As of January 2023, overall inflation, based on the consumer price index (CPI), came in slightly above market expectations with the price index 6.4% above a year ago. Food prices remained persistently elevated at 10.1% year over year (YOY), with the dairy subcategory coming in even higher at 14% above a year ago.

If there was good news for consumers, it was that the month-to-month change between December and January was flat for dairy, on a seasonally adjusted basis. I expect prices to continue easing in the coming months following the decline already experienced in wholesale prices.

Consumers have worked through inflation with a variety of tools like shifting to store-brand foods, preparing more food at home (a pandemic tool still in the chest), and dipping into savings. The personal savings rate can be used as a measure of consumers’ ability to withstand price increases. Following unprecedentedly high savings rates early in the pandemic, savings rates have now fallen to levels not seen since 2008, suggesting that consumers have exhausted that option and will change their consumption patterns.

Butter stands out

The most dramatic impact may have been domestic butter demand, which fell 6.9% in response to record-high prices in 2022. Part of this was due to slower purchases at the grocery store, but the dip was also a shift to more at-home eating, which tends to be less heavy in butter and cream.

Cheese fared slightly better than butter. Domestic commercial disappearance of American cheese (mostly Cheddar) in 2022 was essentially flat compared to 2021 levels. Meanwhile, other cheese types (mostly Mozzarella) were up 2.2% in 2022. Mozzarella, in pizza form, has proven resilient in challenging times.

Declining fluid milk demand was nothing new, but it showed signs of worsening with inflation. Federal order milk pooled for Class I use was down 2.7% in 2022 when compared to 2021. However, milk demand decelerated as the year went on. Demand in the first half of the year was down 1.9% YOY while the second half spiraled 3.5% lower YOY.

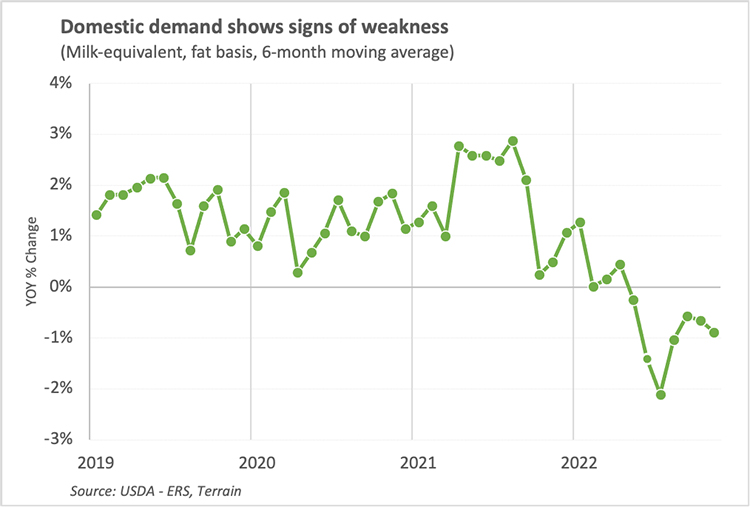

Combining all dairy products together into an equivalent amount of milk revealed that domestic demand was down by between 1.04 billion pounds and 2.3 billion pounds of milk in 2022 (depending on if you use a skim-solids or milkfat basis, respectively).

Weaker demand has already contributed to lower prices for dairy commodities and, in turn, milk checks. Facing recession risk in 2023, consumer demand will continue to struggle to find firm footing, especially with fewer inflation workarounds available. While demand might be more volatile, lower price tags on grocery shelves should ultimately help support domestic demand this year providing a solid base for milk prices.