The outlook for milk prices and dairy farm margins looks favorable into 2025, but will this momentum be maintained? Milk prices are over $20 per hundredweight (cwt.), corn and soybean prices are at multi-year lows, and beef prices continue to be at historically high levels. When talking to dairy farmers and cooperatives around the U.S., the word “optimistic” is regularly heard.

Looking at the supply side of the equation, milk production in the U.S. has been below year-ago levels since July 2023. While the year-over-year changes are expected to turn positive in the second half, there are headwinds to any growth in milk supplies.

Milk per cow has suffered from poor forage quality in some areas, while avian influenza continues to drag down milk output in affected herds. Stretches of hot weather in California, Idaho, and other key states have also caused a drop in milk output. With more incentive to boost milk production, milk per cow is expected to return to small gains going forward.

Limits on growth

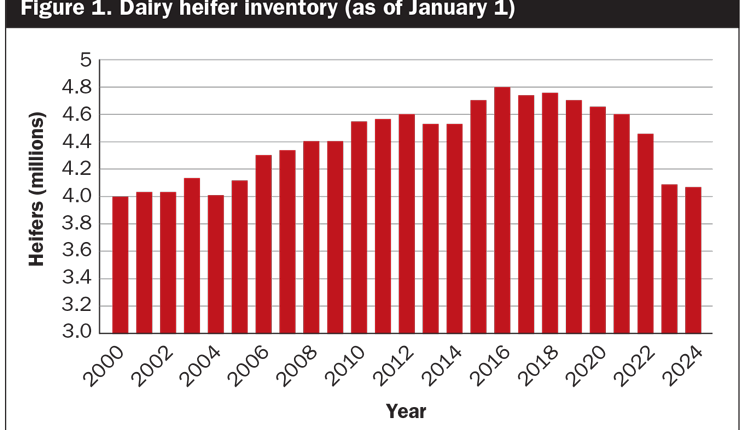

The bigger challenge for dairy farms is to grow the herd given the price signal to expand. Dairy heifer replacements are at the lowest level on record, and the price of replacements is historically high. The number of heifers that will calve next year is already known, and it’s a minimal increase from this year. Therefore, the tight heifer replacement supply will continue.

For that to change, a combination of higher dairy and milk margins and lower beef prices will be needed to incentivize farmers to breed for and keep more dairy heifer replacements. For farms that don’t need more heifers, the math is easy — breed as many cows as possible to beef bulls and sell the calves. At $800 to $1,000 per dairy-beef calf, that is an extra $3 to $4 per hundredweight (cwt.) annual revenue for a cow producing 25,000 pounds of milk per year. With beef prices looking strong into 2025, it’s hard to see dairy heifer numbers going up much for several years.

Without a larger number of replacement heifers, the only other option for a farm to expand is to keep cows around for another lactation. These older cows can be less productive than the next generation of heifers, so this explains part of the lackluster milk per cow growth this year.

Solids are climbing

While milk has been below prior year volumes for 12 consecutive months, milk solids production posted year-over-year increases for seven consecutive months through May, and June was just below last year’s mark. Historically high butter prices gave the signal to farms to produce higher component milk, particularly butterfat.

Farms have responded by upping the total solids in milk from 12.96% in 2021 to 13.15% in 2023 and 13.29% in June 2024 year to date. This is forcing the dairy industry to focus more on milk solids output versus milk volume.

The headline milk production numbers have been negative this year, but milk solids growth was up 0.2% for the first six months. Farmers are breeding, feeding, and managing for higher components to generate more revenue from a fairly stable number of cows.

The processing side

With a number of new dairy plants coming online over the next year or two, a common question has been, “Where will the milk come from for these new plants?”

Companies are not investing hundreds of millions of dollars in new plants and expansions and then wondering where they will get milk from. Most, if not all, of these companies locked in future milk supply commitments before construction even started.

The more relevant question is, “Who won’t get the milk?” In some regions, plants will fight for milk with higher premiums. There could be plants that don’t get all the milk they need or have been used to getting. Plants that perform balancing functions for certain regions will likely handle less milk, presenting challenges to their operational efficiency and financial performance.

How these dynamics play out will have important implications on prices for cheese, butter, and milk powders, and thereby milk prices. More cheese will have to find a home in both domestic and export markets, and lower prices might be needed to accomplish that.

In some regions, milk is likely to get pulled out of butter and milk powder plants, which is supportive to prices for both. Butter prices are forecast to remain historically high in 2025 as a new price equilibrium is defined. However, milk powder prices will be mostly driven by global market fundamentals, which are not bullish at this point.

The bottom line

What does all this mean for milk prices and dairy farm margins? To start with, feed costs could likely fall further as bumper crops of corn and soybeans get closer to harvest. Corn and soybean prices have dropped to the lowest point since late 2020. The Dairy Margin Coverage program’s milk over feed margin for 2024 is projected to be the highest since 2014, and 2025 is expected to be similar. Throw in high beef prices and revenue, and the outlook for dairy farm margins is the best it’s been in a number of years.

This is not to say there aren’t risks going into 2025. Elections, geopolitical events, wars, and the economy all bring uncertainty to commodity price outlooks.

Prudent risk management strategies that lock-in certainty for feed costs and milk prices, along with interest rates and beef revenue, can be used to lower the risk on a portion of a farm’s milk production. Given the inability to expand supplies, not only in the U.S. but also in Europe and Oceania, milk prices should remain at profitable levels for most farms into and through 2025.