The author owns McCully Consulting, which provides management consulting for dairy and food companies.

Dairy product prices fell to levels not imagined several months ago, which pulled milk prices lower. Class III milk prices hit the lowest point since the second quarter of 2020 when the COVID-19 pandemic created havoc on dairy supply chains.

Milk checks in some areas of the country are well below the cost of production with higher culling rates seen in the Southwest and California so far this year. Dairy farms in those areas tend to purchase more of their feed, so margins have been hit by both higher feed costs and lower milk prices. Areas in other parts of the country where farms raise more of their own feed have seen far lower culling rates.

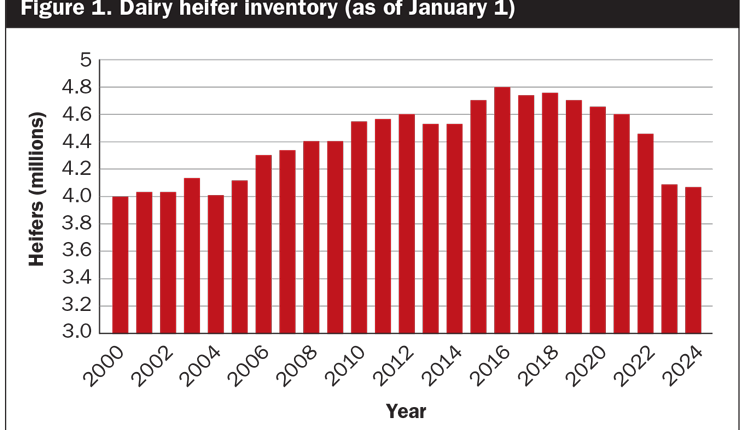

While headlines point to dire farm financial conditions, the actual situation is more nuanced. This is not to say there are not farms struggling to survive as pain is definitely being felt in some regions and cow numbers have started to contract in the last quarter. While modest declines are expected over the next several months, it is important to understand how factors other than milk price are impacting the supply and demand balance in dairy.

Additions to milk checks

First, while we talk $15 Class III milk, this is at 3.5% butterfat and 2.99% true protein. Over the years, the average component levels have risen to 4.09% in 2022. Using the five-year average butterfat price of $2.38 per pound, that adds $1.40 per hundredweight (cwt.) to the milk price. For protein, milk with a test of 3.2% yields an extra 55 cents per cwt. using the five-year average price of $2.65 per pound. Now, $15 milk is $17 at test, which is not great but is less dire than initially thought.

Next are the benefits of several risk management tools. Over 70% of the dairy farms in the country are enrolled in the Dairy Margin Coverage (DMC) program. For a farm that produces the limit of 5 million pounds per year, or around 225 cows, and is signed up for maximum coverage, it could collect nearly $150,000 this year. In fact, a comment was recently made that for some farms, if it was not for DMC payments, they would not be able to pay their bills.

In addition, many larger farms use Dairy Revenue Protection (DRP) insurance to set a floor for milk prices. A recent report by ever.ag estimated nearly 80% of milk is covered by either DRP or DMC in the third quarter. Therefore, the market signal to reduce production is muted by these payments. This is positive for farm balance sheets, but the unintended consequence is to delay a recovery in prices as farms keep producing milk.

Other revenue sources

Another recent change in dairy farm economics is energy revenue. Around 20% of the cows in the U.S. are on farms with methane digesters. For a 3,500-cow dairy at $100 per cow per year, this is close to 40 cents per cwt. These farms are also locked into a contract to supply manure from a set number of cows, so downsizing is not an option.

As more digesters are installed on farms for gas and electricity production, the new revenue stream fundamentally changes the economics for those dairy farms. Milk could become the by-product of manure production if the farm is getting more profit from it than milk.

A lot has been made of high beef prices and the added incentive to cull unprofitable dairy cows. While that is true to a point, it is only part of the story. For farms that are downsizing or exiting, the high beef price is definitely welcome. But for farms wanting to replace those cows, the cost of a replacement heifer is quite expensive, so they might keep the older cow around a bit longer. In addition, for areas with base-excess programs, some farms are taking on additional cows and base as they look ahead to future expansion. This keeps the cows in production.

The other income stream impacted by high beef prices is one rarely discussed — the value of calves. This is a new and overlooked factor in dairy farm finances. In the past, farms sold dairy calves into the beef market for little to no money. But in recent years, more farms are using beef bulls on the lower end of their herds. In the current market, those dairy-beef cross calves are worth substantially more than straight-bred dairy calves.

As an example, a 1,500-cow dairy breeds its top third (500 cows) to dairy for replacements and its bottom two-thirds (1,000 cows) to beef bulls. That cross-bred calf is worth $500 or more right now versus $200 for a dairy calf. Those 1,000 calves bring in $300,000 in extra revenue. On a cwt. of milk basis, that is over 75 cents! Or, consider the value of the dairy calf just a couple years ago when they were $25 to $50 per head. The extra income is $500,000 or more in this example.

Banking on good years

Another underreported aspect of dairy farm finances is that many farms entered 2023 with strong balance sheets after a very profitable 2022, and in some cases, 2020 and 2021 were profitable, too. This allowed farms to pay forward expenses and provided a cushion for lower prices this year. For some, the pot of extra money is now gone and they will have to endure several months of negative margins.

Recently, I have heard of large dairies in several Western states losing $1 million to $2 million per month. Obviously, this is not sustainable, so the pace of contraction is expected to pick up as the third quarter progresses. A common saying in dairy is that it takes longer to slow supply than you think it should, and that has been the case again this year.

Milk prices will rise in the coming months as cheese prices have rallied sharply in the last few weeks. And if weather cooperates, a good but not great corn and soybean crop will result in lower feed costs. Dairy farm break-even levels will drop from the low $20s to the upper teens for most farms. With better margins forecast for 2024, milk production is expected to post near average growth.

There will be another downturn in milk prices in the future and farms will endure another period of poor margins. However, in pure economic terms, each downturn takes longer to take out the marginal level of production as the cows and farms that need to be removed are stronger than the prior downturn.

The next three to five years will likely see an acceleration in dairy farm exits as farmers retire. On current trend, the number of farms could decline to near 15,000 by 2030. The farms that remain will be focused businesses that specialize in dairy production with multiple revenue streams besides the dairy. As a result, the old way of thinking about how dairy farm margins impact supply and demand will need to change, too.