by Amanda Smith, Associate Editor

Growth within the grass-fed segment of our industry will depend primarily on the people, cows and availability of grass. A presentation from Dairy Farmers of America's Dairy Grazing Service highlighted where grazing is most likely to grow its foothold.

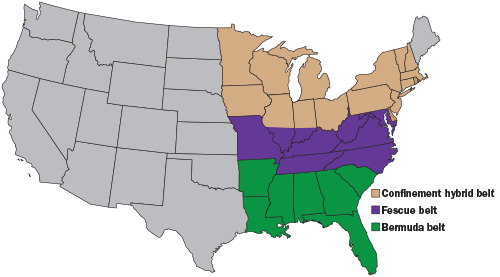

Within the confinement hybrid belt of the Upper Midwest and Northeast, there are thousands of potential converts on existing dairy operations. Grazing also creates an opportunity for the next generation to become involved, should older nongrazing dairies be acquired. For the local market, it could be adding a new operation to the farm's portfolio while new entrants to the market are likely to be lifestyle and value-driven producers.

Across the fescue belt of the Mid-Atlantic and Lower Midwest, there are fewer remaining family farms, which present an opportunity to resurrect empty facilities at a lower cost. It can become the next dairy for early adopters or relocating producers from other parts of the country or world.

The Bermuda belt of the Southeast has the fewest remaining dairies and lost 5.6 percent of its operations last year. The ability to repurpose older operations hinges on the producer's ability to irrigate the land. It can be the next dairy for early grazing adopters. For successful producers, this region holds the opportunity for the biggest scale and profit.

Whether this segment of the U.S. dairy industry will experience continued growth or stall out depends on a few key components:

- Are higher feed costs here to stay?

- Will environmental compliance costs and restrictions be an evolving concern for conventional dairies?

- Are dairy prices equilibrating around the world?

- Is the next generation attracted to a grazing dairy lifestyle?

- Can a grazing dairy be profitable and attract financing?