Exports are increasingly important in dairy trade – globally and in the United States.

Global milk solids exports in 2019 totaled 9.400 million metric tons (MT); in 2020, they had grown nearly 400 million MT, to 9.793 million MT. The United States captured a sizeable portion of that trade, with total U.S. exports reaching over 2 million MT and growing 12% over 2019.

One month’s milk from California

U.S. market share also rose, from 19% of global milk solids exports in 2019 to 21% over the course of last year and the first part of 2021. In terms of metric tons, an increase of 2% market share is roughly 3.4 billion pounds of milk – an amount equal to a month of production from California, the biggest U.S. milk-producing state.

U.S. dairy producers are well-positioned to further these gains in coming years. The United States is the only major dairy exporter experiencing solid growth in milk production. While the European Union and New Zealand, the main U.S. competitors internationally, have grown milk production annually on average by around 1.7% and 2.5%, respectively since 2010, their futures are not as bright.

Production disincentives in both countries have put a significant obstacle in adding cows to the herd, making future production growth largely dependent on efficiency gains alone. We at NMPF anticipate the EU annual growth rate over the next five years to drop from 1.7% a year to 0.6%, while New Zealand growth may drop from 2.5% to 0.4%. That leaves the United States, where production disincentives are not as severe and herd growth is on the uptick, as the only major dairy exporter capable of meeting that growing demand.

Become the biggest trading partner

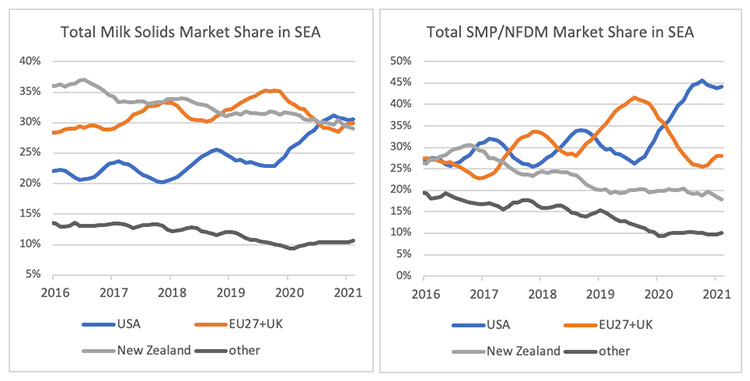

That could make the future of dairy exports look much like Southeast Asia (SEA), where U.S. exports are seeing significant growth. The United States in that region has overtaken New Zealand and the EU to become the largest market share holder in milk solids exports to the region, with a share of 31%. This was in part driven by skim milk power and nonfat dry milk (SMP/NFDM) exports to Southeast Asia where the U.S. market share has grown over time to roughly 45%. Assisting this was strong SMP/NFDM demand out of the region and the U.S., on average, sitting at a 16% discount to New Zealand and a 9% discount to European Union in SMP/NFDM since the start of 2020.

While gains in Southeast Asia and other key markets, like Japan, Korea and China, are all a testament to the strength of the U.S. dairy complex and its growing clout overseas, this doesn’t mean competition from the EU and New Zealand is going away. Both countries will focus on prioritizing key markets and products like whey, powder, and cheese in China and greater Asia-Pacific as production becomes a constraint. These are, unsurprisingly, the places where we gained so much market share last year. Ongoing port issues are also putting a sour taste in the mouths of importers. While largely out of U.S. exporter control, importers are growing tired of not being able to get product when they need it. To help maintain the growth in market share we’ve seen over the past year, U.S. exporters need to, as much as possible, work with importers to make sure all that growth we have achieved doesn’t slide back to our competitors.

But despite these challenges, U.S. dairy is well-positioned to continue growing export market share. That’s great news for U.S. dairy farmers and for global consumers on the hunt for high-quality dairy products.

The author is a economic policy and market research analyst, National Milk Producers Federation