The West Coast receives top billing in any discussion of ports and dairy exports. Roughly two-thirds of all U.S. dairy exports, on a product-volume basis, leave the United States via the West Coast. On a milk solids equivalent basis, that number jumps to roughly 85%.

The importance of the West Coast as a dairy export center cannot be understated — and over the last 18 months, it has been put to the test. Greater trade volume, labor constraints, global container shortages, and higher operating costs have strained a system that’s inadequately prepared to deal with it.

The result?

Delays and congestion that’s limiting U.S. dairy’s opportunity to expand on what’s already record demand for its products overseas.

The congestion is centered around Southern California, where a staggering 75 vessels at times have been waiting to berth in the Los Angeles and Long Beach ports. Average wait times are approaching 10 days . . . some vessels have waited 20 days to berth. U.S. consumer purchases are the most immediate cause of the congestion.

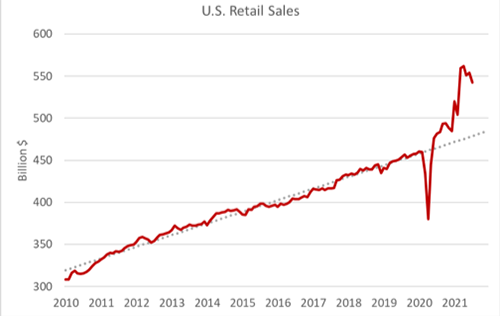

This U.S. Retail Sales chart below shows the level at which consumer retail spending has incrementally grown over the last decade compared with the tremendous spike over the last year.

That’s created a shipping container imbalance driven by the huge demand for high-value products out of Asia. To put that demand in dollars, the average amount shipping companies are charging per container leaving Asia bound for the U.S. West Coast is currently around $8,000 — that rate had reached a dizzying height of over $15,000 only a few short weeks ago.

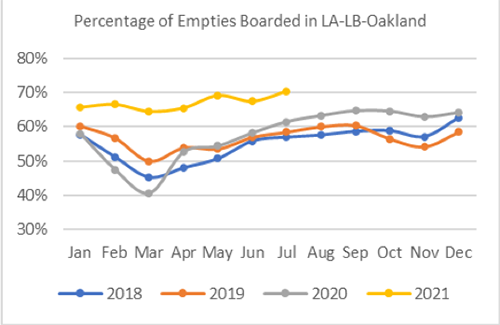

Comparatively, the average cost per container headed to Asia from the West Coast is, while still record high, much less, at around $1,200. This difference has led to a further compounding issue of an increasing number of empty containers being sent back to Asia in an attempt to save a few days in transit time; the faster a shipping company can get a vessel back to Asia, the faster it can benefit from the higher freight rates.

Shipping companies would rather eat the cost and ship a vessel back to Asia empty than wait for a full load of products to ship back. The chart below shows the increasing percentage of empties leaving select West Coast ports.

Unfortunately, dairy isn’t immune to the congestion, and like other industries, it’s attempting to divert product through other ports. In the 12 months leading up to June of this year (latest data available), dairy exports out of West Coast ports dropped nearly 10% while dairy exports out of the East Coast and the Gulf climbed 30% and 22%, respectively.

But in many cases, diversion isn’t economically viable, given the inland shipping costs of moving product to a port further away, country of destination, and labor constraints. Adding to the bad news, congestion won’t clear up in the short term. Dairy likely will struggle with port congestion through much, if not all, of 2022.

Despite all of this, though, dairy continues to show its resiliency. U.S. dairy exports over the last 12 months are up 10%; a testament to the strength of the entire industry and the strong global demand for our products. While the water ahead may (literally) look a little choppy regarding export logistics, the U.S. dairy industry will continue to do what it is does best; produce high-quality dairy products for consumers, both domestically and abroad.