The author is with Atten Babler Commodities, Galena, Ill.

The billion dollar question every dairyman would love to know: how long will these historical milk prices last? In April, USDA announced Class III at $24.31 and Class IV at $23.34. These record prices have financially healed the balance sheets of many dairymen. The typical pattern following these good times in the industry is for dairy producers to expand production, which in turn oversupplies the market and then leads to lower prices.

Could this year be different?

Let's explore that topic a little more in depth.

Dairy price cycles

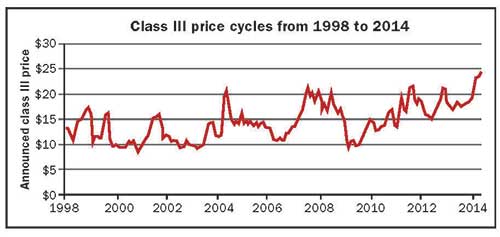

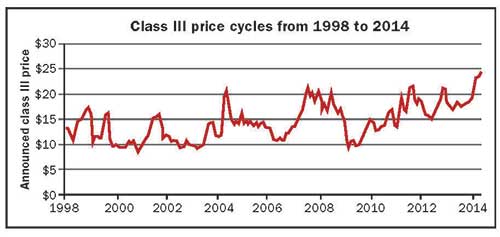

Looking back at the historical USDA-announced Class III milk prices, a significant low has been observed on a fairly regular three-year pattern - 2000, 2003, 2006, 2009 and 2012.

Why has the price moved in such a pattern? There are many different arguments, but most center on the time required to expand and contract the herd and the overshooting and undershooting which results in creating supply and demand imbalances in the milk supply.

In the current phase of the cycle, where your dairy is seeing record returns for producing milk, you will retain cows longer and do everything you can to improve production such as enhanced rations, supplementing with BST or moving from milking 2x to 3x per day. What makes sense for each profit-maximizing producer results in a larger wave of milk across the market. In a perishable commodity market like dairy, it only takes small imbalances to drive boom and bust cycles in price.

Dairy cow slaughter slows

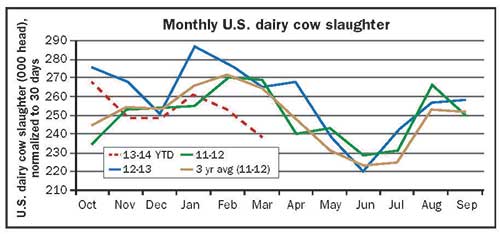

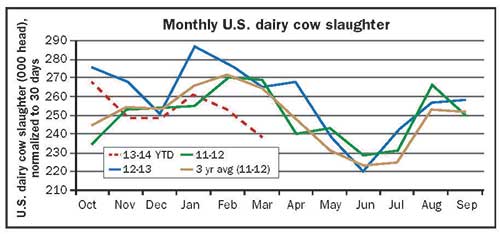

According to USDA, U.S. dairy cow slaughter continues to lag behind last year's slaughter rate through the first half of the 2013 to 2014 season. The March 2014 year-over-year slaughter decline of 10.4 percent was the largest in over three and a half years. Overall, year-to-date dairy cow slaughter is 6.6 percent lower than last year with the culling pattern continuing to accelerate.

With record milk prices and attractive margins, producers will look to continue the trend of reduced dairy cow culling in future months.

Milk production projections for 2015 were released for the first time in the May report with estimated production coming in at 212.1 billion pounds. That 2015 production estimate equates to a 2.9 percent year-over-year gain over 2014's projected production of 206.1 billion pounds. Milk production for 2015 is forecasted higher as lower feed costs and strong milk prices are expected to support both herd expansion and improvements in milk per cow. To put things in perspective, that projected 2.9 percent gain in production for 2015 would be the largest in over a decade.

Strong international milk flow

The U.S. dairy market is becoming further integrated with the world dairy market with each passing day. To put this point into perspective, the world is absorbing almost one-fifth of total milk production by purchasing U.S. dairy products. Since the export market and export pricing is largely shaped by conditions in New Zealand and Europe, it is important to keep tabs on supply trends in both of those regions. High prices, improved weather and expansionary policy are causing significant production gains for both regions.

According to Eurostat, February 2014 European Union milk production continued the recent trend of production growth, growing 5.1 percent when compared to the previous year. Monthly year-over-year gains have gone up each of the past 11 months among the European Union's 28 member countries. In fact, the February 2014 gain of 5.1 percent was the largest in three and a half years.

According to Dairy Companies Association of New Zealand (DCANZ), February 2014 New Zealand milk production continued the recent trend of production growth, growing 11.8 percent over the previous year. On a percentage basis, the February change in milk production was the largest in 18 months. This was partially due to adverse weather conditions reducing production in February 2013.

