Global and domestic demand for dairy products remains weak amid slowing economic conditions. China’s combined whole milk powder (WMP) and skim milk powder (SMP) imports are down 24% year-over-year, a reduction of 184,000 metric tons, or about the fluid equivalent of the annual production of about 150,000 U.S. cows. Research firm Oxford Economics is forecasting world gross domestic product (GDP) growth to barely top 2% in 2023 compared to 6.2% in 2021 and 3.1% in 2022. And global milk supply has turned out to be quite a bit more than we thought it would be six months ago. In the U.S., Cheddar and American cheese prices are really struggling with year-to-date domestic production through May up 3% but export volumes down a whopping 15%.

With the global economy likely in the doldrums through at least 2024, the quickest way out of the low milk price predicament will be via lower global milk supplies. And with farm gate milk prices across the globe having dropped the equivalent of $5 to $7 per hundredweight (cwt.) since late 2022, we expect reduced cow numbers to have a measurable impact on milk supplies by the end of the year. In the U.S., the recent surge in cow culling has been dramatic. Dairy cow slaughter in the month of June (260,000 head) was the highest level since way back in 1986. And for the five-week period ending July 1, dairy cow slaughter was about 18,000 higher than a year ago.

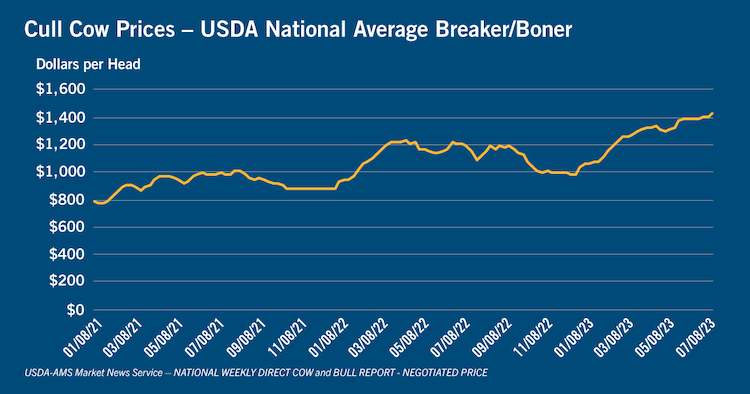

So far, U.S. dairy cow slaughter is up 36,000 head year-to-date. We expect that pace will speed up significantly by year-end, which should more than neutralize the slight herd expansion we saw in the first half of the year. With cull cow prices at record highs — about 18% higher than last year — producers will be increasingly motivated to cull less profitable cows (see chart).

Average quality cull cow prices are currently bringing around $1,300 per head. The high prices should hold through 2024 because the supply of beef cattle is hitting a cyclical low after two years of drought in the West and low profitability. The U.S. beef supply chain is now in desperate need of more cattle, and we expect that to continue well into 2025, which is when beef cattle supplies should finally turn higher.