Since 2008, Chinese import growth has accounted for about half of the growth in global import dairy demand. Back in those days, their imports were roughly equivalent to the milk production from 325,000 U.S. cows. By 2022, China’s dairy product imports had grown to the equivalent of 1.5 million U.S. cows. To be clear, I’m talking about Chinese dairy imports from all sources, not just the U.S. However, putting it into the context of U.S. cows makes it easier to relate to the incredible growth and scale of the imports.

As this was taking place, there have been some efforts made by the government to support the domestic industry, primarily around infant formula. Tightening government regulation and a declining birth rate has helped to drive both Abbott and Reckitt Benckiser (Enfamil) out of the Chinese infant formula market in recent years. With this shift in place, it looks like China has made some significant steps toward increasing self-sufficiency across the dairy markets in the past two years.

A major dairy producer

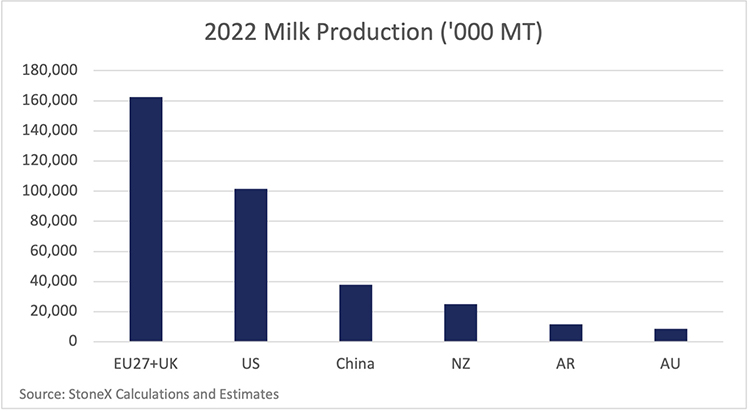

We probably don’t talk about it enough, but China is a large milk producer. Last year, they produced roughly as much as California, Wisconsin, and Minnesota combined. Historically, their fresh milk went primarily into fluid milk products. Imported ingredients like whole milk powder (WMP), dairy fats, and skim milk powder (SMP) were used as ingredients in yogurt, ice cream, baked good, and other products.

But YiFan Li, StoneX Head of Asia Dairy, was traveling around China back in December and again during May and found that an increasing number of dairy products are being made with fresh local milk and even locally made WMP instead of imported powder.

If China has always had a policy of self-sufficiency, why would there be a shift to producing and using more domestic milk now? Why didn’t this happen 5 or 10 years ago?

I have a couple of theories, and they are nothing more than theories. You have some broader drivers like pandemic supply chain disruptions and increasing political tensions that are driving re-shoring, but to be fair, I don’t think these are the main drivers on dairy.

China’s largest dairy supplier is New Zealand with whom they have a pretty good political relationship. Its second largest supplier is Europe. That relationship is shakier but still decent.

Instead, I think China looked at the tighter environmental regulations that are being implemented in both places and saw that as a threat to the availability of exportable supply in the future. Also, starting in January 2024, Chinese importers can bring in an unlimited amount of WMP and SMP from New Zealand with no tariff thanks to the phasing in of the China-NZ free trade agreement. There may have been a push by the Chinese industry to try and build local market share before January 2024.

What does the future hold?

So, what does all of this mean for the global supply, demand, and prices of dairy products moving forward?

First, self-sufficiency does not mean zero imports. Last year China was about 69% self-sufficient in dairy, up from 63 to 64% in 2020 to 2021. As far as I can tell, the government considers something in the 70% to 80% range as self-sufficient, or at least self-sufficient enough. So, they are not trying to drive imports to zero.

When you look at it from a purely economic perspective, the cost of milk production inside China is very high. Corn in China is around $10.50 per bushel. Imported hay is around $500 per ton at the port, then add in tariffs and transportation to the farm. It makes more sense to import milk powders produced elsewhere at a lower cost than to rely on expensive local production. It’s possible the government could raise tariffs or technical barriers on dairy imports. Or they could further subsidize, or mandate, more domestic milk production. Or maybe consumers will start to favor domestically produced products over imports.

But as it stands now, there is a financial incentive to use imported dairy products. Between self-sufficiency already being close to 70%, the high cost of locally produced milk, and the relatively low cost of imported dairy products, I think the most likely long-run outlook for Chinese imports is higher or, in the worst case, steady imports.

With that said, the outlook for Chinese imports in the second half of 2023 is getting less rosy, and with the shift toward using more domestically produced milk, we could see medium and long-run Chinese imports growing much slower than they have over the past 15 years. However, if the tighter environmental restrictions do end up holding back milk production growth in Europe and New Zealand, then the exportable supply of dairy products does tighten up dramatically in 2025 or 2026 and the global market looks tight even if we assume Chinese imports are flat from 2024 to 2030.

Over the past 15 years, Chinese imports have exploded and have been a largely bullish driver for prices. A push toward greater self-sufficiency in the past two years has been a bearish influence on the global dairy markets and that might not change during the second half of 2023. We need to contemplate a world where Chinese imports stop growing or grow much slower than they have over the past 15 years. Right now, the expectation is that slowing milk production growth in Europe and New Zealand will balance out against the weaker Chinese import outlook, but there are an almost unlimited number of ways the future can play out.