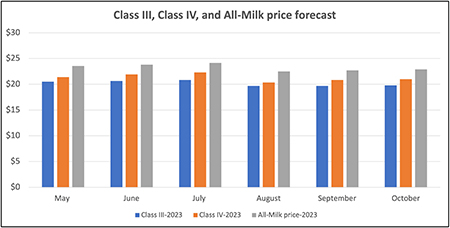

Over the course of 60 days, USDA economists raised their 2023 All-Milk price projections by 40 cents. In making that move from a $22.50 to a $22.90 per hundredweight price forecast, economists pinned the hopes of higher prices to the Class IV portion of milk checks.

At the moment, the U.S. butter price is well above the world market, and that price has been buoying Class IV prices. Butter prices likely will fade, to some degree, after this fall and early winter’s hot holiday baking season.

However, the other portion of the Class IV category, dry milk powders, may take over the pole position from its counterpart when holiday butter demand backs off. That’s because natural gas is a key energy source for drying down milk. If natural gas inventories remain limited throughout Europe due to the ongoing conflict between Russia and Ukraine, the continent’s skim milk and whole milk powder supplies could dwindle. That, in turn, would cause customers to turn to other sources such as the United States. Those shifts in buying patterns would underpin the category or even send Class IV prices higher. That’s part of the reason USDA economists raised Class IV projections from $20.35 to $21 over the last 60 days.

While Class IV shows upside, the Class III cheese category has been rather flat on the price front. USDA projections moved only 10 cents in the past month. While cheese demand remains strong, several new cheese plants have come online and that will keep supplies strong throughout the next year.

Overall, U.S. cheese production has grown 19% from 2014 to 2021, reported AMPI CEO Sheryl Meshke at the Global Dairy Symposium held during World Dairy Expo. “We project that will grow by 13% by 2025,” said the leader of the nation’s No. 1 cheese co-op that is also ranked No. 12 in the world.

While USDA’s price projections would indicate profitability for many dairy farms, volatility will remain, and that will make risk mitigation strategies so very important. “Dairy will be the most volatile commodity in agriculture moving forward,” shared Torsten Hemme of the IFCN Dairy Research Network. “Don’t fight volatility. Manage it,” advised Hemme, alluding to the fact that farmers should lock in a profit when futures markets present opportunities.