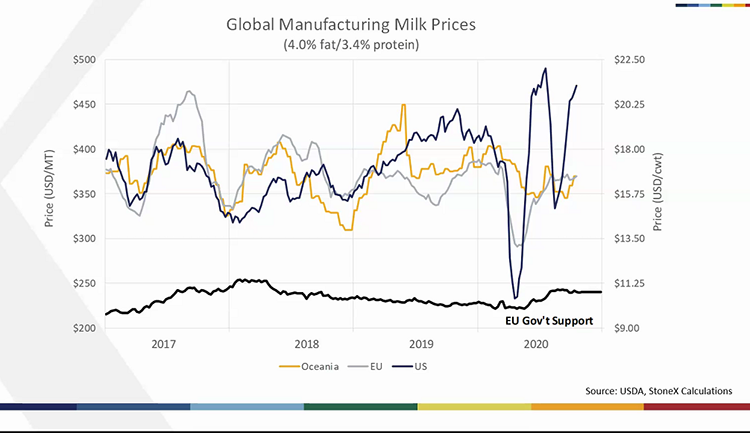

“The volatility within dairy has been very, very extreme,” said Kyle Schrad, vice president of Global Dairy and Food Operations at StoneX Financial Corporation. (Figure 1).

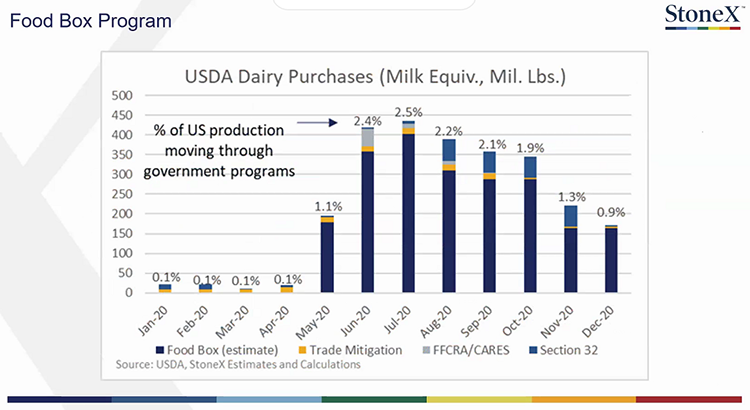

The biggest reason the U.S. dairy product prices have made huge swings is because of government purchases.

“Normally the government is buying one-tenth (0.1%) or two-tenths (0.2%) of a percent of our overall milk equivalents,” he said during “Volatile Commodity Markets & Industry Procurement Trends.” “And over the last kind of six to eight months here, we’ve bumped that number up from a tenth (0.1%) of a percent to a 2.4% or 2.5% on a monthly basis.” (Figure 2).

The U.S. government Food Box program was the recipient of much of this purchased food, but Schrad expects the program to dissipate in 2021.

“That kind of sets the stage where for where you can imagine prices might be going — as a massive government purchasing program would disappear,” he said.

Milk could end up, up, up

As for the rest of the world, New Zealand is expected to expand production by 2%, the EU is expected to increase 1%, and the U.S. is still expected to increase by 1.5%. In addition, U.S. dairy exports are forecasted to be up 1.1% in 2021.

“If that holds, that’s a pretty healthy milk supply . . . our margins have been relatively strong, and producers are reacting to those margins and producing more milk flow,” he said.

China continues to import whey and other products, but imports by secondary purchasers in the Middle East, India, and Asia excluding China have particularly exploded.

Schrad noted that many of the countries buying more product from the U.S. also have negative Gross Domestic Products (GDPs). This indicates they may be building up inventory while they have the funds, but they might not have them in the future.

Demand issues could linger

“The biggest question from the demand side, is what’s happening within these other countries, and is it sustainable . . . our forecast here is indicating that it’s not,” he said.

In looking at food service, the market recovered from the lows in March and April, but with 20% of U.S. restaurants closing in 2020, it’s a difficult market to cover.

“Retail is up 30%, which is great, but it doesn’t make up for the gap between what we see on the loss in food service,” Schrad said.

Schrad admits that forecasting for 2021 is difficult due to many factors.

“The question from a historic standpoint is, we don’t have anything to look back on that says, hey, what do we do during a global pandemic?”

The author and her family own and operate a sixth generation dairy near St Johns, Mich.