There have been numerous news articles, research reports, and podcasts about the “Japanification” of the Chinese economy. They draw parallels between China today and the experience of Japan in the 1990s and 2000s as economic growth slowed down, population peaked, and debt levels rose while the property market struggled. That got me curious about the trends in dairy consumption in Japan as their population peaked and what that might suggest about dairy consumption in China.

When I dug into the data for the two countries, it was quickly apparent that they are/were at vastly different stages of development when their populations peaked; it probably wasn’t fair to compare how dairy consumption in Japan developed after its population peaked with the way dairy consumption in China will develop. My biggest takeaway from the Japanese data was that despite population decline, milk equivalent consumption is up about 7% since its population peaked in 2010. So, a declining population does not guarantee a decline in total dairy consumption.

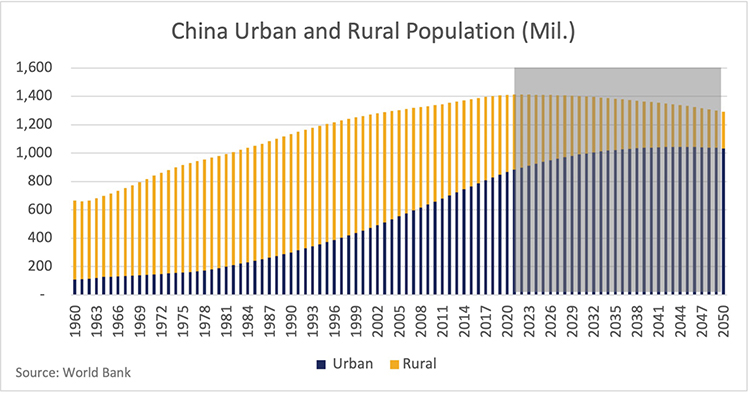

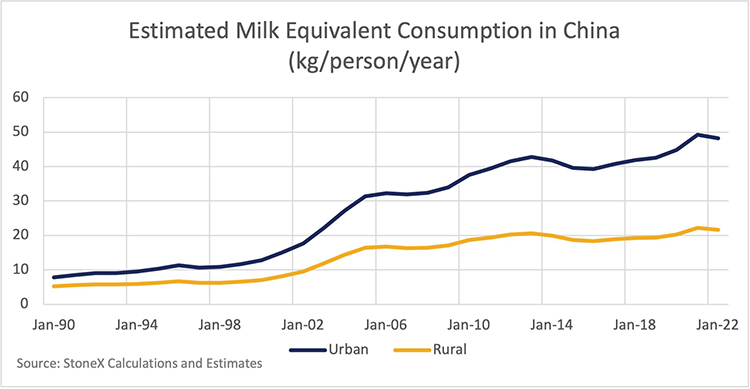

One big difference between Japan and China is the level of urbanization. When Japan’s population peaked in 2010, nearly 91% of the population was living in cities. When China’s population peaked in 2021, only 62.5% of the population was living in cities, and the population in Chinese cities isn’t forecast to peak until 2044. Consumers in urban areas tend to earn more money than consumers in rural areas and are exposed to Westernized diets where they also have easier access to dairy products through retail, food service, and home delivery options. Different sources have conflicting data on the level of per capita consumption by rural and urban consumers in China, but they all point toward current per capita consumption being at least twice as high in cities compared to rural areas. So, as the Chinese population continues to shift from rural to urban areas, it will help boost dairy consumption even as the total population declines.

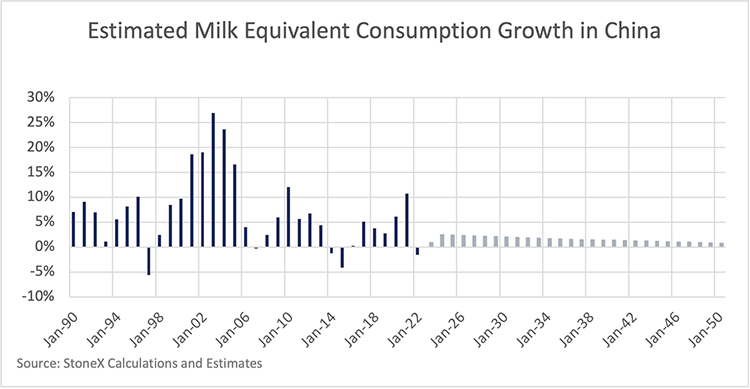

I still think there is a positive demand growth story for China as the population becomes more urbanized and richer, but growth of both income and the urban population is expected to slow in coming decades, which means dairy demand growth will likely slow as well. With conservative assumptions, I think consumption could still easily grow by 2% to 2.5% per year through 2030 and slow into the 1.5% to 2% range through 2040. Some years will be much stronger than that, and some years will be weaker.