The authors are with Atten Babler Commodities, Galena, Ill.

As a commodity price rally rolls over and a trend or cycle price high is identified, attention shifts to evaluating how low a price may fall. A number of sophisticated technical price analysis tools are available for evaluating potential price objectives based solely on price and time data. We have chosen another technical evaluation approach.

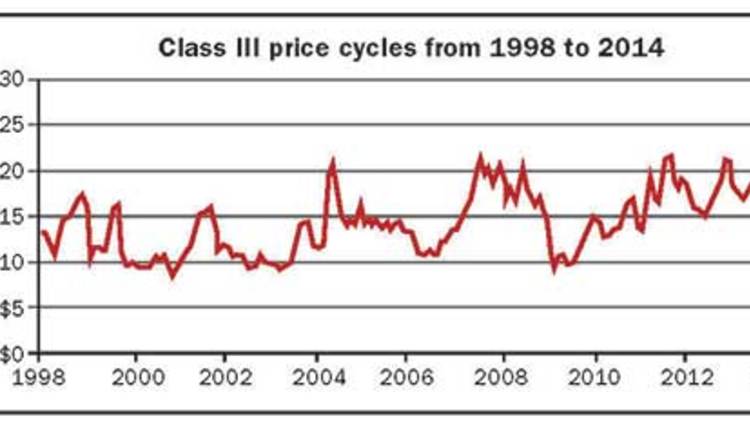

Price pattern history is a simple approach to evaluating forward price objectives fully based on price patterns of the past. The Class III milk market portrays a pronounced three-year cycle low pattern which has slowly become an accepted pattern of milk price behavior. We will look deeper into the cycle pattern.

The monthly Class III milk futures price shows cycle high and low prices since 1996. When looking at past price history of a commodity, it is often debated that fundamental factors have changed in a given market, thus the patterns of the past are not relevant. Market participants often continue to discount price patterns even as those patterns continue to unfold.

First off, no one really knows where any commodity price is going at any time in any market, ourselves included. However, we can define producer price risk in terms of where milk price could go based on previous patterns. In the article our analysis requires only observation. Of course many other factors can alter cycles and we all must be vigilant of events which may affect our businesses.

Such observation reveals that prices dropped from the cycle highs as indicated:

1997: a drop of $10.70 per hundredweight (cwt.) off the $21.70 futures high

2000: a drop of $8.90/cwt. off the $17.40 futures high

2003: a drop of $6.31/cwt. off the $15.89 futures high

2006: a drop of $9.90/cwt. off the $20.60 futures high

2009: a drop of $12.16/cwt. off the $21.43 futures high

This small sample of five-cycle occurrences in the past 15 years is not statistically significant. However, there is indication that the current cycle low, based off the 2011 high of $21.62, could be anywhere between $15.31 and $9.46 if the 2012 price falls in the range of cycle price drops of the past. The Olympic average of the five price drops is $9.83/cwt. (An Olympic average is taken during a five-year period, dropping the high and low values.)Thus, such a price drop this year could project a 2012 Class III milk cycle low of $11.80 per cwt.

Through this discussion, some readers may think we are being too negative, cynical, or pessimistic. This message is not about gloom and doom, it is about what price has done in the past. The average price for the cycle low years of the past is also worth noting. The average USDA announced Class III milk price for the cycle low years in discussion:

$12.05 average price for 1997

$9.74 average price for 2000

$11.42 average price for 2003

$11.88 average price for 2006

$11.35 average price for 2009

Managing the risk of a 2012 Class III milk price cycle low using strategies to protect a Class III price of $15 or better is fitting at this point in time. Review your cost of production and develop a strategy that benefits your business.

This Milk Check Outlook article appears on page 427 of the June issue of Hoard's Dairyman.

As a commodity price rally rolls over and a trend or cycle price high is identified, attention shifts to evaluating how low a price may fall. A number of sophisticated technical price analysis tools are available for evaluating potential price objectives based solely on price and time data. We have chosen another technical evaluation approach.

Price pattern history is a simple approach to evaluating forward price objectives fully based on price patterns of the past. The Class III milk market portrays a pronounced three-year cycle low pattern which has slowly become an accepted pattern of milk price behavior. We will look deeper into the cycle pattern.

The monthly Class III milk futures price shows cycle high and low prices since 1996. When looking at past price history of a commodity, it is often debated that fundamental factors have changed in a given market, thus the patterns of the past are not relevant. Market participants often continue to discount price patterns even as those patterns continue to unfold.

To predict the future

First off, no one really knows where any commodity price is going at any time in any market, ourselves included. However, we can define producer price risk in terms of where milk price could go based on previous patterns. In the article our analysis requires only observation. Of course many other factors can alter cycles and we all must be vigilant of events which may affect our businesses.

Such observation reveals that prices dropped from the cycle highs as indicated:

1997: a drop of $10.70 per hundredweight (cwt.) off the $21.70 futures high

2000: a drop of $8.90/cwt. off the $17.40 futures high

2003: a drop of $6.31/cwt. off the $15.89 futures high

2006: a drop of $9.90/cwt. off the $20.60 futures high

2009: a drop of $12.16/cwt. off the $21.43 futures high

This small sample of five-cycle occurrences in the past 15 years is not statistically significant. However, there is indication that the current cycle low, based off the 2011 high of $21.62, could be anywhere between $15.31 and $9.46 if the 2012 price falls in the range of cycle price drops of the past. The Olympic average of the five price drops is $9.83/cwt. (An Olympic average is taken during a five-year period, dropping the high and low values.)Thus, such a price drop this year could project a 2012 Class III milk cycle low of $11.80 per cwt.

Must be realistic

Through this discussion, some readers may think we are being too negative, cynical, or pessimistic. This message is not about gloom and doom, it is about what price has done in the past. The average price for the cycle low years of the past is also worth noting. The average USDA announced Class III milk price for the cycle low years in discussion:

$12.05 average price for 1997

$9.74 average price for 2000

$11.42 average price for 2003

$11.88 average price for 2006

$11.35 average price for 2009

Managing the risk of a 2012 Class III milk price cycle low using strategies to protect a Class III price of $15 or better is fitting at this point in time. Review your cost of production and develop a strategy that benefits your business.