products to help support the market. A shock imbalance, particularly for cheese, occurred. Block cheese prices have rallied to an all-time high of $2.50 per pound. But, while price rebounds are welcome, it may be best to wait for the dust to settle to assess the true strength of the current market.

Food service is beginning physical therapy

The balance between food service sales and retail sales has been one of the most defining features of this crisis. As we lift the lockdowns in much of the world, food service resembles a knee replacement patient beginning physical therapy. Food service sales will take time to return to normal due to remaining capacity restrictions, cautious consumers, and the financial status of consumers.

Elevated retail sales will eventually return to a normal trend over time. However, the extent of the lockdown may have been long enough to form new habits, and some segments of consumers may continue preparing more food at home on an ongoing basis. If schools don’t fully reopen in the fall, parents more broadly may continue to serve bowls of cereal and milk in the morning and home cooking in the evenings.

A less robust economy

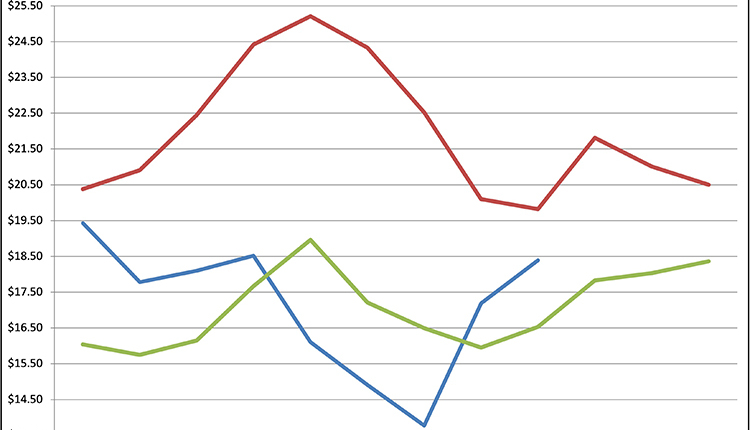

Much of the world will emerge from COVID-19 lockdowns into economic recession. Slower economic growth will weigh on domestic demand as well as curb import demand in many regions. Southeast Asia has been a critical force in driving export opportunities for many milk-producing areas. With import demand down in this region as well as China, the U.S. will be competing with European and Oceania exporters to fill the orders that do come.

Heavy inventories of storable dairy products and reduced demand growth will weigh on global milk prices through 2020 and into 2021. Given that it’s an election year, the government is likely to continue to be supportive of U.S. agriculture, which may keep the U.S. prices somewhat elevated relative to the rest of the world through 2020. What happens in 2021 is highly uncertain at this stage, but current fundamentals point to ample milk and weaker global demand.