THE U.S. DAIRY HEIFER INVENTORY FELL TO A 20-YEAR LOW, according to numbers released by USDA. At the first of this year, there were 4.06 million heifers weighing over 500 pounds across the country.

THE NUMBER OF HEIFERS EXPECTED TO CALVE this year is 2.59 million head, the smallest inventory by far since tracking began in 2001. Elevated rearing costs, along with high beef prices that incentivized more producers to use beef sires, are some factors that contributed to this decline.

TIGHT HEIFER SUPPLIES FORCED DAIRY PRODUCERS to rein in cull rates last fall, according to Sarina Sharp from the Daily Dairy Report. Dairy cow slaughter remained well below normal, and over the first three weeks of this year, it lagged 2023’s pace by 24%.

ALL CATTLE AND CALVES IN THE U.S. AS OF JANUARY 1 (dairy and beef) totaled 87.2 million head, down 2% from the year before.

THE NUMBER OF DAIRY COWS FELL SLIGHTLY IN 2023 to 9.36 million head. Meanwhile, milk production rose marginally to 226.6 billion pounds, a 0.04% year-over-year gain from 2022.

POTENTIAL RESTRAINTS ON MILK OUTPUT resulted in upward price movement in many product categories, including Class III futures that now sit in the $17-range for March to May as of early February.

THE AVERAGE CLASS III PRICE FOR THE YEAR could be around $17.30, which is similar to 2023 and isn’t good news for farmers, noted StoneX’s Nate Donnay. The Class IV milk price, on the other hand, could be closer to $21, which would be almost $2 higher than in 2023.

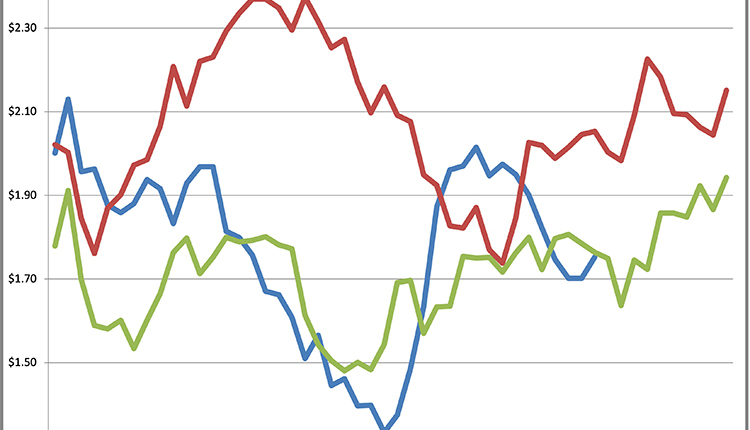

ON A POSITIVE NOTE, DONNAY SAID FEED COSTS are expected to come down by about 15%, which would improve farmer margins, especially for the second half of the year. Read more on page 91.

ENROLLMENT FOR THE DAIRY MARGIN COVERAGE (DMC) program remained closed. Software and database updates needed to make milk production history modifications is one reason for the delay.

AFTER 12 WEEKS OF TESTIMONY AND CROSS-EXAMINATION, the longest Federal Milk Marketing Order (FMMO) hearing in history concluded on January 30. USDA will now proceed through the required steps before presenting a final rule for producers to vote on.

THE AMERICAN FARM BUREAU FEDERATION sent a letter to USDA Secretary of Agriculture Tom Vilsack urging the agency to issue a final decision on an emergency basis to speed up the implementation of the “higher of” Class I mover formula to buffer farmers from further losses during the remaining FMMO revision process. Read more on page 102.

EXPORTS ARE A GROWTH OPPORTUNITY FOR DAIRY, but sales overseas weakened in 2023. Just over 5.8 billion pounds of dairy products were sent abroad, down 7.3% from the year before. A sluggish global economy and noncompetitive prices held back U.S. exports.

EXPORTS TO MEXICO REACHED A RECORD HIGH of nearly 1.59 billion pounds in 2023. Unfortunately, exports to other major destinations were lower, including China (down 14%) and Canada (down 11%).

CHINA’S WHOLE MILK POWDER IMPORTS IN 2023 plummeted 38.4% compared to 2022, while ultra-high temperature (UHT) milk, butter, and whey imports were also down. Skim milk powder imports tumbled at the end of the year but were up slightly overall in 2023. Cheese was the import winner, up 23% from the year before.