Whether you’re talking about David Copperfield making the Statue of Liberty disappear or the CME cheese market, sometimes there just isn’t a rational explanation. The best we can say it is: The market has likely gotten ahead of itself and should pull back, but a significant bottom has been put in and we won’t be retesting the lows anytime soon.

There are now a lot of people chasing spot dairy supplies that need to be delivered in the next six weeks. Food service sales continue to slowly improve as people venture out to support local and chain restaurants. And more states are reopening, further straining a system that just weeks ago worked to run very lean. Meanwhile, the U.S. government has stepped in with the first round of their Food Box Program, which was twice as big as previously expected. Toss in a slowdown in milk production thanks to milk handlers putting over-base programs into place in May and you can see why dairy markets have gone skyward.

Making a connection

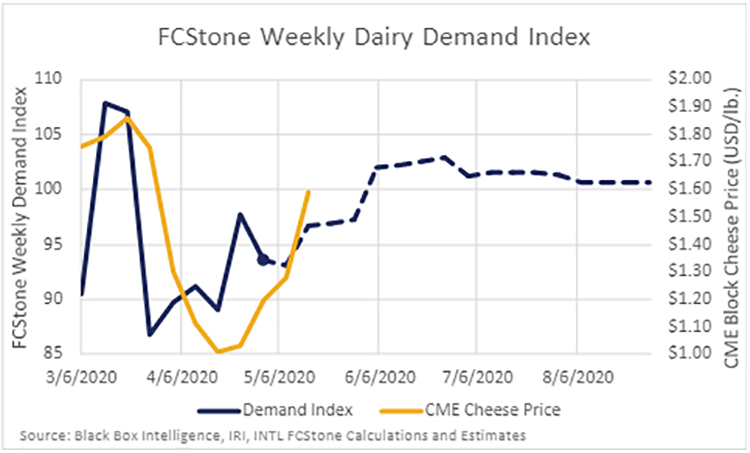

Recently, I did some work to connect sales through different channels (food service, retail, and schools) back to total monthly dairy commodity sales. I then rolled everything up to a milk solids basis and shifted it to a weekly timeframe. The ultimate purpose was to assess the weekly reported changes in food service and retail product sales, combine it with government purchases and estimates for other channels, and create a near real-time measure of total dairy demand. While I have no idea if the correlation will continue, the index is well-correlated with the CME block price and leads the price changes by one to two weeks.

Using this methodology, total U.S. dairy sales bottomed out in the last week of March at 13% below year-ago levels. Food service sales bottomed out that week and retail sales had slowed significantly.

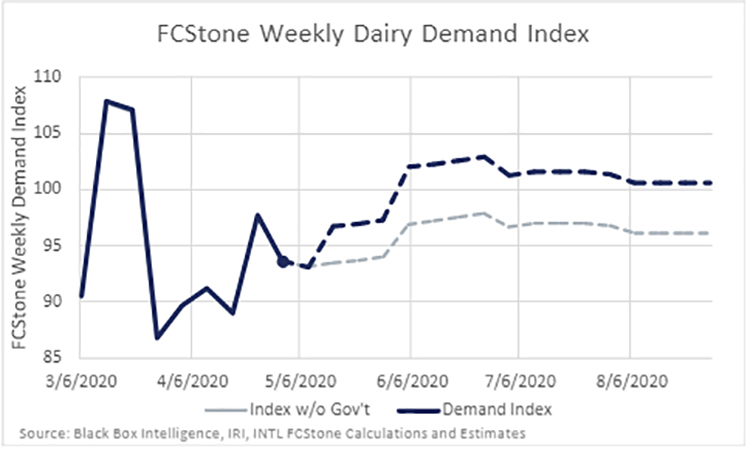

The index has bounced around, but the trend has clearly been up since the late-March low. Our estimate for the first week of May put sales down 6.4% from last year. If food service and retail sales continue along their respective paths, we could see total dairy demand back above year-ago levels in the first week of June. If you exclude government purchases, dairy sales would stay below a year ago at least through August.

Future prices

While the rally in the spot market (and futures) this week has probably overdone it, if you look at the demand index moving forward, the ongoing government purchases do make a significant difference, and we could be looking at positive sales growth at a time when milk production growth is very weak. I don’t think there is fundamental justification for sustained $1.80 cheese anytime soon, but we can probably hold around $1.50 or higher.