The author is director of dairy services at Informa Economics, Eagan, Minn.

During the first five months of 2015, milk production across the major exporting countries grew 2.9 billion pounds ( 1.1 percent) compared to last year. That's just half the story, as milk equivalent imports by Russia were down 3.2 billion pounds (-88 percent) and Chinese imports were down 4.9 billion pounds (-38 percent). Imports by everyone other than China and Russia were up 5.9 billion pounds ( 13.1 percent). However, it has taken the lowest prices in years, or in some cases the lowest prices in decades, to entice the orders from the smaller importing countries.

When you net it all together, global imports were down 2.2 billion pounds during the first five months of the year. Combine the production growth and the import reduction and you can reasonably say there was a 5.1 billion pound surplus of milk globally during the first five months of the year. Some of that surplus was absorbed by domestic buyers inside the major exporting countries, but that would still leave a surplus of 2.5 to 4 billion pounds in the first five months of the year. That puts us on track for a global surplus of 6 to 9 billion pounds for the year. We estimate that the surplus in 2009 was only 5.6 billion pounds. That makes the current supply and demand balance worse than in 2009.

What has to happen to turn around the world market?

Let's be optimistic, take the low side of the range and say the surplus is running at an annualized level of 6 billion pounds of milk. If the adjustment came only on the supply side, milk production across the major exporters (New Zealand, EU-28, U.S., Australia, Argentina) would only need to fall 1 percent from the current pace, which seems small and easily accomplished. But when you start looking at the situation country by country, the task of cutting production starts to look harder.

What would it take to reduce milk by 6 billion pounds? That number represents 1.8 percent of the EU-28's production, 2.9 percent of U.S. production, 11.9 percent for New Zealand, 27.5 percent for Australia, and 24.4 percent for Argentina.

Not a likely scenario

It's very unlikely that production growth will fall by that much for any of the individual exporters. If the adjustment is going to come solely on the supply side, it will take a significant slowdown in production in at least two or three of the major exporters. Our supply models are suggesting that current farm-gate margins aren't low enough to cut global production by 6 billion pounds, so even lower prices, poor weather that reduces production, and/or part of the adjustment has to come on the demand side.

It's unlikely global imports will grow fast enough to absorb the surplus in 2015. Prior to Russia banning imports of dairy products from the EU-28, U.S., Australia, Canada, Norway and Ukraine, they were averaging about 8.5 billion pounds of milk equivalent imports a year. If Russia dropped the embargo, it would eliminate the global surplus of milk essentially overnight, but the odds of that happening appear low. The conclusion that we've come to is that the global surplus is likely going to persist at least through the end of the year and likely into early 2016 unless adverse weather reduces milk production in two or more of the major exporters.

Margins outpace last downturn

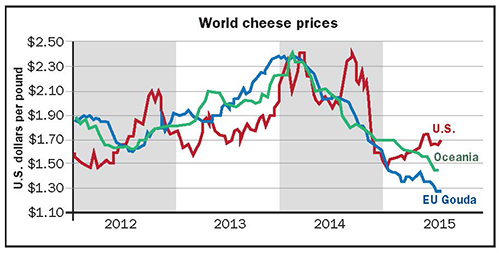

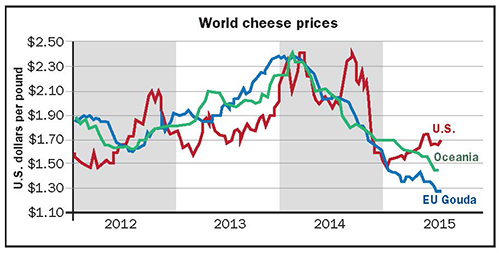

Why haven't U.S. dairy farm margins fallen as far as 2009? Good domestic demand for cheese and butter, combined with a relatively tight supply, kept CME cheese prices 10 to 40 cents above the world market, and the CME butter price at a 20- to 60-cent premium to the world market since April.

The fact that the U.S. has been blocked out of the Russian market since 2008 means the embargo had less of a disruptive impact on the U.S. industry than it did in Europe. Also, U.S. exports to China on a milk equivalent basis were only down 13.6 percent during the first five months of the year compared to the 53.5 percent drop in shipments from New Zealand to China.

But some of the willingness of domestic buyers to pay $1.60 to $2 for U.S. cheese and butter this year is only because the prices look attractive compared to the $2.20 to $3 they were paying in late 2014. If prices don't spike higher during the second half of 2015, commercial buyers will probably shift their focus to the spread between the U.S. and world market instead of comparing prices to the peak back in 2014.

Given the California drought and what the future holds for the slowdown in U.S. milk production growth during the second quarter, we think the U.S. cheese and butter markets will stay tight enough to maintain their premium to the world market at least through the third quarter but possibly into early 2016.

