The financial health of dairy producers has weakened in 2023. The April 2023 Dairy Margin Coverage (DMC) margin falling below the $6 level provides insight into dairy producers' tight margin situation. Uncertainty remains regarding what financial headwinds producers may face for the remainder of 2023. Developments impacting both receipts and production costs could make the second half of 2023 better or worse from a dairy margin standpoint.

Demand for dairy products has slowed. Although wholesale cheese prices started the year more than 30% above their 2016 to 2019 average, as of May they had fallen to near the 2016 to 2019 average. These lower prices highlight how strong domestic dairy demand was in 2022 and that we could be returning to a period similar to what was experienced before COVID-19. International demand growth for U.S. dairy products has also slowed, as shown by USDA's latest monthly supply and demand report estimating lower U.S. dairy exports on a skim-solids basis and fat basis for 2023 relative to 2022.

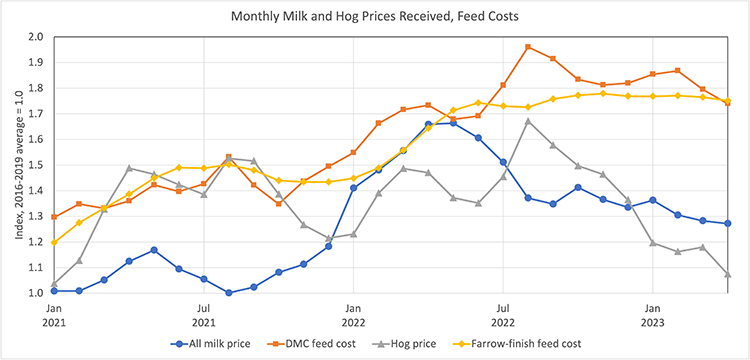

Meanwhile, milk production costs have remained high. The April DMC feed cost is more than 70% above the 2016 to 2019 average. Although there is still time for rainfall before this fall's corn crop matures, dry weather is popping up in larger areas of the country that could keep this year's corn yield below trend levels.

The hog industry faces similar financial headwinds in 2023. The graph shows that current hog prices are almost back to their 2016 to 2019 average after exceeding that historical average by nearly 70% in mid-2022, while feed costs remain 75% above the 2016 to 2019 average. Inelastic supply and demand have put the hog industry in a financial situation not seen since the late 1990s.

Could dairy face hog’s dilemma?

The question for the dairy industry is whether the financial situation could become as difficult as that currently faced in the hog sector. The graph shows dairy feed costs, as measured by DMC feed costs, are similar to hog feed costs, and milk prices have come off of the highs seen in the spring of 2022. The major difference between these two industries is that milk prices remain nearly 30% above their 2016 to 2019 average.

Dairy producer margins could continue to weaken in the coming months if feed costs stay high and milk prices continue to slide. Hog producers did not expect the tough economic times that have unfolded for them in 2023. Although risk protection may prove difficult when margins are tight, the situation for hogs only reminds the dairy industry that returns can worsen.