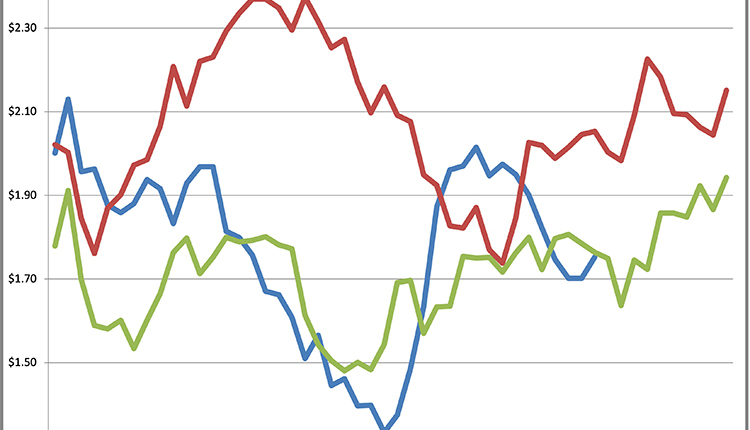

THE BUTTER MARKET CLIMBED TO NEW HEIGHTS when prices peaked at $3.5025 per pound on October 6. That followed seven days of trading at record prices in late September and early October.

PRODUCTION WAS STRONG the first seven months of the year, but hot weather conditions and the demand for cream dropped August butter output 2.1% compared to 2022, resulting in the lowest August production seen since 2018. Reduced inventories, along with high domestic demand, joined together to push butter prices to new levels.

MANUFACTURERS FACED COMPETITION for cream this summer, with output increases in ice cream (up 1.26%), low-fat cottage cheese (up 15%), full-fat cottage cheese (up 6%), and yogurt (up nearly 3%) when comparing August 2023 to the year before.

AUGUST U.S. DAIRY EXPORTS WERE DOWN 25% in value compared to the same month last year. For the first eight months of 2023, U.S. dairy exports were valued at $5.55 billion, down 13% from the first eight months of 2022. Exports to Mexico and Canada were up, but sales to China were down 20% and exports to Japan were 18% lower.

MEANWHILE, DAIRY IMPORTS WERE HIGHER than a year ago. In August 2023, dairy imports into the U.S. were valued at $443.4 million, up 7% from August 2022. That is the third-highest monthly dairy import value on record, only sitting behind October 2022 and March 2023. For the year so far, imports are up 12% over last year.

A GOVERNMENT SHUTDOWN WAS AVOIDED when President Joe Biden signed a temporary measure passed by Congress that continues to fund the federal governement through November 17. Current farm bill funding did expire at the end of September, but some key programs in the 2018 version of the bill remain funded through the end of the year.

A NEW FARM BILL IS UNLIKELY by the end of this year, said National Milk Producer Federation’s incoming president and CEO, Gregg Doud, during a panel discussion at World Dairy Expo. Little progress is expected to be made until a new Speaker of the House is named after the ousting of former Speaker Kevin McCarthy earlier this month.

AFTER SEVEN WEEKS of testimony, the Federal Milk Marketing Order hearing was put on pause October 11 and is scheduled to resume on November 27. Originally scheduled to conclude by mid-October, the number of proposals, extent of cross-examination, and logistical issues with the hearing site in Carmel, Ind., prompted the pause.

MARGINS FOR THE DAIRY MARGIN COVERAGE program improved in the most recent calculation. For August, the milk price above feed costs margin was $6.46, $2.94 higher than July’s record low. Margins remain depressed, though. This marks the seventh consecutive month with a margin below $6.50; margins only fell below that threshold seven times total between 2019 and 2022.

THE OCTOBER CLASS III CONTRACT fell to $16.84 per hundredweight at the magazine’s closing. Cooler weather and reduced culling, with dairy cow slaughter falling below historical averages for several weeks in a row, are adding to milk supplies. University of Missouri’s Scott Brown expects Class III prices to hover around $20 per hundredweight in 2024. Read more on page 546.

WALMART ANNOUNCED PLANS TO BUILD a $350 million milk processing plant in southern Georgia. The facility will employ nearly 400 people and will provide milk to more than 750 Walmart and Sam’s Club stores in Georgia and neighboring states. Georgia currently has just two commercial milk processing plants.