There are growing concerns about what impact an escalating conflict in the Middle East may have on the dairy market. If the conflict remains relatively isolated between the Israelis and Palestinians, the impact on the global dairy market will likely be almost nothing. But there seems to be a growing risk that third parties are going to be drawn into the conflict to various degrees.

I don’t know how the situation will play out. We’ve had decades of Israeli-Palestinian conflict without creating a global conflagration, and it only rarely pulled neighboring countries into direct warfare. I hope we can avoid a wider war, but who knows. With the uncertainty around who is going to do what to whom, I think the only real analysis we can do is to look at the size and structure of the regional market and consider some different scenarios and their impact on global dairy prices.

It's difficult to determine which countries should be included in the analysis. It’s clear that neighboring countries like Egypt and Lebanon could be directly affected. Regional powerhouses like Iran and Saudi Arabia will probably be impacted to some degree. Taken as a whole, the geographic region of the Middle East and North Africa (MENA) is a large importer of dairy products, but the biggest regional importer (Algeria) isn’t geographically close to Israel and seems less likely to get hit with sanctions or embargos than the regional powerhouses might.

In terms of who supplies the region, the 27 countries in the European Union, the United Kingdom, and New Zealand supply about 63% of the milk solids imported. The U.S. has only supplied about 3% of the milk solids over the past year. But if Europe and New Zealand lose demand in the MENA region, they will push the milk into other regions and compete more aggressively with the U.S. MENA imports skew heavy toward cheese, whole milk powder (WMP), and skim milk powder (SMP) with surprisingly little butter/anhydrous milkfat (AMF) or whey products.

Figuring out whether a wider or more intense conflict is good or bad for dairy demand in the region is harder than it seems. My gut reaction is that it would be bad for demand. I don’t have hard data to prove it, but I’m willing to bet consumers in war zones buy less dairy than they otherwise would. If MENA countries take actions that result in sanctions from the West, it would likely reduce their access to the global banking system and foreign currency, which would limit their ability to import. Even for countries not directly involved or sanctioned, the greater instability likely hurts consumer confidence and people probably shift to saving more of their income for an uncertain future instead of spending it.

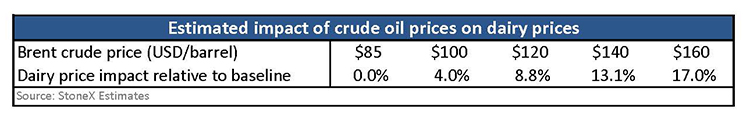

On the flip side, uncertainty about the future could drive some stockpiling in the short-term, and we could see better short-term demand from the region. Disruptions to the oil supply could boost revenues for countries in the region, which might be supportive for dairy consumption, although it is at least partially offset with weaker demand in other parts of the world as energy takes a bigger bite out of consumer budgets.

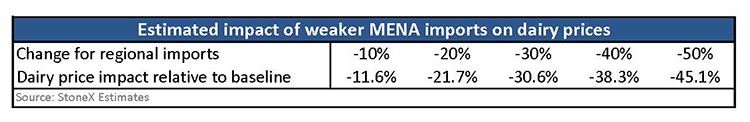

If I plug a 10% decline for MENA imports into the model, it knocks 11.6% off of the equilibrium for dairy prices in the model. The more extreme the scenario gets, such as a 50% drop for MENA imports, the less I trust the model, but it looks like the rule of thumb is that every 1% decline for regional imports knocks about 1% off prices if everything else holds constant. Eventually the lower prices feed through to the farm level and production will fall to balance the market, so this price impact would only be applicable for the first three to 12 months before the supply-side starts to adjust.

On the bullish side, a wider conflict could limit oil exports from the region and lift oil prices. My baseline assumption is $85 for Brent crude in 2024. The model says $100 crude oil would boost dairy prices by 4% and $160 crude oil would boost prices by 17% compared to the baseline. However, consumers around the world are more sensitive to inflation than usual right now, and sharply higher crude prices would likely drive inflation up around the world. That would likely reduce dairy demand in other parts of the world even if the higher revenue helps to boost dairy demand in the MENA region, and my model doesn’t do a good job of picking up that negative impact of inflation. So, the positive impact on dairy prices might be less than what is in the table.

The Middle East and North Africa region is a larger importer of dairy products and a shift to lower demand from the region would have a significant negative impact on dairy prices. At this point, it is impossible to know how much of a hit regional demand will take, but in rough numbers, every 1% decline for imports is about a 1% drop for dairy prices in the major dairy exporters.

To comment, email your remarks to intel@hoards.com.

(c) Hoard's Dairyman Intel 2023

October 23, 2023