Speculators believe there is more upside to cheese prices in the fourth quarter of 2019, and they’re putting their money where their mouth is.

Read on to learn more.

Fundamental factors related to supply and demand are still king when it comes to dictating long-term price direction for dairy market prices. However, futures market prices generally anticipate the shift in direction long before the fundamental data reflect this change.

This phenomenon often leads novice traders and risk managers to believe that others in the marketplace already own the “answers to the test.” Of course, even the notorious Duke brothers in the movie Trading Places proved that having the data prior to a major report’s release isn’t an infallible trading method.

Different traders, different perspectives

Market psychology often differentiates one trader from another. In its simplest form, it is the difference between being an anticipatory trader versus a reactionary trader. Anticipatory traders sell into price strength and buy price weakness.

Reactionary traders do the opposite.

Moreover, in futures trading, sometimes size does matter. Although there are exceptions, traders with large positions are primarily anticipatory and traders with small positions are primarily reactionary.

A deeper look

As its name implies, a futures market is a price discovery mechanism. It is a daily consensus of where the entire dairy industry feels prices will be at some point in the future.

Futures markets — including milk markets — epitomize the adage that the whole is greater than the sum of the parts. However, it also is important to separate traders into different groups and see what side of the market they sit. After all, a hedger’s agenda in the futures market is often quite different than that of a speculator.

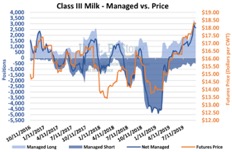

The Commitments of Traders (COT) report is one of the most important, yet underutilized reports offered to dairy market traders. Released every Friday afternoon, the report subdivides every futures contract into four main trader groups: Commercial, Managed Money, Swaps, and Others.

“Commercials” are hedgers with large positions, and “Managed Money” are speculators with large positions. “Swaps” can be either but often represent hedgers. “Other” category traders are either hedgers or speculators with less than 25 Class III or Cheese futures contracts in any one month.

Within the report, the “Managed” traders often are the most intriguing group to monitor for market direction shifts. Unlike hedgers, they have no loyalty to either the long or short side. They tend to shift positions when they anticipate a future change in market fundamental indicators.

Bringing it back to dairy

The latest COT report shows that while the “Managed” has been willing to buy Class III futures, only on the recent September Cheese market correction did that take a stab at owning Cheese futures/options as well. They’re now net long of both commodities.

What does this mean?

It means that, although the price of Cheese at the CME spiked and fell quickly in September, speculators believe there is more upside to cheese prices in the fourth quarter (Q4) and they’re putting their money where their mouth is.

Corrections happen in every market, and there will be major corrections in the price of cheese and milk prices at times. But gaining insight into who’s doing what in the market can help dairy farmers to understand how they ought to view the market — and perhaps, when they should market milk. Understanding the COT report can help toward that end.