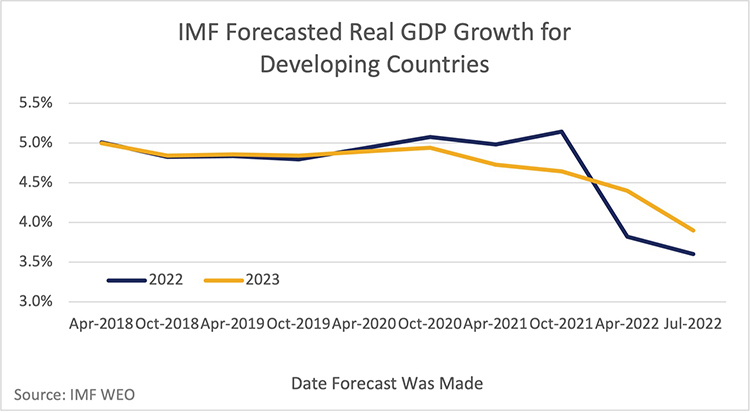

The International Monetary Fund (IMF) revised down their Gross Domestic Product (GDP) forecasts for most countries this week. Overall, resource-rich regions fared better with GDP forecasts for some of the large oil exporting nations steady or higher compared to the IMF’s previous forecasts. However, GDP growth rates for developing countries this year were brought down by 0.2% and next year was revised down by 0.5%.

What does this mean for dairy? I had already tweaked down our GDP numbers in my model assuming we would see downward revisions, but the weaker GDP numbers did knock 2.3% off average Oceania dairy prices for 2022 and 3.3% off next year.

As for the impact on future milk prices, I’ve spent the past two months digging into the impact of recessions on dairy demand and prices. That being noted, I’m starting to think that most of the downward pressure we’ve seen on dairy prices so far is due to China.

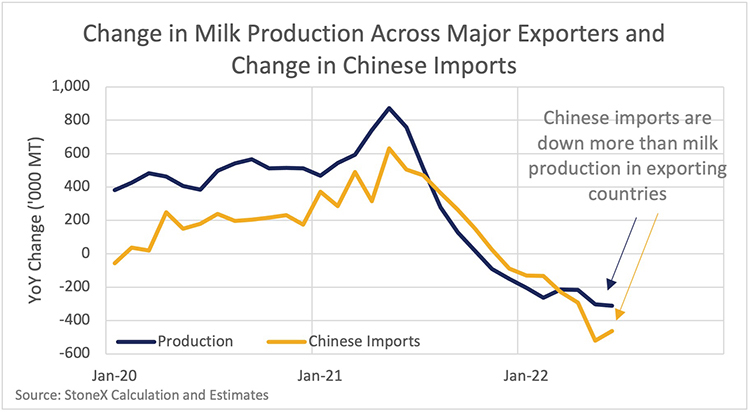

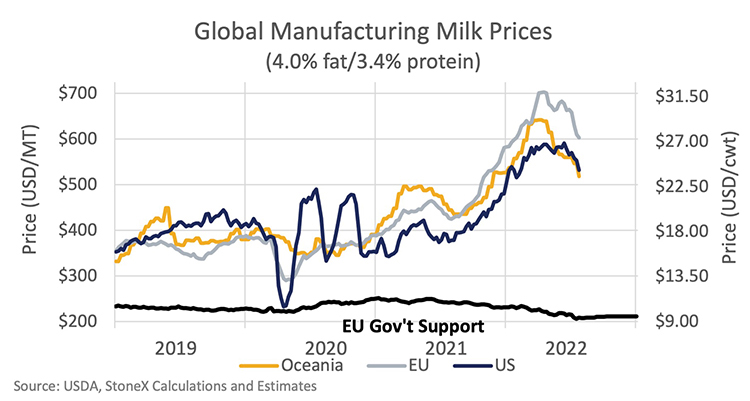

While we’ve seen milk production move back above year-ago levels in the U.S. and New Zealand during June, production is Europe and Australia is still well below last year. On a three-month rolling basis (to remove some of the noise), production across the major exporters in June was down 1.2%, or 322,000 metric tons (MT) of milk. But imports by China were down 24.4% or 463,000 MT of milk equivalents.

The decline in Chinese imports is bigger than the decline in milk production, meaning that despite declining production, we still have to find a different buyer for the product that previously had been going to China. Some other importing countries have taken advantage of the improved availability, but to clear the available supply, dairy pries have had to shift lower.

There isn’t any sign of a recovery in Chinese demand yet. I started the year expecting Chinese imports to be up 2.6% from last year. That has slipped to down 10.5%, but even that might be optimistic given that they are down 17% YTD. The import slowdown started prior to the big COVID-19 lockdowns in late February through May. So, we can’t blame all the weakness on lockdowns. I think the decline in imports is partly driven by inventory build-up last year, and there must have been a slowdown in consumption late last year and into this year. It seems very likely that the lockdowns early this year, and now ongoing testing and fear of lockdowns, is hurting demand.

The counter argument is that we’ve seen nearly all commodity prices (and equities, and bonds) pull back in June and the first half of July as there are more and more signs of stress on consumers in the U.S. and the EU (and other parts of the world). The broad decline in prices across asset classes and commodity types would suggest that there is something bigger happening than just a decline in Chinese demand, but we can probably blame most of the decline in dairy prices over the past two months on weak Chinese demand.

Maybe we will slip into a recession; maybe we won’t. But economic growth is slowing down and inflation is running above wage growth in large parts of the world. Milk production across the major exporters was still down in June, but there are signs that production has finally started to respond to record high milk prices. Even if Chinese import demand improves in coming months, demand inside of the U.S., EU, and other parts of the world is expected to be soft at the same time that production is improving. Hot weather has bounced feed prices higher again, and environmental concerns should limit the milk production growth in New Zealand and Europe. The price outlook is bullish when demand improves, but we could be in for some more weakness in demand or prices before demand gets better.