research assistant professor in the department of agricultural and applied economics at the University of Missouri.

As 2023 comes to a close, dairy producers are hopeful that 2024 will be a better year. Record-low Dairy Margin Coverage (DMC) levels are one measure pointing to the tough financial year that has been endured in 2023. Earlier hopes for a better second half of the year have been slow to develop.

Looking ahead to next year highlights the fact that many factors make the 2024 outlook uncertain. Growth in U.S. milk production, backed by technological advancements and greater efficiencies, could keep downward pressure on 2024 milk prices. The emphasis on export potential, especially to high-demand areas like Asia, could compensate for the expected growth in milk production. More robust domestic dairy product demand could also be crucial to the supply-demand balance and prices.

A few projections

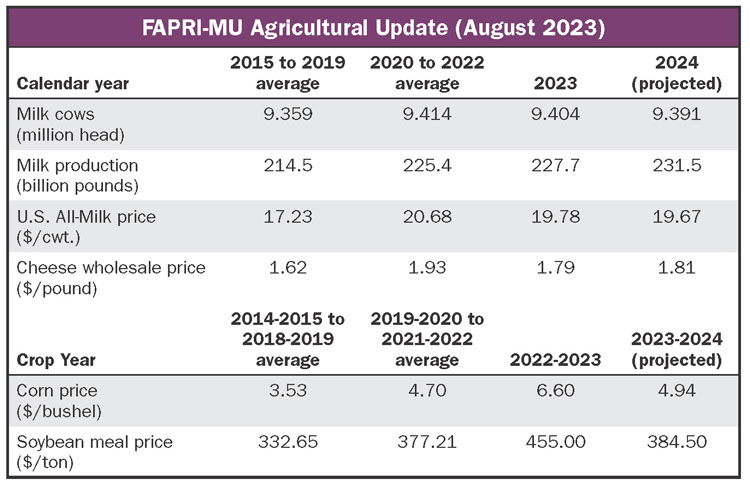

The Food and Agricultural Policy Research Institute (FAPRI-MU) at the University of Missouri recently updated the long-term baseline for the dairy industry (on.hoards.com/2023BaseUpdate). The baseline highlights that lower feed costs should help the financial picture for dairy producers if the U.S. does not face additional drought conditions in 2024. A summary of the key dairy drivers are contained in the table.

FAPRI-MU projects the 2023-2024 corn price will decline by more than $1.60 per bushel from the 2022-2023 level. An additional drop of nearly 50 cents per bushel is projected for 2024-2025 as another large corn crop, 15.2 billion bushels, drives ending stocks higher and weighs on corn prices.

The FAPRI-MU update projects soybean meal prices will decline by more than $100 per ton as more soybeans are crushed due to strong renewable diesel demand. Hay and alfalfa prices in 2024 are expected to fall by more than $40 per ton from their 2022-2023 records.

The FAPRI-MU baseline projects milk production will grow by more than 3.5 billion pounds in 2024 despite a reduction in dairy cows as milk yields are expected to grow. The projected growth in milk supply is the primary driver that will keep milk prices from climbing in 2024. Since 2000, there have been 11 times that annual milk production growth exceeded 3.5 billion pounds. Of those times, only three resulted in higher milk prices.

Uncertainty in demand

On the demand side, per capita fluid milk consumption is projected to decline by nearly 3 pounds per person. Cheese wholesale prices are forecasted to move higher in 2024 relative to 2023 but are still more than 25 cents per pound below their 2022 peak of $2.07 per pound. On both a skim solids and a milkfat basis, dairy product exports are expected to expand in 2024 following declines this year.

Interest rates, inflation, and fuel costs have been some of the factors that have created uncertainty around consumer demand for dairy products. If 2024 consumer demand is stronger than shown in the FAPRI-MU baseline, the outlook for milk and dairy prices will be more positive than projected in the report. Given the inelastic demand for dairy products, even small demand shifts could result in much higher prices.

Challenges remain

The FAPRI-MU outlook projects that the 2024 U.S. All-Milk price will be little changed from 2023. The current FAPRI-MU baseline estimates that milk prices will be flat for the next few years, hovering around $20 per hundredweight. This baseline should not be seen as a projection that milk price volatility is over, though, as many of the factors that could keep milk prices volatile are not assumed in a long-term baseline projection exercise.

When all the financial pieces are put together, 2024 net returns are projected to exceed 2023 by more than $2.25 per hundredweight. The recovery of 2024 net returns is driven by projected reductions in feed costs, not higher milk prices. Despite the 2024 milk net returns recovery, it is still expected to be a financially challenging year for dairy producers. Longer-term projections of lower feed costs will eventually result in positive net returns.

A blend of factors will undoubtedly influence the exact trajectory of milk prices in 2024. For dairy stakeholders, staying informed, adaptive, and proactive will be key to navigating these price fluctuations successfully.