“Employed people eat more pizza than unemployed people.” Or at least that is how I remember the quote. As we were coming out of the last recession, Domino’s pizza sales were surging. When their CEO would be asked about macroeconomic conditions and Domino’s performance, he would just repeat that line about employed people eating more pizza.

To be fair, Domino’s had invested in online ordering back in 2007, which was just starting to take off in 2010, and they rolled out a new recipe and aggressive advertising campaign in late 2009. So, their double-digit, same-store sales growth in 2010 wasn’t just due to the recovering economy, but clearly, a strong economy and full employment is generally better for food service sales than a weak economy.

With COVID-19 spreading across the country, and more and more states declaring stay-at-home orders during March, it was clear that tens of millions of Americans were going to be unemployed. I was very concerned about what that meant for dairy demand. Cheese prices in the spot market dropped to $1 per pound in mid-April and the situation was looking grim. Since then, the market promptly turned around and rallied to a new record high of $2.70 per pound in mid-June.

How?

There are about 20 million people filing weekly unemployment claims, up from 2 million in early March. If unemployed people eat less pizza, then why have cheese prices rallied to record highs?

I think a lot of credit has to go to the U.S. government, both for supporting consumers through additional unemployment benefits, enhanced Supplemental Nutrition Assistance Program (SNAP) benefits, stimulus checks, other support measures, as well as directly purchasing dairy products. As an example of money making its way to consumers . . . a recent study estimates 68% of the unemployed people are receiving more in unemployment benefits than they received in wages from their previous jobs. So, even with unemployment at its highest levels in decades, pizza sales are actually very good, with Domino’s reporting that same-store sales were up 14% from last year for the months of both April and May.

Strong government support

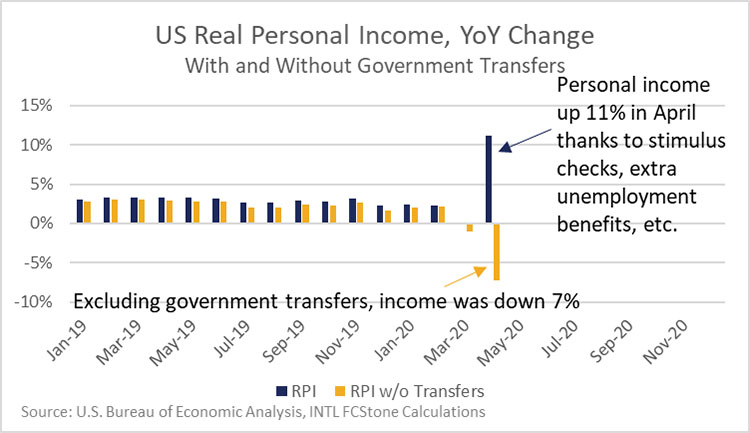

Another example of support to consumers can be seen in the April national income estimates for the U.S. Bureau of Economic Analysis. Real personal income in the first quarter was up 1.5% from last year, but then it surged to 11% above last year in April. But if you remove government transfer payments, which are things like the stimulus checks and unemployment benefits, then real personal income was down more than 7%.

I don’t want to gloss over the negative impact that the economy is having on many people, but at the aggregated national level, government transfers in April more than made up for the decline in economic activity and I think, on average, the U.S. consumer has been doing “OK” or better (so far) despite the high unemployment rate and recession.

On top of indirectly supporting dairy demand by supporting U.S. consumers, the U.S. government has also been buying dairy products (or reimbursing companies who buy and donate dairy products in the food box program). Through June, the U.S. government has bought about $451 million worth of dairy products using money that was allocated through Section 32/CARES Act/Trade Mitigation and the Food Box program. We expect they will spend another $650 million before the end of the year.

Traditionally, the USDA would only purchase dairy products when prices were at very low levels, and sales to the government would fade as prices rose. However, the USDA seems to be going all-out and they continue to put out new solicitations to buy cheese even with the market near a record high.

Postelection fallout

While the government theoretically has unlimited resources, at some point they are going to cut back on payments to consumers and they are going to slow their purchases of dairy products. Given that an election is less than five months away, we could see the payments and related dairy purchases stay strong through the end of the year. I just hope U.S. consumers and dairy demand will be strong enough to support themselves when the government money disappears or we could be looking at another significant drop for dairy prices.