The author owns McCully Consulting, which provides management consulting for dairy and food companies.

Dairy markets had a pretty dull July with range-bound prices for most products. On the bearish side, milk supplies are growing in the main export regions including a stronger than expected U.S. milk production number for June. Milk output has been hit by hot summer weather in parts of the U.S. and Europe, but ideal conditions have prevailed in California. While there has been some progress on U.S. trade deals, higher tariffs and uncertainty with key trading partners have resulted in markets treading water until more is known.

Global prices have seen little change over the last month. The Global Dairy Trade index recovered 1.7% of the 7.5% it lost since mid-May as whole milk powder and skim milk powder prices rose 3% to 4%. In Europe, prices moved lower on a Euro basis. The global supply environment is quite different than a year ago when prices moved higher for some products.

Economic indicators continue to give mixed signals while the tariff and trade uncertainty presents challenges. As long as milk supplies in the key export regions are growing more than 1% to 1.5%, this should moderate any potential price rallies through the rest of 2025.

Dairy margins are profitable

While uncomfortable for humans and livestock, the heat and humidity that prevailed across the Midwest in late June and all of July was beneficial for crops. As of early August, 73% of the corn was rated good to excellent, up from 67% last year. Iowa, the number one corn producing state, had 85% of its crop rated good to excellent. Soybeans were rated 69% good to excellent, near to last year’s rating. The weather has moderated in early August with lower temperatures. If crops receive needed rainfall over the next month, this year’s harvest will be a new record.

The Dairy Margin Coverage (DMC) margin outlook is holding near 2024, with lower feed costs offsetting declines in milk futures prices. Current futures point to continued moderate feed costs in 2026. When we add in extra revenue from beef, future dairy farm margins remain quite profitable.

Looking at historical data, a $4.50 corn price roughly correlates to a $17.50 per hundredweight (cwt.) Class III milk price, lower than current futures prices. Although $17.50 becomes $19 to $20 per cwt. when factoring in higher fat and protein in the milk. Additionally, the national average All-Milk price has been above $20 since September 2023 and looks to hold strong.

Milk production is growing

U.S. milk production swung to the upside in June with a 3.3% jump compared to last year, the strongest growth since May 2021 (easy year-over-year comparisons to second quarter 2020, the COVID-19 pandemic). In addition, the May figure was revised significantly, going from 1.6% to 2.3%, mainly due to a revision in California data. In June, 19 of the top 23 states posted growth compared to last year, although last June was the low point in milk output impacted by highly pathogenic avian influenza (HPAI).

The biggest percentage gains in milk production were seen in Kansas (+19%), South Dakota (+11.5%), Idaho (+9.7%), and Texas (+9.5%), with Idaho up 135 million (MM) and Texas up 131 MM, representing the largest volume growth. It’s also notable that California’s output rose in June for the first time since last September with a 2.7% gain. Weather has been favorable for milk production in California this summer with supplies much higher than expected for this time of year. Expect large percentage gains by the fourth quarter when compared to the 8% declines from last year.

The nation’s dairy herd continues to expand with a 4,000-head climb in June. Cow culling was down through the same period. The largest growth was seen in areas where new plants have been built and farms are expanding to meet the demand. In June, the U.S. dairy herd totaled 9.47 million head, up 146,000 from last year, and was the largest since July 2021.

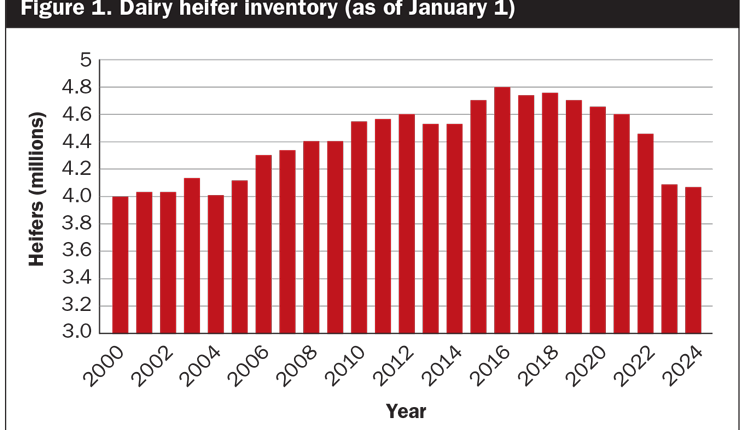

The outlook for dairy farm margins remains positive, so farms are holding onto cows longer given the shortage and high cost of replacement animals. With calf prices at extraordinarily high levels, the incentive remains to breed dairy cows to beef bulls, thus lengthening the time to grow the number of dairy heifers available. One watch-out will be if the culling rate picks up in the third quarter given Class III milk prices in the $17 range.

Dairy product sales mixed

Total fluid milk sales were down 0.9% compared to last May, a smaller decline than what was seen in April (-1.9%) and March (-1.5%). In a rare move, conventional fluid milk sales performed better than the total category, falling 0.7%, while the 4.2% drop in organic milk sales pulled the average lower. In conventional milk, whole milk sales continue to rise, up 2.1% compared to the yield adjusted (YA) total in May and up 0.6% YTD. Lower fat products lost ground with sales down 4% to 7% YTD for 2%, 1%, and fat free. The “other fluid products” category had another strong month, up 18%, with YTD sales up 23%. The drop in organic milk was partly due to a comparison to a strong May 2024 when sales were up 10%.

Strong demand continues for cottage cheese and yogurt. Cottage cheese once again saw the largest gains with curd production up 14.5% compared to last June and, yogurt production was 11.7% above last year. On the negative side, sour cream production was down 1.8% and ice cream and mix output was down 2% to 4% compared to last year.

Outlook is mostly positive

While there is some uncertainty over trade and tariffs, dairy markets have been resilient. The surge in protein demand has helped sales of dairy products ranging from high-protein milk and dairy beverages to cottage cheese, yogurt, milk, and whey protein powders. Seasonal trends should result in modest jumps in dairy product and milk prices into the fourth quarter.

Next year’s milk prices could be lower than 2025, but so will feed costs. The resultant margin doesn’t look too different than the profitable levels seen for the last year or more. Beef prices are forecast to remain historically high, which could offset any dip in margins from milk.