Ongoing port congestion has delayed hundreds of millions of dollars in U.S. dairy exports, and that situation continues to be closely monitored throughout the industry. For exporters, the current news is mixed.

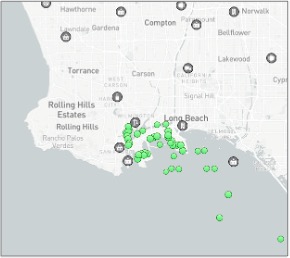

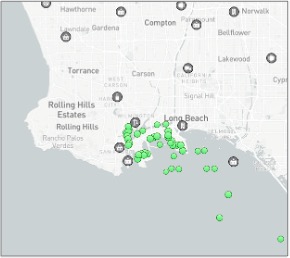

First, the good news: Congestion at West Coast ports has come down considerably. As of May 2, only 11 cargo vessels were waiting to berth outside the critical L.A./Long Beach port.

But now, the bad news: Congestion at Chinese ports has skyrocketed over the last six weeks as COVID-19 lockdowns have crippled the country’s supply chains.

Waiting game

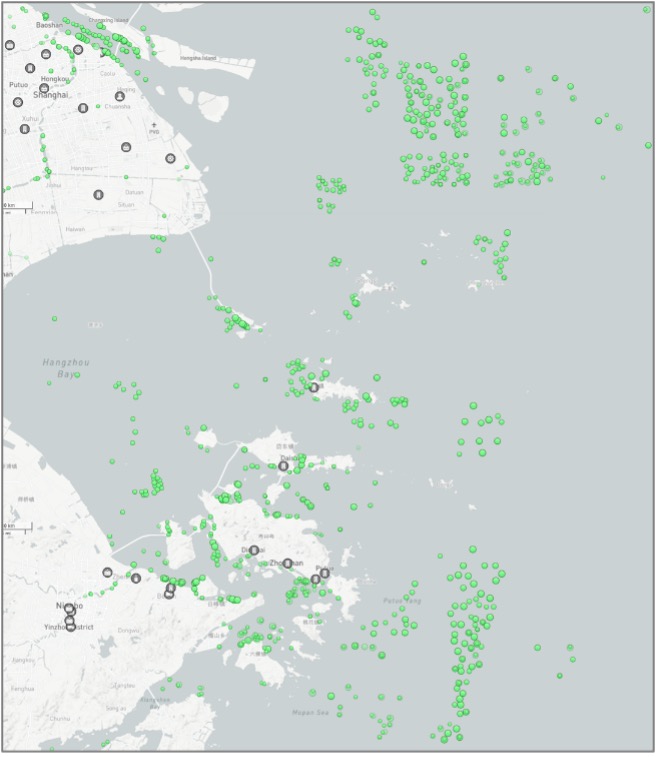

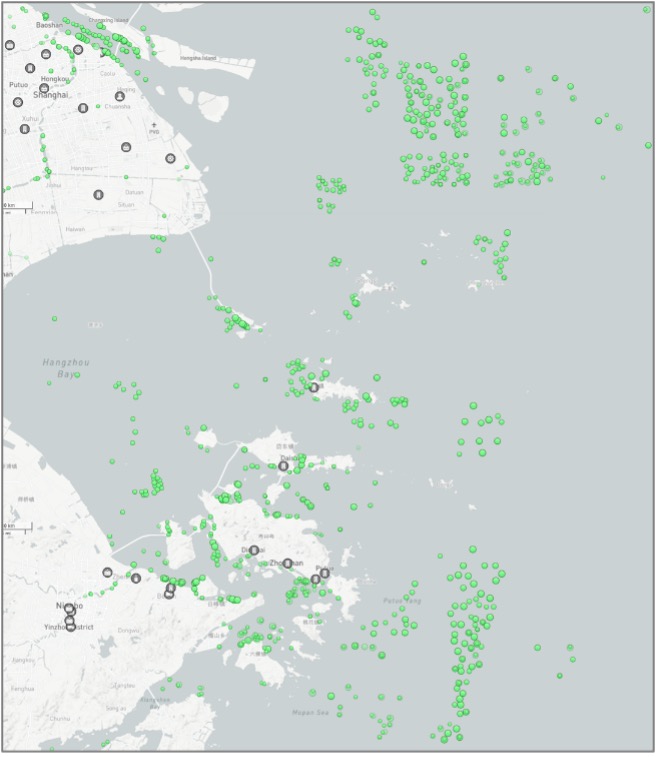

Cargo Vessels Waiting to Berth Outside Select Chinese Ports (As of 5/2/2022) Source: Marine Traffic

Shanghai was placed under strict lockdown in late March due to COVID-19 outbreaks in the region; that sudden halting of operations has led to an ever-growing number of vessels stuck outside of port waiting to offload. According to shipping analytics firm Windward, as of April 19, there were over 500 vessels waiting to berth outside Chinese ports, with Shanghai alone accounting for roughly half of them.

On top of the logjammed ports, inland supply chains are feeling the impacts of the lockdowns as well. Truckers, already in short supply and slowing down the system, are facing greater delays due to mass COVID-19 testing throughout the region, which is further hampering product flow within the country.

Orders haven’t stopped

Cargo Vessels Waiting to Berth Outside L.A./Long Beach (As of 5/2/2022)

Source: Marine Traffic

Beyond the effects of this combination, a potentially even worse outcome may be the impact the congestion will have on U.S. West Coast ports when Chinese ports finally reopen. While Chinese ports have been locked down, orders haven’t stopped, even if the vessels have. That will create a heavy push to turn vessels around to the United States as fast as possible. A similar wave of vessels partially created the West Coast congestion that began in 2020 and is now close to being worked through. This new wave of vessels has the potential to restart the vicious cycle of congestion all over again.

On the positive side, the Chinese congestion is partially responsible for allowing U.S. West Coast ports to work through their own backlog. But the looming threat of a new wave of vessels lurks behind that achievement. Whether or not that wave occurs, as well as how intense it is, largely depends on how the Chinese government handles its current backlog.

A measured reopening working up to full operation would provide the greatest chance of avoiding another backlog-inducing wave of vessels hitting the U.S. West Coast, but, as we’ve seen throughout the pandemic, Chinese government actions are at times hard to understand and even more difficult to predict. The National Milk Producers Federation and its counterparts with the U.S. Dairy Export Council will continue to advocate for supporting U.S. ports and infrastructure with the tools and resources needed to clear shipments, as well as put pressure on international carriers to pick up agricultural products instead of leaving U.S. ports empty, with the goal of making sure U.S. dairy products can get to global consumers who increasingly depend on them.

To comment, email your remarks to intel@hoards.com.(c) Hoard's Dairyman Intel 2022 May 9, 2022