The author is a chief marketplace officer for Farm Credit East.

Rodger Murray

Rodger MurrayThankfully, milk prices have risen as well. But these price increases on both the input and output sides add significant management complexity and uncertainty, challenging even the best business managers. To get some ideas on how to manage a dairy farm in these circumstances, I spoke with several of our business consultants to hear what they’re seeing at the farm level.

Return on investment

“Keep your eyes on the gross margin,” advised senior consultant Mark Mapstone. “Know your costs of production and be sure to use inputs wisely. But don’t skimp up front on things like fertilizer or feed and hurt your revenue in the end.”

There is always a point of diminishing returns — whether it’s crops or cows — where the cost of that additional input doesn’t pay for itself anymore. Know where that is for your farm. Producers with accurate records and good protocols can track their return on investment much better than those without, enabling them to use inputs more efficiently.

With fertilizer and crop costs soaring, you don’t want to apply more nutrients than necessary, but you don’t want to hurt yields or quality, either. Now might be a good time to engage agronomists or crop consultants to maximize the return on your crop inputs.

“It comes back to basics and doing the kinds of things you should be doing all along,” Mapstone added. “It’s just that the stakes are higher now with rising prices.”

Re-evaluate risk

We say this a lot, but risk management, whether crop insurance, hedging, forward contracting, or other tools, can be more important than ever. You’re dealing with bigger dollars. Whatever your strategy is, be informed, deliberate, and consistent in your efforts. Don’t go it alone — build a team of advisers you can rely on.

Don’t just look at the total cost of risk management programs; consider their cost in terms of hundredweight (cwt.) of milk or bushels of crops. While the gross cost may be more, the cost in terms of cwt. of milk to cover the premiums may still be the same because of the higher milk prices.

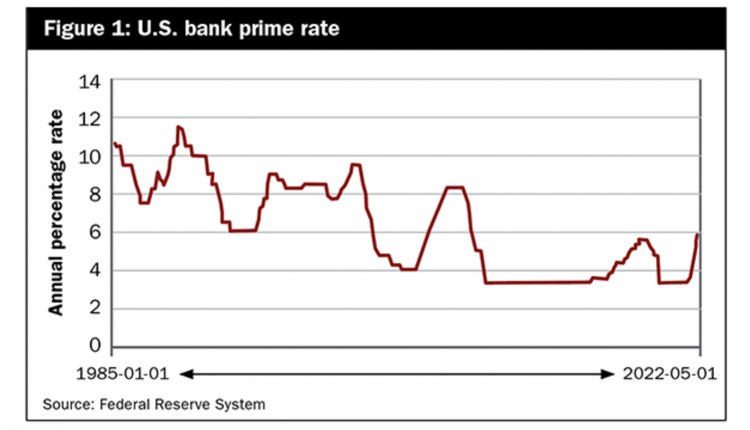

Dairy farmers are seeing a well-deserved “good year” after a period of challenges, but good times don’t last forever. We will almost certainly see either a recession or, at best, an economic slowdown in the coming years. This may bring lower milk prices or other financial challenges, so prepare now for what could come. Shore up your balance sheet, build working capital, and get your financial “house” in order so a downturn won’t sting quite as much.

Three more considerations

Labor costs deserve special mention. Labor is certainly a cost, but it is also an investment because your workers are the key to getting the job done. As prices rise, make sure you’re keeping up with market wages. Invest in equipment, tools, and systems to set your people up to work efficiently. Give them the training and support they need to do their job right. Make an effort to reward and retain your best people. Think about the difference between retaining and building your best employees versus starting over with newcomers.

If you’re operating under a base-excess quota program, improving milk quality or components may allow you to enhance milk revenue without incurring over-base penalties. Complete a partial budget and monitor the impact of feed costs needed to boost components compared to the potential added revenue received from the premiums.

Now is also the time to speak with your tax adviser and lender to begin planning how to manage your 2022 tax bill. Prepaying crop needs for 2023 may ensure you get priority for what could be tight supplies.

Your gross revenue will rise in 2022, so plan ahead for ways to keep more of it in your own pocket. Inflation adds complexity to financial management, but if you work through it well, you may be able to use it to your advantage.