The value of U.S. dairy exports rose by 26% last year, following an 18% gain in 2021. Yet for the first half of 2023, dairy export value has slid by 10%, with double-digit percentage declines in butter (-31%), nonfat dry milk (-19%), and whey (-15%).

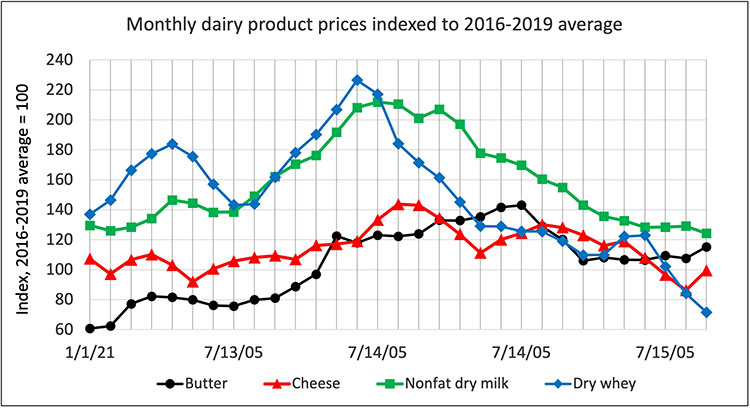

This slowdown in U.S. dairy export value has affected dairy product prices differently. In July, dry whey prices were less than one-third of the values posted in early 2022, and nonfat dry milk prices had also dropped significantly. Given that the U.S. has exported nearly half of its dry whey production over the last few years and nearly two-thirds of dry skim milk production, it is not surprising that these product prices have suffered more in recent months. On the other hand, the U.S. exports less than 10% of its butter and cheese production.

Lower dairy product price levels have resulted in weaker milk prices. The U.S. All-Milk price averaged $17.90 per hundredweight (cwt.) in June 2023, which is the lowest monthly average since August 2021, though it is still slightly above the 2016 to 2019 average of $17.22. With export values unable to maintain the growth from 2021 and 2022, it appears that improvements in domestic demand for cheese and butter will be necessary for milk prices to significantly increase. Is this likely to happen?

Block cheese prices have rallied to approach $2 per pound in early August after bottoming out at $1.40 in June. Butter prices have also strengthened a little in July and early August, following a string of steady monthly values to begin the year.

While it is always difficult to pinpoint the exact reasons for short-term market price movements, consumer sentiment has been improving in recent months as inflation has been slowing and unemployment remains historically low. Expectations for a near-term economic recession appear to be receding as well.

Even as dairy producers have been trimming the national herd for the last few months, current feed price levels have shifted margins for many operators far enough into the red that it will take a demand boost to push milk prices high enough to restore profitability. Let’s hope that domestic consumers lead this recovery with a greater willingness to purchase the high-quality and nutritious dairy products that U.S. dairy producers are known for.