Given the current dairy economy, most among us may have the feeling that farms that have minimized debt in recent years has allowed them to survive the current crisis. Yet, debt, when used appropriately, is a useful tool that farms can employ to make updates that will allow them to become more efficient and profitable.

How much debt is too much?

On the one hand, no debt might indicate that the owners have been overly cautious and underinvested. On the other hand, too much debt can impose stress and constraints on management preventing an efficient use of existing assets.

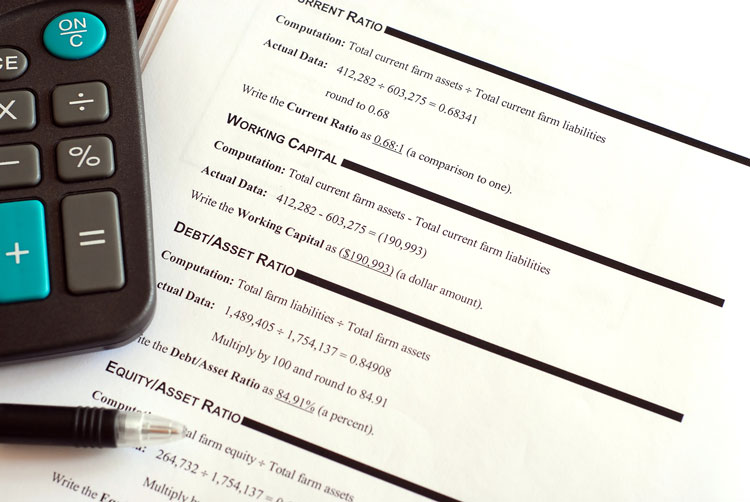

We looked at data from Wisconsin dairy farms between 2005 and 2017 and focused on the relationship between working capital — an indicator of short-term debt and liquidity — and return on assets as a measure of profitability. We asked ourselves, is there such a thing as an ideal level of debt?

Middle may be the sweet spot

We found that, on average, farms with a manageable level of debt were posting higher profits in the following year. That is, those farms with manageable debt were likely to have higher profits in subsequent years than farms with no debt at all or farms with high debt levels.

Those results held for smaller herds and for larger ones, so this wasn’t a reflection of farm size or expansion decisions.

While many are currently struggling with liquidity issues, we can still hope for better days. And keep in mind that debt is not necessarily a bad thing if used carefully and reasonably, as indicated by our data.

While excessive debt can put your operation at greater risk, carefully invested money is always a good thing, and debt financing can lead to new profitable business activity. When it comes to debt, don’t be afraid but be careful.