Even with U.S. NFDM (nonfat dry milk) prices in the 70- to 80-cent range and dry whey in the 20- to 30-cent range, CME cheese and butter prices in the $1.60 to $1.90 range should keep the Margin Protection Program (MPP) margin above the $6 level. But if we're wrong, and CME prices collapse to world market levels, we could see a sub-$4 MPP margin in early 2016, assuming roughly steady feed costs from the current level.

This article appears on page 559 of the September 10, 2015 issue of Hoard's Dairyman.

Return to the Hoard's Dairyman feature page.

During the first five months of 2015, milk production across the major exporting countries grew 2.9 billion pounds ( 1.1 percent) compared to last year. That's just half the story, as milk equivalent imports by Russia were down 3.2 billion pounds (-88 percent) and Chinese imports were down 4.9 billion pounds (-38 percent). Imports by everyone other than China and Russia were up 5.9 billion pounds ( 13.1 percent). However, it has taken the lowest prices in years, or in some cases the lowest prices in decades, to entice the orders from the smaller importing countries.

When you net it all together, global imports were down 2.2 billion pounds during the first five months of the year. Combine the production growth and the import reduction and you can reasonably say there was a 5.1 billion pound surplus of milk globally during the first five months of the year. Some of that surplus was absorbed by domestic buyers inside the major exporting countries, but that would still leave a surplus of 2.5 to 4 billion pounds in the first five months of the year. That puts us on track for a global surplus of 6 to 9 billion pounds for the year. We estimate that the surplus in 2009 was only 5.6 billion pounds. That makes the current supply and demand balance worse than in 2009.

What has to happen to turn around the world market?

Let's be optimistic, take the low side of the range and say the surplus is running at an annualized level of 6 billion pounds of milk. If the adjustment came only on the supply side, milk production across the major exporters (New Zealand, EU-28, U.S., Australia, Argentina) would only need to fall 1 percent from the current pace, which seems small and easily accomplished. But when you start looking at the situation country by country, the task of cutting production starts to look harder.

What would it take to reduce milk by 6 billion pounds? That number represents 1.8 percent of the EU-28's production, 2.9 percent of U.S. production, 11.9 percent for New Zealand, 27.5 percent for Australia, and 24.4 percent for Argentina.

Not a likely scenario

It's very unlikely that production growth will fall by that much for any of the individual exporters. If the adjustment is going to come solely on the supply side, it will take a significant slowdown in production in at least two or three of the major exporters. Our supply models are suggesting that current farm-gate margins aren't low enough to cut global production by 6 billion pounds, so even lower prices, poor weather that reduces production, and/or part of the adjustment has to come on the demand side.

It's unlikely global imports will grow fast enough to absorb the surplus in 2015. Prior to Russia banning imports of dairy products from the EU-28, U.S., Australia, Canada, Norway and Ukraine, they were averaging about 8.5 billion pounds of milk equivalent imports a year. If Russia dropped the embargo, it would eliminate the global surplus of milk essentially overnight, but the odds of that happening appear low. The conclusion that we've come to is that the global surplus is likely going to persist at least through the end of the year and likely into early 2016 unless adverse weather reduces milk production in two or more of the major exporters.

Margins outpace last downturn

Why haven't U.S. dairy farm margins fallen as far as 2009? Good domestic demand for cheese and butter, combined with a relatively tight supply, kept CME cheese prices 10 to 40 cents above the world market, and the CME butter price at a 20- to 60-cent premium to the world market since April.

The fact that the U.S. has been blocked out of the Russian market since 2008 means the embargo had less of a disruptive impact on the U.S. industry than it did in Europe. Also, U.S. exports to China on a milk equivalent basis were only down 13.6 percent during the first five months of the year compared to the 53.5 percent drop in shipments from New Zealand to China.

But some of the willingness of domestic buyers to pay $1.60 to $2 for U.S. cheese and butter this year is only because the prices look attractive compared to the $2.20 to $3 they were paying in late 2014. If prices don't spike higher during the second half of 2015, commercial buyers will probably shift their focus to the spread between the U.S. and world market instead of comparing prices to the peak back in 2014.

Given the California drought and what the future holds for the slowdown in U.S. milk production growth during the second quarter, we think the U.S. cheese and butter markets will stay tight enough to maintain their premium to the world market at least through the third quarter but possibly into early 2016.

Even with U.S. NFDM (nonfat dry milk) prices in the 70- to 80-cent range and dry whey in the 20- to 30-cent range, CME cheese and butter prices in the $1.60 to $1.90 range should keep the Margin Protection Program (MPP) margin above the $6 level. But if we're wrong, and CME prices collapse to world market levels, we could see a sub-$4 MPP margin in early 2016, assuming roughly steady feed costs from the current level.