As for the entire production season, the 2013 to 2014 year-to-date milk production in New Zealand was up 6.4 percent, with additional gains expected in future months. In Fonterra's March Global Dairy Update, the New Zealand milk supply was forecasted to grow 7.5 percent for the most recent season.

What about future prices?

No one can be certain if past patterns will repeat for the upcoming year, but there are certainly risks that could send prices downward. Some of the indicators of risk have been mentioned here, but it is important to note that no one can be certain of the timing or extent of a market decline. Equally important is the need to realize that price reductions are inevitable and then take steps to mitigate the risk.

Dairy producers are encouraged to examine their operation and understand the pros and cons to each available strategy in the cash market, futures market and also with the new MPP program. There is no blanket strategy because no two operations are the same. The key is to put together a sound risk management plan and stick with it even when everyone thinks the good times will never end.

This article appears on page 409 of the June 2014 issue of Hoard's Dairyman.

The billion dollar question every dairyman would love to know: how long will these historical milk prices last? In April, USDA announced Class III at $24.31 and Class IV at $23.34. These record prices have financially healed the balance sheets of many dairymen. The typical pattern following these good times in the industry is for dairy producers to expand production, which in turn oversupplies the market and then leads to lower prices.

Could this year be different?

Let's explore that topic a little more in depth.

Dairy price cycles

Looking back at the historical USDA-announced Class III milk prices, a significant low has been observed on a fairly regular three-year pattern - 2000, 2003, 2006, 2009 and 2012.

Why has the price moved in such a pattern? There are many different arguments, but most center on the time required to expand and contract the herd and the overshooting and undershooting which results in creating supply and demand imbalances in the milk supply.

In the current phase of the cycle, where your dairy is seeing record returns for producing milk, you will retain cows longer and do everything you can to improve production such as enhanced rations, supplementing with BST or moving from milking 2x to 3x per day. What makes sense for each profit-maximizing producer results in a larger wave of milk across the market. In a perishable commodity market like dairy, it only takes small imbalances to drive boom and bust cycles in price.

Dairy cow slaughter slows

According to USDA, U.S. dairy cow slaughter continues to lag behind last year's slaughter rate through the first half of the 2013 to 2014 season. The March 2014 year-over-year slaughter decline of 10.4 percent was the largest in over three and a half years. Overall, year-to-date dairy cow slaughter is 6.6 percent lower than last year with the culling pattern continuing to accelerate.

With record milk prices and attractive margins, producers will look to continue the trend of reduced dairy cow culling in future months.

Milk production projections for 2015 were released for the first time in the May report with estimated production coming in at 212.1 billion pounds. That 2015 production estimate equates to a 2.9 percent year-over-year gain over 2014's projected production of 206.1 billion pounds. Milk production for 2015 is forecasted higher as lower feed costs and strong milk prices are expected to support both herd expansion and improvements in milk per cow. To put things in perspective, that projected 2.9 percent gain in production for 2015 would be the largest in over a decade.

Strong international milk flow

The U.S. dairy market is becoming further integrated with the world dairy market with each passing day. To put this point into perspective, the world is absorbing almost one-fifth of total milk production by purchasing U.S. dairy products. Since the export market and export pricing is largely shaped by conditions in New Zealand and Europe, it is important to keep tabs on supply trends in both of those regions. High prices, improved weather and expansionary policy are causing significant production gains for both regions.

According to Eurostat, February 2014 European Union milk production continued the recent trend of production growth, growing 5.1 percent when compared to the previous year. Monthly year-over-year gains have gone up each of the past 11 months among the European Union's 28 member countries. In fact, the February 2014 gain of 5.1 percent was the largest in three and a half years.

According to Dairy Companies Association of New Zealand (DCANZ), February 2014 New Zealand milk production continued the recent trend of production growth, growing 11.8 percent over the previous year. On a percentage basis, the February change in milk production was the largest in 18 months. This was partially due to adverse weather conditions reducing production in February 2013.

As for the entire production season, the 2013 to 2014 year-to-date milk production in New Zealand was up 6.4 percent, with additional gains expected in future months. In Fonterra's March Global Dairy Update, the New Zealand milk supply was forecasted to grow 7.5 percent for the most recent season.

What about future prices?

No one can be certain if past patterns will repeat for the upcoming year, but there are certainly risks that could send prices downward. Some of the indicators of risk have been mentioned here, but it is important to note that no one can be certain of the timing or extent of a market decline. Equally important is the need to realize that price reductions are inevitable and then take steps to mitigate the risk.

Dairy producers are encouraged to examine their operation and understand the pros and cons to each available strategy in the cash market, futures market and also with the new MPP program. There is no blanket strategy because no two operations are the same. The key is to put together a sound risk management plan and stick with it even when everyone thinks the good times will never end.