Recent reductions in milk supplies have contributed to record milk prices. The U.S. Department of Agriculture’s most recent monthly outlook projects that annual 2022 milk production will fall below the 2021 level. If realized, it will be the first time since 2009 that there has been a reduction in annual milk production.

Examining dairy cow inventory on a state-by-state basis provides more detail regarding this latest reduction in milk supplies. One way to approach state data is to divide states into two categories: larger and smaller dairy operation states. This analysis only examines the top 24 dairy states where monthly data is available.

Using 2017 Census of Agriculture data, larger dairy operation states were defined as those with at least 50% of total state inventory on operations of greater than 1,000 cows. These include:

• New Mexico (97.4%)

• Arizona (95.8%)

• Colorado (87.2%)

• Texas (87.2%)

• Idaho (86.7%)

• Kansas (83.2%)

• California (82.6%)

• Florida (79.4%)

• South Dakota (73.2%)

• Washington (70.5%)

• Oregon (65.7%)

• Utah (59.7%)

• Georgia (50.6%).

Smaller dairy operation states containing less than 50% of inventory on operations with more than 1,000 dairy cows include:

• Michigan (47.7%)

• Indiana (47.0%)

• New York (40.2%)

• Iowa (37.0%)

• Minnesota (31.5%)

• Wisconsin (27.2%)

• Vermont (26.7%)

• Ohio (26.3%)

• Illinois (14.3%)

• Virginia (10.5%)

• Pennsylvania (7.5%)

The smaller dairy operations states also include the USDA reported other states category.

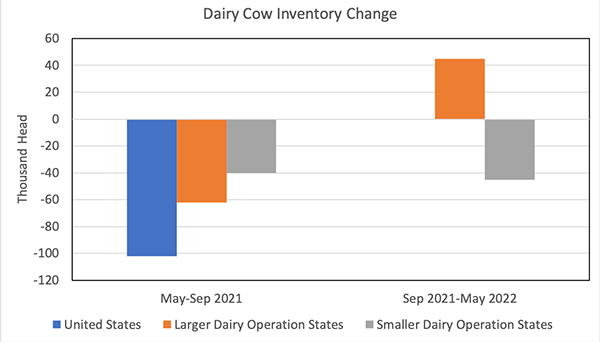

The chart looks at two time periods during this latest reduction in milk supplies. The first period is May through September 2021, when most of the reduction in dairy cow inventory occurred, and the second period is from September 2021 through May 2022.

Losses erased by gains

In the first period, U.S. dairy cow inventory fell by 102,000 head, with inventory on larger operation states down 62,000 head and smaller operation states down 40,000 head. However, from September 2021 through May 2022, larger operation states had a 45,000-head gain in dairy cow inventory and completely offset the 45,000-head decline that occurred in smaller operation states to leave the U.S. dairy cow inventory unchanged.

This data shows that larger dairy operation states are recovering cow inventories more quickly than the smaller dairy operation states. This situation has led to continued expansion growth in the proportion of milk produced on larger operations. With that being noted, the national milk supply should resume once the inventory declines in smaller operation states slow. These economic forces continue to drive long-term consolidation in the U.S. dairy industry.